Question: S7-10. (Learning Objectives 3, 4: Computing depreciation; recording a gain or loss on disposal) On January 1, 20X6, Scoot Airline purchased an airplane for $38,700,000.

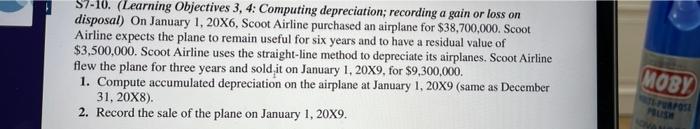

S7-10. (Learning Objectives 3, 4: Computing depreciation; recording a gain or loss on disposal) On January 1, 20X6, Scoot Airline purchased an airplane for $38,700,000. Scoot Airline expects the plane to remain useful for six years and to have a residual value of $3,500,000. Scoot Airline uses the straight-line method to depreciate its airplanes. Scoot Airline flew the plane for three years and sold it on January 1, 20X9, for $9,300,000 1. Compute accumulated depreciation on the airplane at January 1, 20X9 (same as December 31, 20X8). 2. Record the sale of the plane on January 1, 20X9. MOBY TAPOS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts