Question: Sales $ 1 4 , 0 0 0 , 0 0 0 Long - term rent, factory $ 8 5 , 0 0 0 Sales

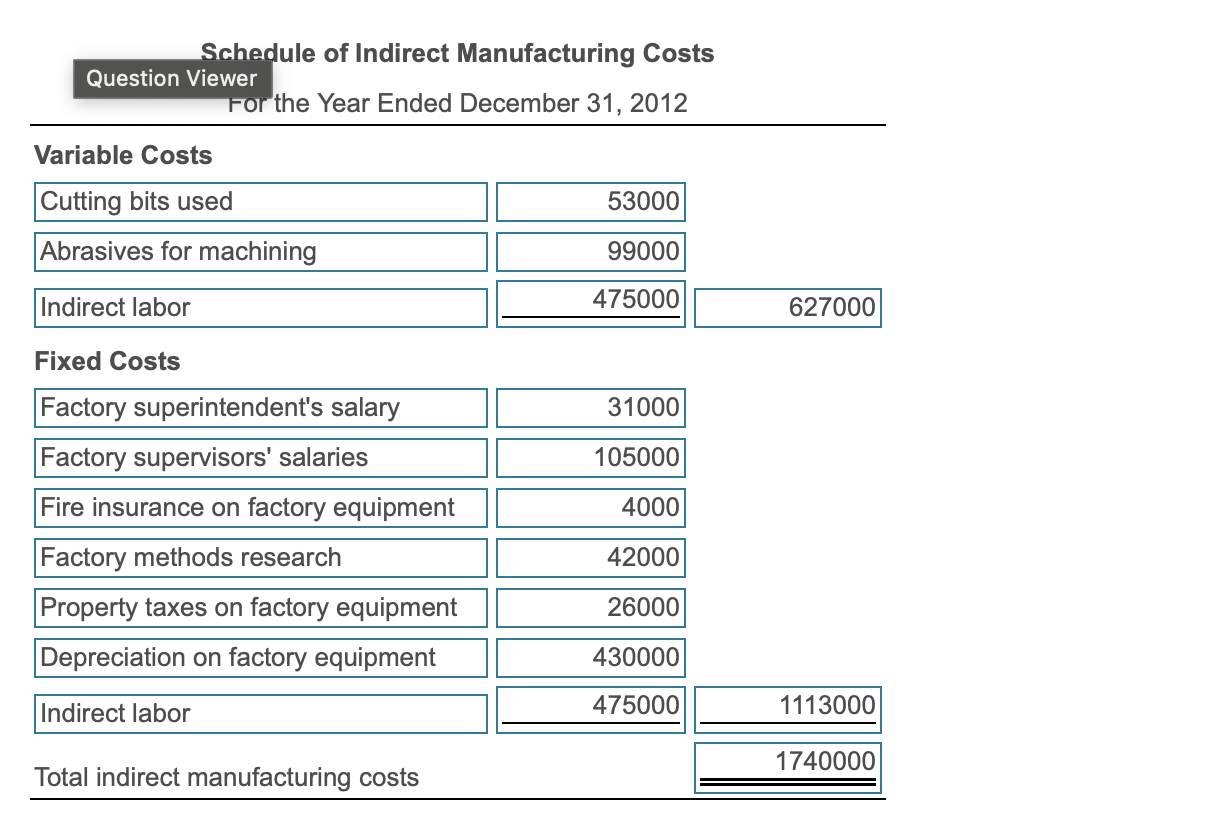

Sales $ Longterm rent, factory $ Sales commissions Factory superintendent's salary Advertising Factory supervisors' salaries Shipping expenses Direct materials used Administrative executive salaries Direct labor Administrative clerical salaries variable Cutting bits used Fire insurance on factory equipment Factory methods research Property taxes on factory equipment Abrasives for machining Indirect labor Depreciation on factory equipment The following information is taken from the records of the ZealandZealand Manufacturing Company for the year ending DecemberDecember There were no beginning or ending inventories. LOADING... Click the icon to view the data. Read the requirements LOADING... Question content area bottom Part Requirement Prepare a contribution income statement and an absorption income statement. If you are in doubt about any cost behavior pattern, decide on the basis of whether the total cost in question will fluctuate substantially over a wide range of volume. Prepare a separate supporting schedule of indirect manufacturing costs subdivided between variable and fixed costs. Begin by preparing the schedule of indirect manufacturing costs subdivided between variable and fixed costs. Schedule of Indirect Manufacturing Costs Question Viewer For the Year Ended December Variable Costs Fixed Costs Indirect labor Total indirect manufacturing costs

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock