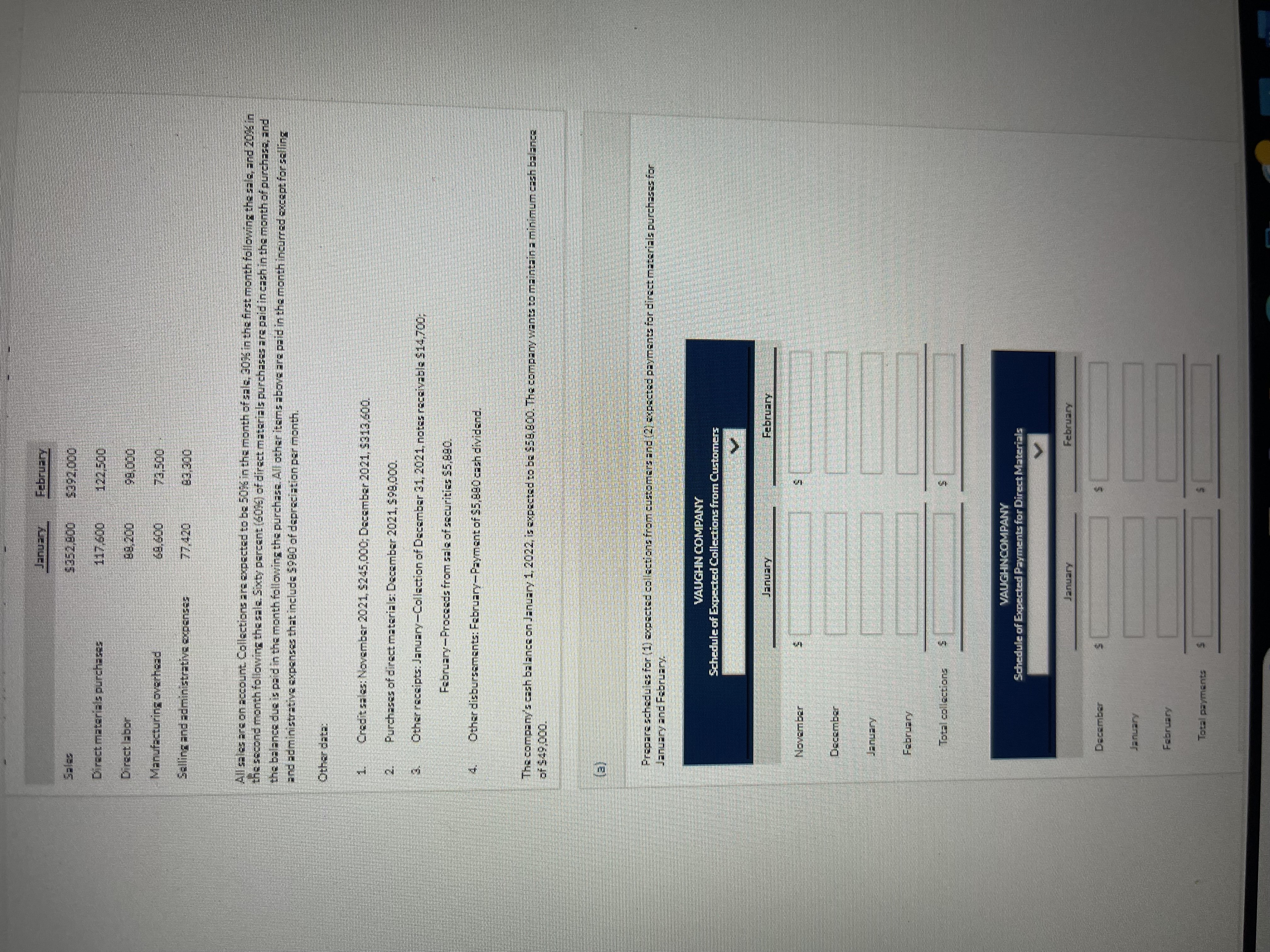

Question: Sales$ 3 5 2 , 8 0 0 $ 3 9 2 , 0 0 0 Direct materials purchases 1 1 7 , 6 0

Sales$$Direct materials purchasesDirect laborManufacturing overheadSalling and administrative expensesBAll sales are on account. Collections are expected to be in the month of sale, in the first month following the sals, and in the second month following the sale. Sixty percent of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in tha month incurred except for selling and aoministrative expenses that include $ of depreciation per month.Other data: Credit sales: November $; Dacember Purchases of direct materials: December $Other receipts: JanuaryCollection of December notes receivable $;FebruaryProceeds from sale of securities $ Other disbursements: FebruaryPayment of $ cash dividend.The company's cash balance on January is expacted to be $ The company wants to maintain a minimum cash balance of $Prepare schedules for expected collections from customers and expactad payments for direct materials purchases forJanuary and Fabruary,VAUGHN COMPANYSchedule of Expected Collections from CustomersJanuaryFebruaryNovemberDecemberJanuaryFebruaryTotal collectionsVAUGHINCOMPANYSchedule of Expected Payments for Direct MaterialsJanuaryFebruary

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock