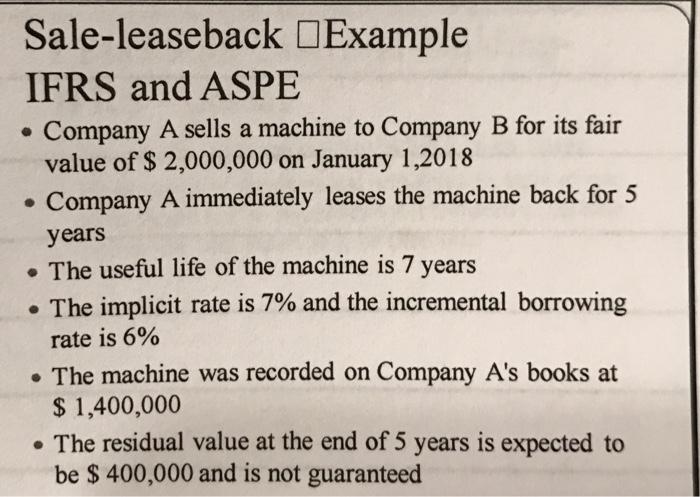

Question: Sale-leaseback DExample IFRS and ASPE Company A sells a machine to Company B for its fair value of $ 2,000,000 on January 1,2018 Company

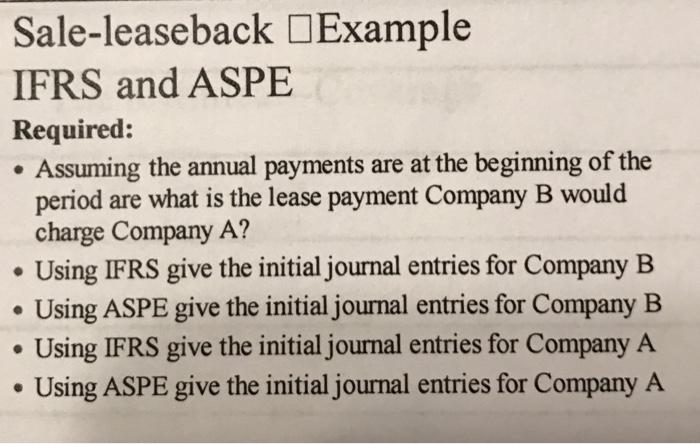

Sale-leaseback DExample IFRS and ASPE Company A sells a machine to Company B for its fair value of $ 2,000,000 on January 1,2018 Company A immediately leases the machine back for 5 years The useful life of the machine is 7 years The implicit rate is 7% and the incremental borrowing rate is 6% The machine was recorded on Company A's books at $ 1,400,000 The residual value at the end of 5 years is expected to be $ 400,000 and is not guaranteed Sale-leaseback DExample IFRS and ASPE Required: Assuming the annual payments are at the beginning of the period are what is the lease payment Company B would charge Company A? Using IFRS give the initial journal entries for Company B Using ASPE give the initial journal entries for Company B Using IFRS give the initial journal entries for Company A Using ASPE give the initial journal entries for Company A

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

The Sale and Lease back transaction has been resulted into Finance Lease as the lease term covers the substantial part of the remaining useful life of ... View full answer

Get step-by-step solutions from verified subject matter experts