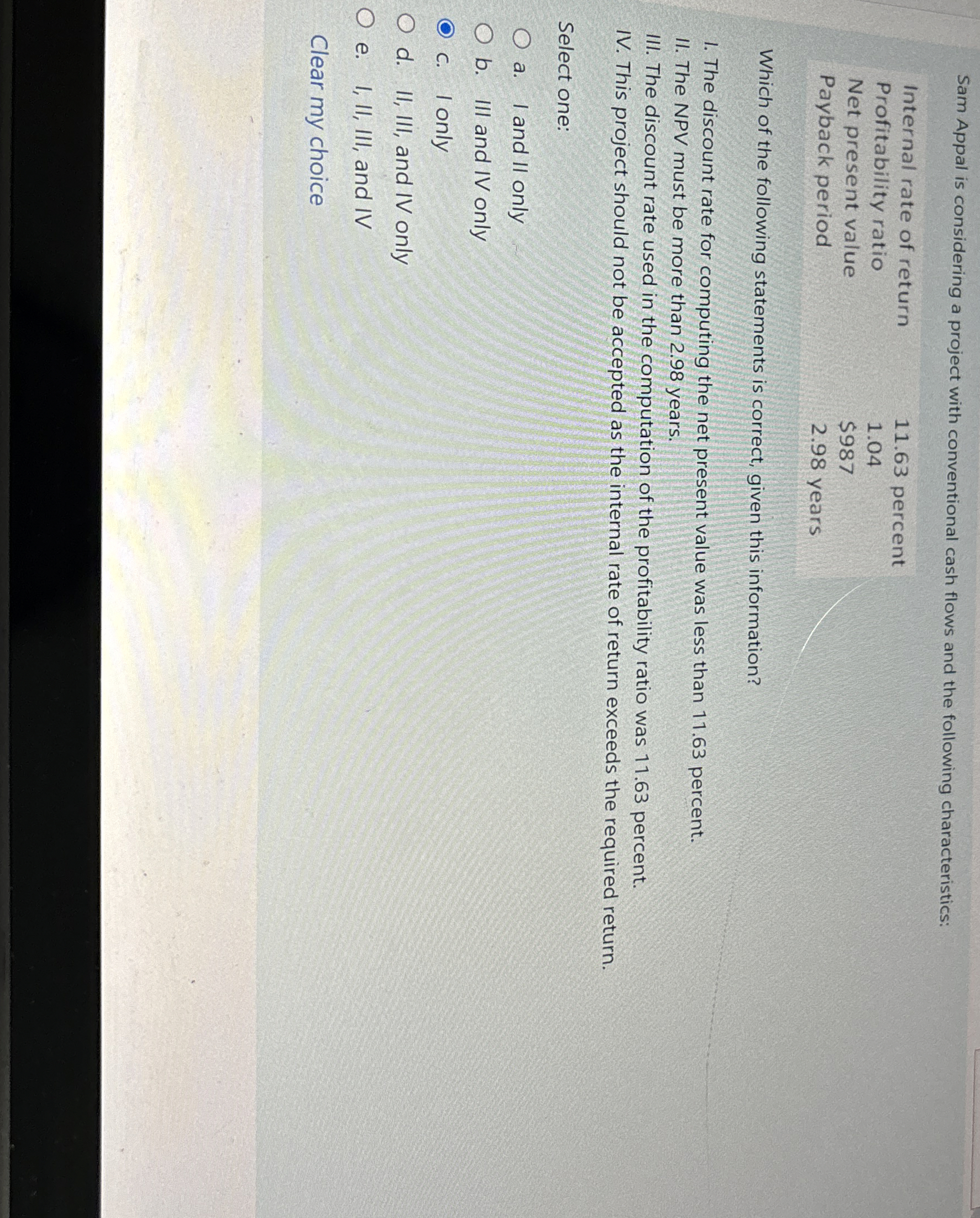

Question: Sam Appal is considering a project with conventional cash flows and the following characteristics: Internal rate of return 1 1 . 6 3 percent Profitability

Sam Appal is considering a project with conventional cash flows and the following characteristics:

Internal rate of return

percent

Profitability ratio

Net present value

$

Payback period

years

Which of the following statements is correct, given this information?

The discount rate for computing the net present value was less than percent.

II The NPV must be more than years.

III. The discount rate used in the computation of the profitability ratio was percent.

IV This project should not be accepted as the internal rate of return exceeds the required return.

Select one:

a I and II only

b III and IV only

c I only

d II III, and IV only

e I, II III, and IV

Clear my choice

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock