Question: Show all work and highlight final answer. Do not answer the question unless you answer all of them. 4. Which one of the following will

Show all work and highlight final answer. Do not answer the question unless you answer all of them.

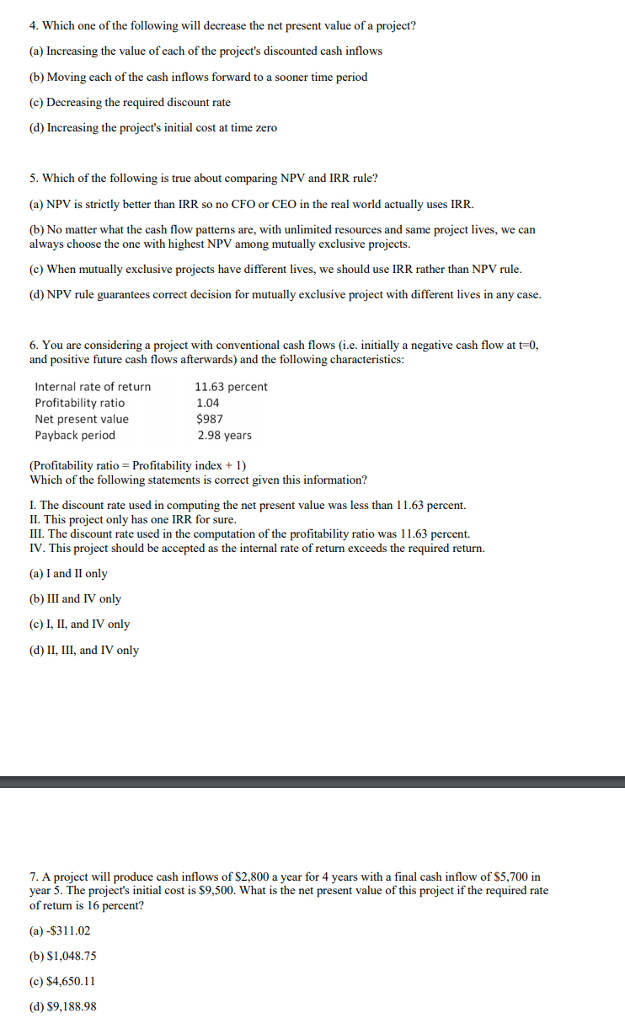

4. Which one of the following will decrease the net present value of a project? (a) Increasing the value of each of the project's discounted cash inflows (b) Moving each of the cash inflows forward to a sooner time period (c) Decreasing the required discount rate (d) Increasing the project's initial cost at time zero 5. Which of the following is true about comparing NPV and IRR rule? (a) NPV is strictly better than IRR so no CFO or CEO in the real world actually uses IRR. (b) No matter what the cash flow patterns are, with unlimited resources and same project lives, we can always choose the one with highest NPV among mutually exclusive projects. (c) When mutually exclusive projects have different lives, we should use IRR rather than NPV rule. (d) NPV rule guarantees correct decision for mutually exclusive project with different lives in any case 6. You are considering a project with conventional cash flows (i.e. initially a negative cash flow at t-0, and positive future cash flows afterwards) and the following characteristics: Internal rate of return Profitability ratio Net present value Payback period 11.63 percent 1.04 $987 2.98 years (Profitability ratio Profitability index + 1) Which of the following statements is correct given this information? I. The discount rate used in computing the net present value was less than 11.63 percent. II. This project only has one IRR for sure. III. The discount rate used in the computation of the profitability ratio was 11.63 percent. IV. This project should be accepted as the internal rate of return exceeds the required return. (a) I and II only (b) III and IV only (c) I, II, and IV only (d) II, III, and IV only 7. A project will produce cash inflows of $2,800 a year for 4 years with a final cash inflow of S5,700 in year 5. The project's initial cost is $9,500. What is the net present value of this project if the required rate of return is 16 percent? (a) -$311.02 (b) S1,048.75 (c) $4,650.11 (d) S9,188.98

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts