Question: Sam has been using direct labor hours to allocate factory overhead. For 2018, he estimated that overhead would be $960,000 and that he would use

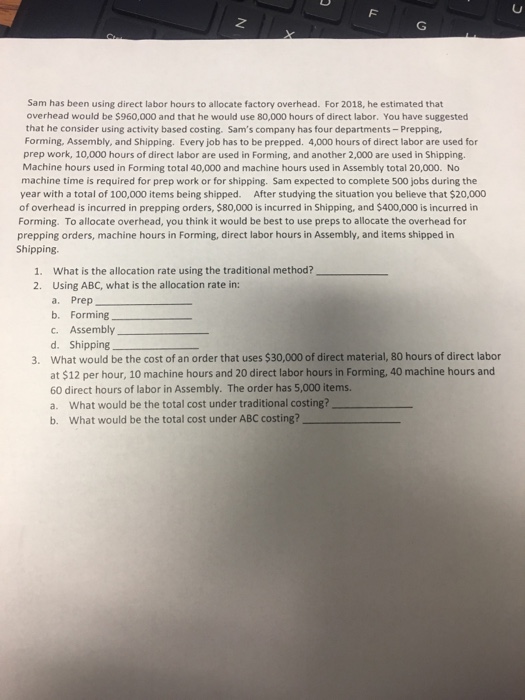

Sam has been using direct labor hours to allocate factory overhead. For 2018, he estimated that overhead would be $960,000 and that he would use 80,000 hours of direct labor. You have suggested that he consider using activity based costing. Sam's company has four departments- Prepping Forming, Assembly, and Shipping. Every job has to be prepped. 4,000 hours of direct labor are used for prep work, 10,000 hours of direct labor are used in Forming, and another 2,000 are used in Shipping. Machine hours used in Forming total 40,000 and machine hours used in Assembly total 20,000. No machine time is required for prep work or for shipping. Sam expected to complete 500 jobs during the year with a total of 100,000 items being shipped. After studying the situation you believe that $20,000 of overhead is incurred in prepping orders, $80,000 is incurred in Shipping, and $400,000 is incurred in Forming. To allocate overhead, you think it would be best to use preps to allocate the overhead for prepping orders, machine hours in Forming, direct labor hours in Assembly, and items shipped in Shipping What is the allocation rate using the traditional method? Using ABC, what is the allocation rate in: a. Prep b. Forming c. Assmbly d. Shipping What would be the cost of an order that uses $30,000 of direct material, 80 hours of direct labor at $12 per hour, 10 machine hours and 20 direct labor hours in Forming, 40 machine hours and 60 direct hours of labor in Assembly. The order has 5,000 items. a. What would be the total cost under traditional costing? b. What would be the total cost under ABC costing? 1. 2. 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts