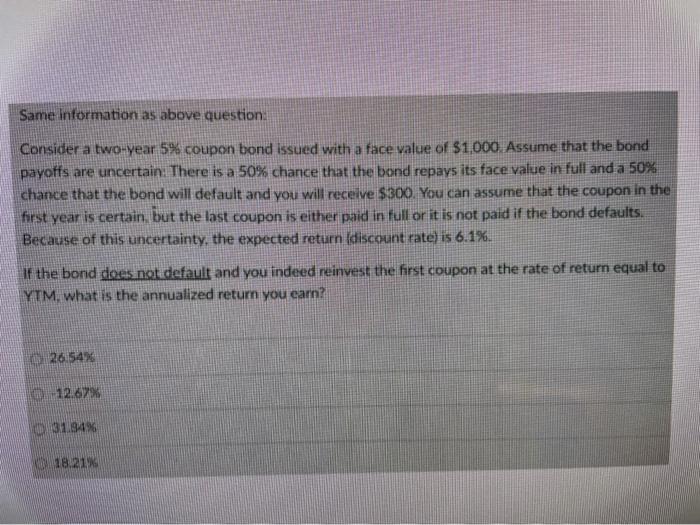

Question: Same information as above question Consider a two-year 5% coupon bond issued with a face value of $1.000. Assume that the bond payoffs are uncertain.

Same information as above question Consider a two-year 5% coupon bond issued with a face value of $1.000. Assume that the bond payoffs are uncertain. There is a 50% chance that the bond repays its face value in full and a 50% chance that the bond will default and you will receive $300. You can assume that the coupon in the first year is certain, but the last coupon is either paid in full or it is not paid if the bond defaults. Because of this uncertainty, the expected return (discount rate) is 6.1%. If the bond does not default and you indeed reinvest the first coupon at the rate of return equal to YTM. What is the annualized return you earn? 26.54% 12.67% 31.94% 18.21%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts