Question: Same question I posted the options for each separate blank choice On the first day of the fiscal year, a company issues a $500,000, 8%,

Same question I posted the options for each separate blank choice

Same question I posted the options for each separate blank choice

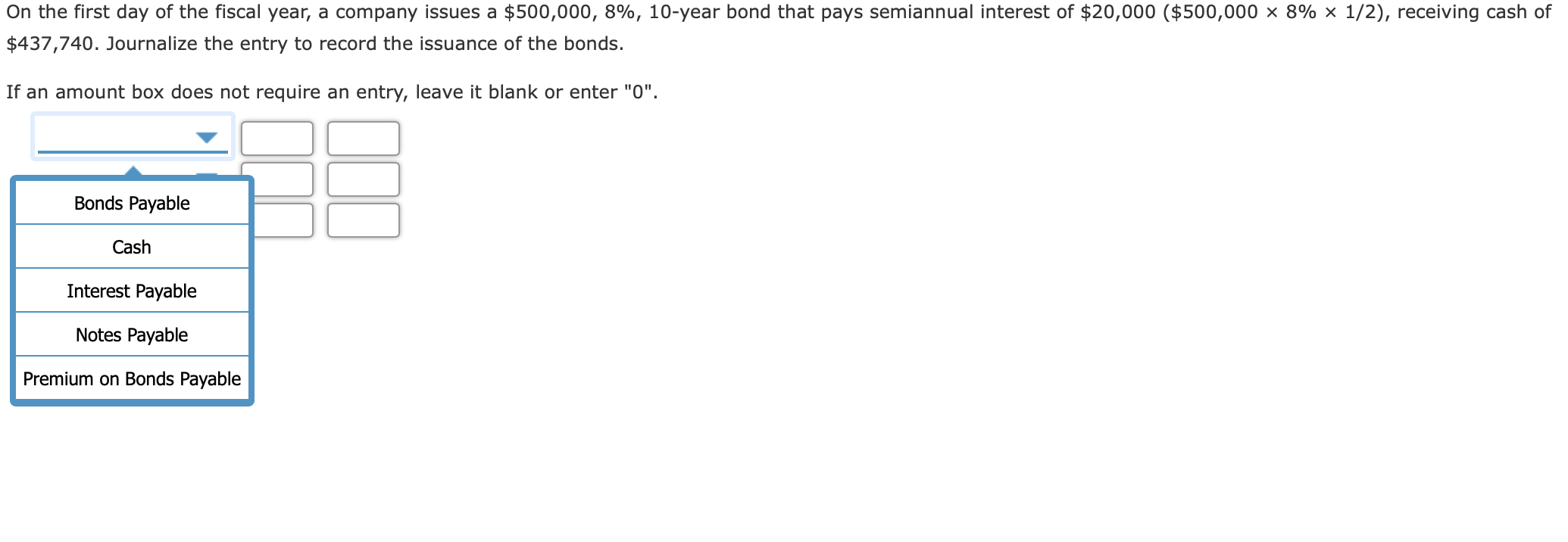

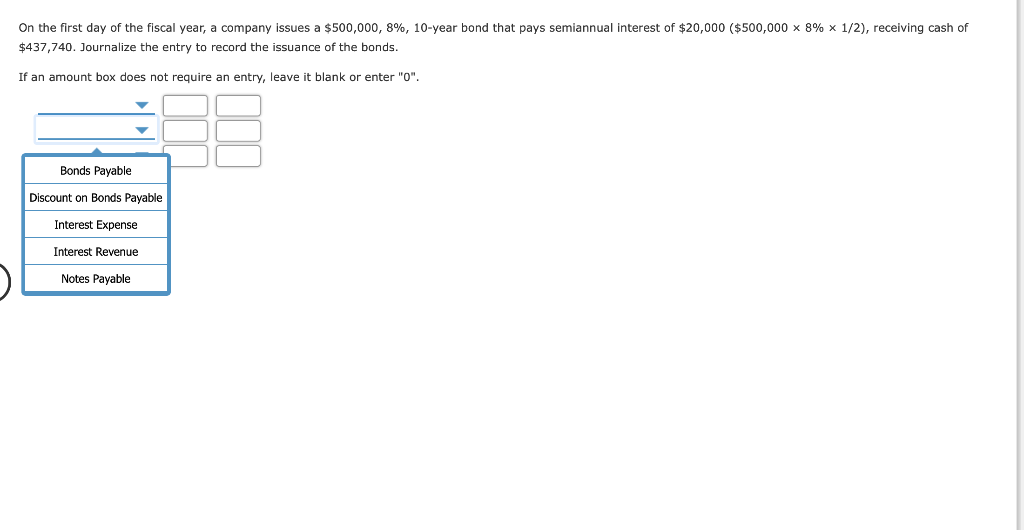

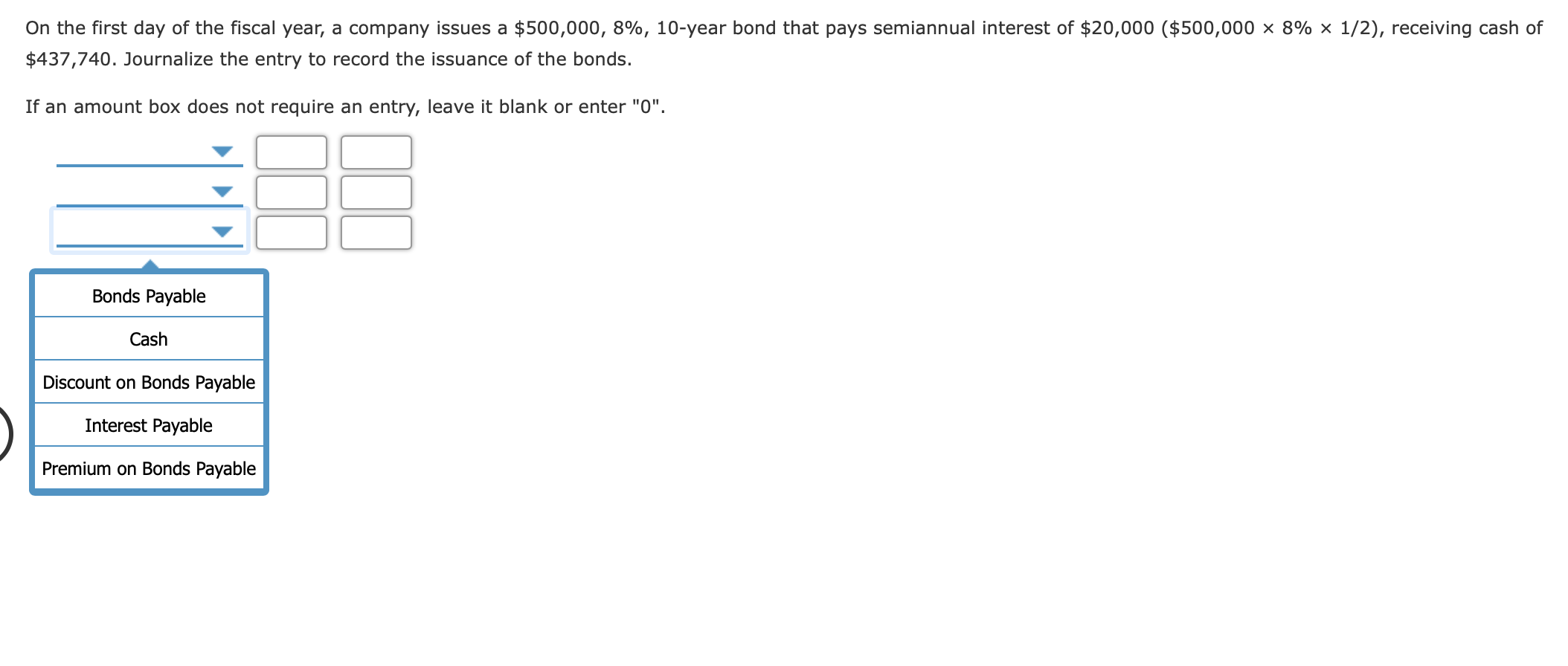

On the first day of the fiscal year, a company issues a $500,000, 8%, 10-year bond that pays semiannual interest of $20,000 ($500,000 ~ 8% 1/2), receiving cash of $437,740. Journalize the entry to record the issuance of the bonds. If an amount box does not require an entry, leave it blank or enter "O". Bonds Payable Cash Interest Payable Notes Payable Premium on Bonds Payable On the first day of the fiscal year, a company issues a $500,000, 8%, 10-year bond that pays semiannual interest of $20,000 ($500,000 x 8% x 1/2), receiving cash of $437,740. Journalize the entry to record the issuance of the bonds. If an amount box does not require an entry, leave it blank or enter "O". Bonds Payable Discount on Bonds Payable Interest Expense Interest Revenue Notes Payable On the first day of the fiscal year, a company issues a $500,000, 8%, 10-year bond that pays semiannual interest of $20,000 ($500,000 ~ 8% x 1/2), receiving cash of $437,740. Journalize the entry to record the issuance of the bonds. If an amount box does not require an entry, leave it blank or enter "O". Bonds Payable Cash Discount on Bonds Payable Interest Payable Premium on Bonds Payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts