Question: Same question, just split it up so you can see it better. I will provide feedback. The project is completed in 2020, and a successful

Same question, just split it up so you can see it better. I will provide feedback.

Same question, just split it up so you can see it better. I will provide feedback.

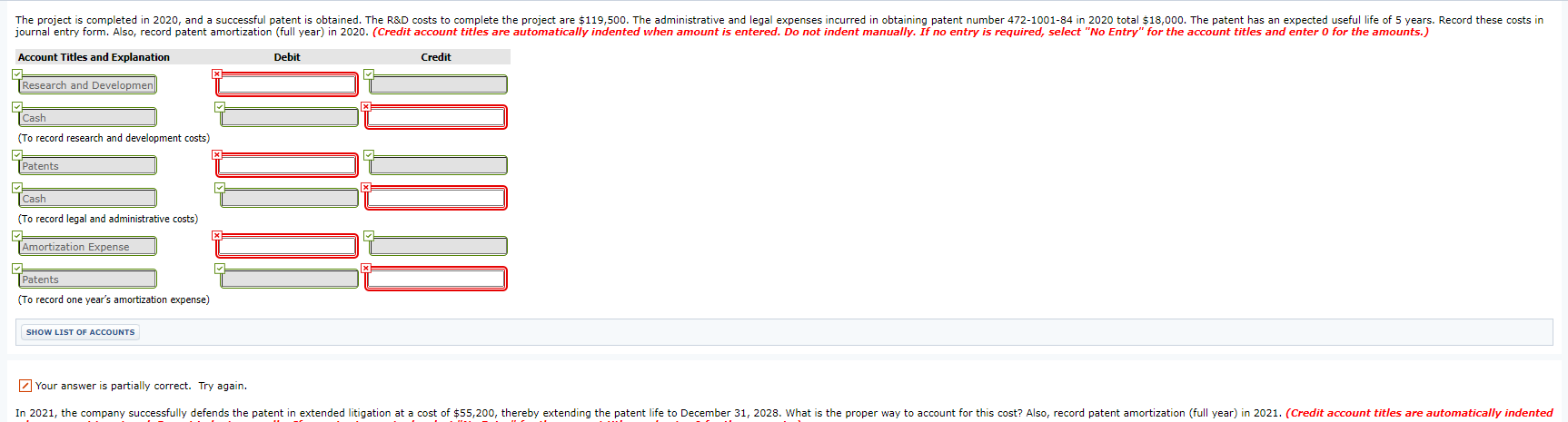

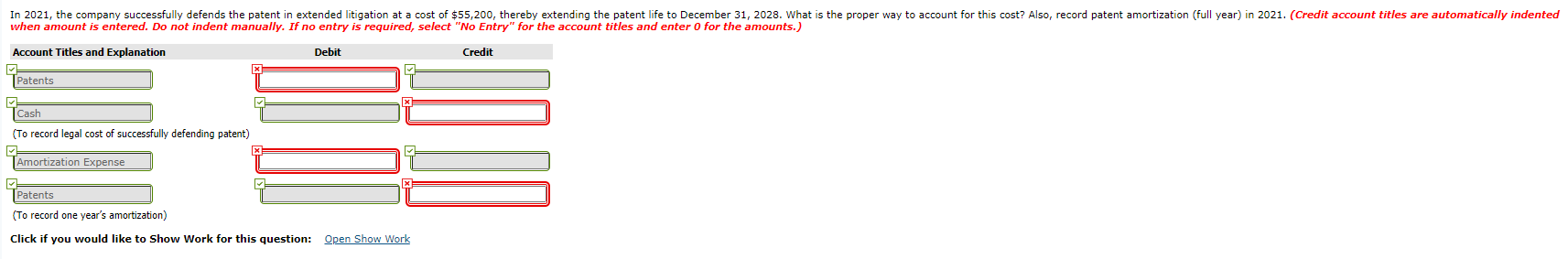

The project is completed in 2020, and a successful patent is obtained. The R&D costs to complete the project are $119,500. The administrative and legal expenses incurred in obtaining patent number 472-1001-84 in 2020 total $18,000. The patent has an expected useful life of 5 years. Record these costs in journal entry form. Also, record patent amortization (full year) in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Research and Developmen Cash (To record research and development costs) Patents Cash (To record legal and administrative costs) X Amortization Expense Patents (To record one year's amortization expense) SHOW LIST OF ACCOUNTS Your answer is partially correct. Try again. In 2021, the company successfully defends the patent in extended litigation at a cost of $55,200, thereby extending the patent life to December 31, 2028. What is the proper way to account for this cost? Also, record patent amortization (full year) in 2021. (Credit account titles are automatically indented In 2021, the company successfully defends the patent in extended litigation at a cost of $55,200, thereby extending the patent life to December 31, 2028. What is the proper way to account for this cost? Also, record patent amortization (full year) in 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Patents [x= TCash (To record legal cost of successfully defending patent) X Amortization Expense TPatents (To record one year's amortization) Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts