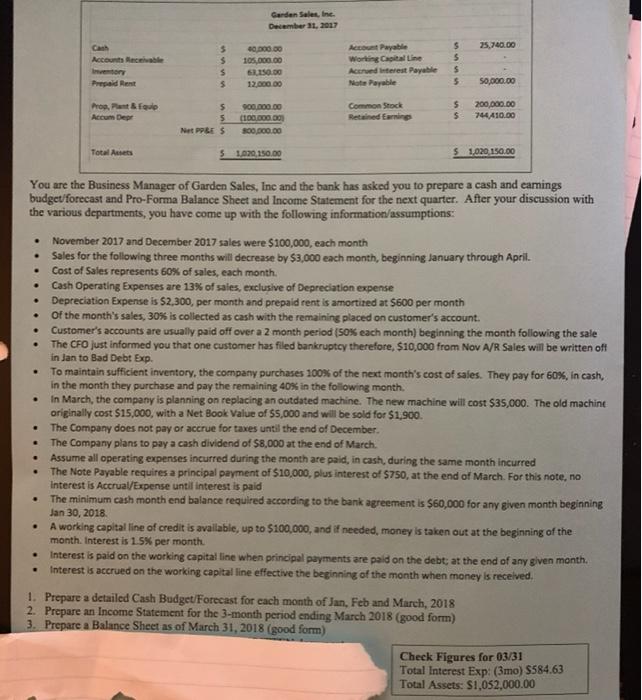

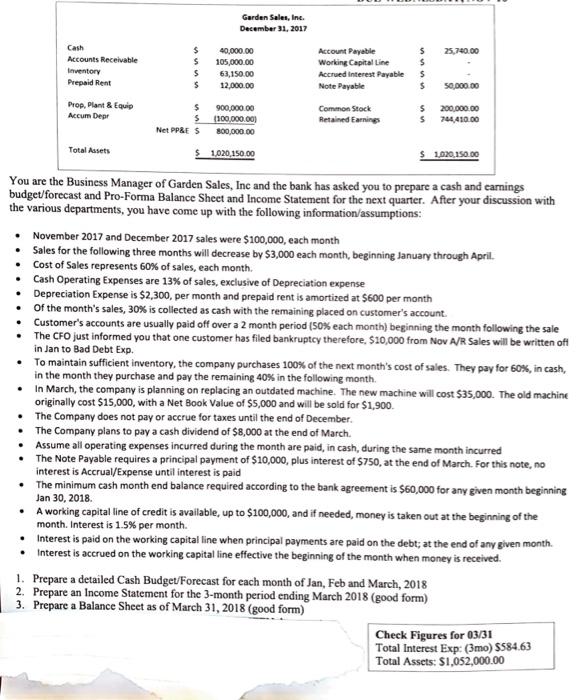

Question: Same question, one is in PDF format in case it is not legible enough. Please help! Garden Sales Inc December 11, 2017 25,740.00 Cash Accounts

Garden Sales Inc December 11, 2017 25,740.00 Cash Accounts Recente $ $ $ 5 105,000.00 GR 150.00 12,000.00 Account Payable Working Line Acered interest Payable Note Payable 5 $ $ 5 Prepaid Rent 50,000.00 Pro Plan favo Accum Dep 5 5 Net PLES 900.000.00 COD00.00 800.000.00 Common Stock Retained Earning 5 $ 200,000.00 744410.00 Total $ 1.020,150.00 1,020,150.00 . . . You are the Business Manager of Garden Sales, Inc and the bank has asked you to prepare a cash and earnings budget forecast and Pro-Forma Balance Sheet and Income Statement for the next quarter. After your discussion with the various departments, you have come up with the following information/assumptions: November 2017 and December 2017 sales were $100,000, each month Sales for the following three months will decrease by $3,000 each month, beginning January through April. Cost of Sales represents 60% of sales, each month. Cash Operating Expenses are 13% of sales, exclusive of Depreciation expense Depreciation Expense is $2,300, per month and prepaid rent is amortired at $600 per month of the month's sales, 30% is collected as cash with the remaining placed on customer's account. Customer's accounts are usually paid off over a 2 month period (50% each month) beginning the month following the sale The CFO just informed you that one customer has filed bankruptcy therefore, $10,000 from Nov A/R Sales will be written off in Jan to Bad Debt Exp To maintain sufficient inventory, the company purchases 100% of the next month's cost of sales. They pay for 60%, in cash. in the month they purchase and pay the remaining 40% in the following month. In March, the company is planning on replacing an outdated machine. The new machine will cost $35,000. The old machine originally cost $15,000, with a Net Book Value of $5,000 and will be sold for $1,900 The Company does not pay or accrue for taxes until the end of December. The Company plans to pay a cash dividend of $8,000 at the end of March Assume all operating expenses incurred during the month are paid, in cash, during the same month incurred The Note Payable requires a principal payment of $10,000, plus interest of $750, at the end of March. For this note, no Interest is Accrual/Expense until interest is paid The minimum cash month end balance required according to the bank agreement is $60,000 for any given month beginning Jan 30, 2018 A working capital line of credit is available, up to $100,000, and if needed, money is taken out at the beginning of the month. Interest is 1.5% per month Interest is paid on the working capital line when principal payments are paid on the debt: at the end of any given month. Interest is accrued on the working capital line effective the beginning of the month when money is received. . . . . . 1. Prepare a detailed Cash Budget/Forecast for each month of Jan, Feb and March, 2018 2. Prepare an Income Statement for the 3-month period ending March 2018 (good form) 3. Prepare a Balance Sheet as of March 31, 2018 (good form) Check Figures for 03/31 Total Interest Exp: (3mo) S584.63 Total Assets: $1,052,000.00 Garden Sales, Inc. December 31, 2017 Cash 25,740.00 Accounts Receivable Inventory Prepaid Rent $ s 5 $ 40,000.00 105,000.00 63,150.00 12,000.00 Account Payable 5 Working Capital Line $ Accrued Interest Payable $ Note Payable $ 50,000.00 Prop. Plant & Equip Accum Depr $ 900,000.00 S 100.000,00) Net PP&E $ 800,000.00 Common Stock Retained Earnings 5 s 200,000.00 744.410.00 Total Assets $1,020,150.00 $ 1.020,150.00 You are the Business Manager of Garden Sales, Inc and the bank has asked you to prepare a cash and carings budget/forecast and Pro-Forma Balance Sheet and Income Statement for the next quarter. After your discussion with the various departments, you have come up with the following information/assumptions: . November 2017 and December 2017 sales were $100,000, each month Sales for the following three months will decrease by $3,000 each month, beginning January through April. Cost of Sales represents 60% of sales, each month. Cash Operating Expenses are 13% of sales, exclusive of Depreciation expense Depreciation Expense is $2,300, per month and prepaid rent is amortized at $600 per month of the month's sales, 30% is collected as cash with the remaining placed on customer's account. Customer's accounts are usually paid off over a 2 month period (50% each month) beginning the month following the sale The CFO just informed you that one customer has filed bankruptcy therefore, $20,000 from Nov A/R Sales will be written oft in Jan to Bad Debt Exp. To maintain sufficient inventory, the company purchases 100% of the next month's cost of sales. They pay for 60%, in cash, in the month they purchase and pay the remaining 40% in the following month. In March, the company is planning on replacing an outdated machine. The new machine will cost $35,000. The old machine originally cost $15,000, with a Net Book Value of $5,000 and will be sold for $1,900 The Company does not pay or accrue for taxes until the end of December The Company plans to pay a cash dividend of $8,000 at the end of March Assume all operating expenses incurred during the month are paid, in cash, during the same month incurred The Note Payable requires a principal payment of $10,000, plus interest of $750, at the end of March. For this note, no interest is Accrual/Expense until interest is paid The minimum cash month end balance required according to the bank agreement is $60,000 for any given month beginning Jan 30, 2018 A working capital line of credit is available, up to $100,000, and if needed, money is taken out at the beginning of the month. Interest is 1.5% per month Interest is paid on the working capital line when principal payments are paid on the debt; at the end of any given month. Interest is accrued on the working capital line effective the beginning of the month when money is received 1. Prepare a detailed Cash Budget/Forecast for each month of Jan, Feb and March, 2018 2. Prepare an Income Statement for the 3-month period ending March 2018 (good form) 3. Prepare a Balance Sheet as of March 31, 2018 (good form) Check Figures for 03/31 Total Interest Exp: (3mo) $584.63 Total Assets: $1,052,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts