Question: The Darden Global Supply Chain please read and answer the following questions. 1. Describe how Darden Restaurants achieves competitive advantage with their supply chains. 2.

The Darden Global Supply Chain please read and answer the following questions.

1. Describe how Darden Restaurants achieves competitive advantage with their supply chains.

2. What are the primary logistical (shipping, warehousing, and distribution) differences in the four supply chains?

3. How does the Darden supply chain differ from your organization? Why do the differences exist?

Submission

Please submit online. Papers must be in either MS Word or PDF format. I am unable to read mac files. Please use a 12 point font, double space, and a cover page.

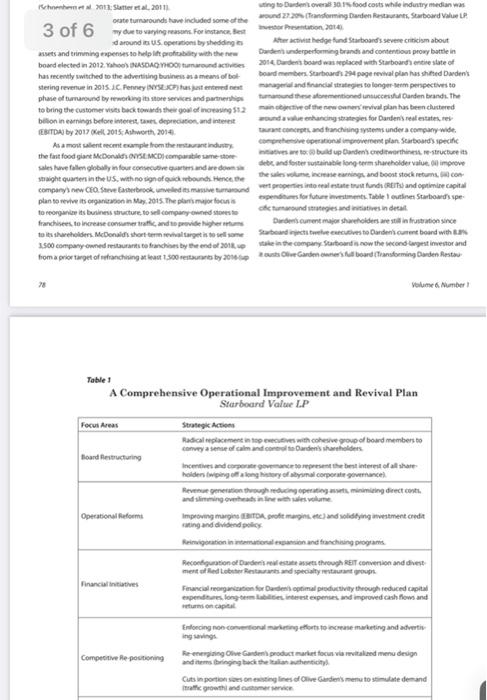

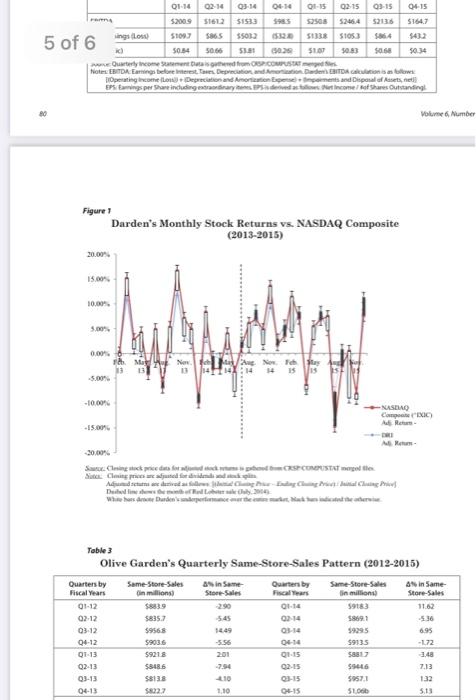

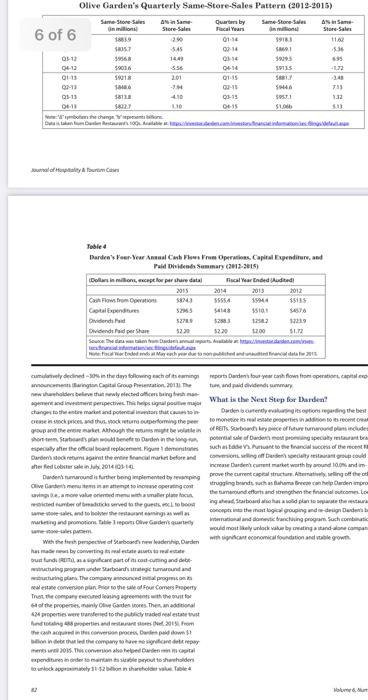

Darden Restaurants, Inc. Is the Turnaround Happening? By Murat Kizildag, Fevzi Okumus and Kevin Murphy Introduction operational and financial strategies to turnaround Darden. Therefore, the primary objectives of this case stud are to: (a) examine the revival strategies implemented by Darden to boost the stagnant earnings, profit margins, and market value, (b) analyze the critical operational and financial measures executed by Darden to re- verse its losses, and (c) scrutinize the future prospects of Darden after the implementation of the turnaround plan. Additionally, this case study seeks answers to several critical questions below: What caused Darden to require a major corporate turn- around attempt? Due to increased competition, changing consumer preferences, tougher market conditions, more knowledgeable shareholders, and rising raw product costs, US restaurant companies are experienc- ing more economic distress and higher risk of bankruptcy. In the aftermath of the great recession in 2008, bankruptcies across US corporations climbed to the record number of bankruptcy filings. Busi- ness bankruptcy filings at different levels (bankruptcy chapters 7, 11, 12, and 13) totaled 58,721 and 58,322 in 2009 and 2010 respectively (United States Court Reports, 2012). Although bankruptcy filings have fallen to 26,130 in 2015 (United States Court Reports, 2015), high probability of bankruptcy is still seen in most of the capital-intensive industries, such as the restaurant industry since most of the restaurant corporations use long-term debt to expand and generate cash flows. However, this creates greater financial risk for them (Kizildag, 2015). These companies are far more inclined to engage in strategic corpo- rate turnarounds by selling assets, creating real estate investment trusts (REITs), streamlining or closing divisions, and/or laying people off to cut costs and generate earnings (ie, Quiznos LLC.). In the past 10 years, some of America's biggest restaurant chains have lost more than 50.0% of their sales as they closed hundreds of locations nation- wide (Hess and Sauter, 2012). What were the roles of Starboard Value LP in Darden's revival plan? What are Darden's key strategic turnaround actions to pre- vent further losses? What are the fundamental operational and financial out- comes that signify turnaround? How does transformed Darden's performance look for the near future? Corporate Turnarounds The decline of a firm from a superior performance position to a poor position on any appropriate performance criterion normally points to fundamental operational problems with its management and financial strategies. Corporate business failure, after the onset of performance decline, is highly correlated to leadership inaction and poor timing of strategic actions. In such circumstances, firms need to reverse the overall performance decline and bring performance back to the operational norms by implementing a wide range of turnaround strategies and restructuring (Filatotchev and Toms, 2006; Pearce Il and Robbins, 2008; Sudarsanam and Lai, 2001). The preponderance of bankruptcies, store closures, and negative macro and micro-economic facts have caused companies to take a multitude of strategic actions in order to avoid business failure, to cope with severe financial distress, and to maintain their financial solvency. The turnaround of Darden Restaurant, Inc. is considered to be one of the most remarkable turnarounds of an underperforming restaurant com- pany in recent years for the industry. In October 2015, activist hedge fund Starboard Value LP won a protracted proxy battle to take over Darden's executive board by winning the vast majority of the sharehold- er votes by publishing a rescue plan manifesto to reverse the fortunes of the struggling restaurant group. Starboard's suggested revival plan was to create positive operational and financial momentum and restore the economic value of Darden's two flagship brands-Olive Garden Restaurants and Red Lobster Restaurants, from which most of Darden's revenue was generated. Since then, Starboard has introduced specific Corporate turnaround is defined as: "the implementation of a set of actions required to save an organization from business failure and return it to operational normality and financial solvency. Turnaround management usually requires strong leadership and can include corpo- rate restructuring and redundancies, an investigation of the root causes of failure, and long term programs to revitalize the organization" (CIMA, 2009). Diversification, business mergers and acquisitions, management Murat Kizildag, Fevzi Okumus and Kevin Murphy are all affiliated with University of Central Florida. 1 This case study was written for the purposes of dassroom discussions. It was not intended to show effective or ineffective handling of executive decisions or a managerial situation. Published materials and academic sources were used in preparing this case study 2 of 6 organization, or a combination of these, are rial strategies for the executives who confront turnaround situations (Pretorius, 2008, Sudarsanam and Lai, 2001). Whatever the reasons for the business failure are, adopted turnaround strategies must reverse the causes of poor performance, resolve the op erational problems, achieve a rapid and steady improvement in financial performance (profitability, solvency, and liquidity), regain stakeholder support, and overcome internal problems. Operational turnaround and restructuring strategy (ie, output maximization and input minimization) is composed of cost reduc tion, revenue generation, asset reduction, and integration of business units strategies to improve efficiency and margin by reducing direct costs and slimming overhead expenses in line with sales volume (Haron et al, 2013; Slatter et al., 2011). Managerial restructuring and re-organization strategy Ge, removal of Chairman or Chief Executive Officer) entails changes to the leadership and executive structure to yield improved leadership, management, organizational structure, organizational alignment and culture (Chen and Hambrick, 2011; Koh et al, 2015). Financial turnaround and restructuring strategy is simply the reworking of a firm's capital structure to relieve the strain of inter- est and debt repayments and to strengthen the balance sheet and/or provide funding. Specifically, cash generation strategies (ie, dividend cut, etc.) and additional stock issuances are commonly-used strate gies to pay down debt, reduce interest cost and improve cash flows (Schoenberg et al. 2013; Slatter et al, 2011). In recent years, corporate turnarounds have included some of the "giants in the US. economy due to varying reasons. For instance, Best Buy (NYSEBBY) has turned around its U.S. operations by shedding its assets and trimming expenses to help lift profitability with the new board elected in 2012. Yahoo's (NASDAQ:YHOO) turnaround activities has recently switched to the advertising business as a means of bol stering revenue in 2015. J.C. Penney (NYSE:JCP) has just entered next phase of turnaround by reworking its store services and partnerships to bring the customer visits back towards their goal of increasing $1.2 billion in earnings before interest, taxes, depreciation, and interest (EBITDA) by 2017 (Kell, 2015: Ashworth, 2014). As a most sallent recent example from the restaurant industry. the fast food giant McDonald's (NYSEMCD) comparable same-store- sales have fallen globally in four consecutive quarters and are down six straight quarters in the US, with no sign of quick rebounds. Hence, the company's new CEO, Steve Easterbrook, unveiled its massive turnaround plan to revive its organization in May, 2015. The plan's major focus is to reorganize its business structure, to sell company-owned stores to franchisees, to increase consumer traffic, and to provide higher returns to its shareholders. McDonald's short-term revival target is to sell some 3,500 company-owned restaurants to franchises by the end of 2018, up from a prior target of refranchising at least 1,500 restaurants by 2016 (up from a current 81% to about 90%). Additionally, the new plan aims to re- organize its menu (e. garlic sauce) to bring customer retentions rates back to the previous corporate norms (Wohl, 2015). Case Synopses: Efforts to Turnaround Darden Over the past few years, Darden Restaurants, Inc. has underper formed its peer group (e. Brinker International Inc, DineEquity, Inc. OSI Restaurant Partners, LLC, Ruth's Hospitality Group, BU's Restaurants Inc.) and the corporation has disappointed its shareholders with its sluggish sales volume, revenue, margins, per share earnings and stock returns. The declining sales, earnings, and brand reputation have been clear signs for the shareholders to have a logical move to reverse years of declines and to consider perpetual solutions for turnaround, especial- ly for Olive Garden and Red Lobster Restaurants. Concurrently, these two brands were among the worst performers, reporting same-store-sales growth of -2.3% for Olive Garden and -28% for Red Lobster (Barington Capital Group Presentation, 2013). This action was much needed and crucial to longer term operational survival, since those two flagship brands made up close to three-quarters of Darden's total revenue The story of Darden's financial struggle started with Olive Garden's and Red Lobster's enormous increase in food cost and con tinuously declining same-store-sales, declining guest counts, and shrinking profit margins. Olive Garden's food costs historically was about 26-27% of sales, but rose to an estimated 29% in 2014 contrib uting to Darden's overall 30.1% food costs while industry median was around 27.20% (Transforming Darden Restaurants, Starboard Value LP Investor Presentation, 2014). After activist hedge fund Starboard's severe criticism about Darden's underperforming brands and contentious proxy battle in 2014, Darden's board was replaced with Starboard's entire state of board members. Starboard's 294 page revival plan has shifted Darden's managerial and financial strategies to longer-term perspectives to turnaround these aforementioned unsuccessful Darden brands. The main objective of the new owners revival plan has been clustered around a value enhancing strategies for Darden's real estates, res taurant concepts, and franchising systems under a company-wide. comprehensive operational improvement plan.Starboard's specific initiatives are to: () build up Darden's creditworthiness, re-structure its debt, and foster sustainable long-term shareholder value. (i) improve the sales volume, increase earnings, and boost stock returns, G) con- vert properties into real estate trust funds (REITs) and optimize capital expenditures for future investments. Table 1 outlines Starboard's spe cific turnaround strategies and initiatives in detail Darden's current major shareholders are still in frustration since Starboard injects twelve executives to Darden's current board with 8.8% stake in the company. Starboard is now the second-largest investor and it ousts Olive Garden owner's full board (Transforming Darden Restau uting to Darden's overall 30.1% food costs while industry median was around 27.20% (Transforming Darden Restaurants, Starboard Value LP stor Presentation, 2014) After activist hedge fund Starboard's severe criticism about Dardens underperforming brands and contentious proxy battle in 2014, Darden's board was replaced with Starboard's entire state of board members. Starboard's 294 page revival plan has shifted Darden's managerial and financial strategies to longer term perspectives to turnaround these aforementioned unsuccessful Danden brands. The main objective of the new owners revival plan has been clustered around a value enhancing strategies for Danden's real estates, res taurant concepts, and franchising systems under a company-wide. comprehensive operational improvement plan Starboard's specific intatives are to build up Darden's creditworthiness, re-structure its deb, and foster sustainable long-term shareholder value, 0) improve the sales volume, increase earnings, and boost stock returns, con vert properties into real estate trust funds (REITS) and optimize capital expenditures for future investments Table 1 outlines Starboard's spe cfic turnaround strategies and initiatives in detail Darden's cument major shareholders are still in frustration since Starboard injects twelve executives to Darden's current board with 8 stake in the company Starboard is now the second largest investor and outs Olive Garden owner's full board (Transforming Darden Restau Volume 6, Number 1 Scheneta 2013 Satter et al. 2011) orate turnarounds have included some of the 3 of 6 my due to varying reasons. For instance Best d around its US operations by shedding assets and trimming expenses to help lift profitability with the new board elected in 2012. Yahoo's NASDAQ YHOO) tumaround activities has recently switched to the advertising business as a means of bol stering revenue in 2015. JC Penney (NYSE JCP) has just entered nest phase of turnaround by reworking its store services and partnerships to bring the customer visits back towards their goal of increasing $1.2 billion in earnings before interest, taxes, depreciation, and interest (EBITDA) by 2017 (Kell 2015; Ashworth, 2014 As a most sallent recent example from the restaurant industry. the fast food giant McDonald's (NYSE MCD) comparable same-store- sales have fallen globally in four consecutive quarters and are downsi straight quarters in the US, with no sign of quick rebounds. Hence, the company's new CEO Steve Easterbrook, unveiled its massive turnaround plan to revive its organization in May, 2015. The plan's major focus is to reorganize its business structure to sell company-owned stores to franchisees, to increase consumer traffic, and to provide higher res to its shareholders. McDonald's short term revival target is to sell some 1.500 company-owned restaurants to franchises by the end of 2018 up from a prior target of refranchising at least 1,500 restaurants by 2016 up 28 Table 1 A Comprehensive Operational Improvement and Revival Plan Starboard Value LP Focus Areas Strategic Actions Radical replacement in top executives with cohesive group of board members to convey a sense of calm and control to Danden's shareholders Board Restructuring Incentives and corporate governance to represent the best interest of all share holders (wiping off a long history of abysmal corporate governance) Revenue generation through reducing operating assets, minimizing direct costs. and slimming overheads in line with sales volume Operational Reforms Improving margins BITDA profit margins, etc) and solidifying investment credit rating and dividend policy Remigration in international expansion and franchising programs. Reconfiguration of Darden's real estate assets through REIT conversion and divest ment of Red Lobster Restaurants and specialty restaurant groups Financial initiatives Financial reorganization for Dardens optimal productivity through reduced capital expenditures, long-term abilities, interest expenses and improved cash flows and returns on capital Enforcing non conventional marketing efforts to increase marketing and advertis Competitive Re-positioning Re-energizing Olive Gandens product market focus via revitalized menu design and items (bringing back the Italian authenticity) Cuts in portion sizes on existing lines of Olive Garden's memu to stimulate demand traffic growth and customer service Q1-14 02-14 03-14 04-14 01-15 02:15 03-15 04-15 $1533 1985 52508 5246.4 52136 $164.7 $200.9 $161.2 $109.7 586.5 sings (Loss) $5032 $1338 $105.3 K) 50.84 50.66 53.81 0026 $1.07 50.83 $0.68 50.34 Quarterly Income Statement Data is gathered from OSPCOMPUSAT med fes Notes EBITDA Earnings before Interest, Tares Depreciation, and Americation Darder's EBITDA calculation is as follows: Operating Income (Loss) Depreciation and Amortization Expense moments and Disposal of Assets, EPS Earnings per Share including extraordinary itenes EPS is deved as aos Net Income/of Shares Outstanding Figure 1 Darden's Monthly Stock Returns vs. NASDAQ Composite (2013-2015) 20.00% 15.00% 10.00% 5.00% wwwma 0.00% Aug Nov. Feb ay 14 15 -5.00% -10,00% NASDAQ Compte (DOC) Ad Ren -15.00% DRI A Re -20.00% bood CRSPCOMPUTAT e lex Sat Closing stock price data for addock Sat Closing prices are adjusted for dividends and stock splits Adjud sets are derived as follows a Cg-Ending Cling Price: Iittal Closing Price Duded lines the month of Red Lober sally 2004 Whitehors drote Durden's nderperformance or the market, black han indicated the otherwise Table 3 Olive Garden's Quarterly Same-Store-Sales Pattern (2012-2015) Same-Store-Sales 4% in Same Quarters by Quarters by Fiscal Years Same-Store-Sales in millions) 4% in Same- Store-Sales (in millions) Store-Sales Fiscal Year 01-12 $883.9 -2.90 01-14 59183 11.62 02-12 $835.7 -5.45 02-14 $869.1 -5.36 03-12 $956.8 1449 03-14 19295 6.95 04-12 $903.6 -5.56 04-14 $9135 -1.72 Q1-13 $9218 2:01 01-15 5881.7 -3.48 Q2-13 5848.6 -7.94 02-15 59446 7.13 03-13 4.10 Q3-15 $957.1 1.32 04-13 $822.7 1,10 04-15 $1,066 5,13 5 of 6 Volume 6, Number Olive Garden's Quarterly Same-Store-Sales Quarter by Same-Store-Sales 4% in Same in million Store-Sales Facal Year 6 of 6 18819 2.50 01:14 $835.7 $45 02:14 05-12 19568 144) 03-14 04-12 $9016 5:56 04-14 01-13 19018 201 01-15 02-13 1848.6 -794 02-15 05-13 18138 4.10 03-15 04-11 1832.7 1.10 04-15 the change Data is taken Den Restas 100 Available. of Holy A Cas Pattern (2012-2015) Same-Store-Sales A Same in million 19183 11.62 $69.1 5.36 19295 695 19115 -1.72 1881.7 3.48 $9446 735 $957.1 132 $1,066 $13 inance intermed Darden's Four-Year Annual Cash Flows From Operations, Capital Expenditure, and Paid Dividends Summary (2012-2015) Dollars in millions, except for per share data Fiscal Year Ended Audited) 2015 2014 2013 2012 Cash Flows from Operations $8743 $555.4 15944 15135 52965 $4576 Capital Expenditures Dividends Paid Dividends Paid per Share 5278.9 $268.3 12582 12239 $2.30 12:20 $2.00 $1,72 Source: The was taken from Darde anuals.com/ mat Me Fal War Ended and at May each year due to nonched and financial data 2013 ports Darden's four-year cash flows from operations, capital exp ture, and paid dividends summary What is the Next Step for Darden? cumulately declined -30% in the days following each of its eamings announcements Barington Capital Group Presentation, 20131 The new shareholders believe that newly elected officers being ma agement and investment perspectives. This helps signal changes to the entire market and potential in that cause to crease in stock prices and thus, stock return outperforming the peer group and the entire market. Although the retums might be volte in Short Starbon plan would benefit to Darden in the longue especially after the official board replacement. Figure 1demontes Darden's stock returns against the entire financial market before and after Red Lobster sale in July 2014 (314 Darden is uently evaluating its options regarding the best to monetize its real estate properties in addition to its recent cream of REITS Starboard key piece of future turnaround plans includes sale of Darders most proming specialty restaurant bras such as tade V. Pursuant to the financial success of the recent F conversioning off Derdens specialty restaurant group could increase Darden's current market worth by around 100% and im Dandens turnaround is further being implemented by revamping prove the current capital structure. Alternatively selling off the ol Olive Gardens mentes in an attempt to increase operating coststruggling brands such as Bahama Breese can help Darden improm savings e, a more value oriented menu with a smaller plate fathe tumound efforts and strengthen the financial outcomes. Low restricted number of badsticks served to the guests to boostingahead Starboard also has a solid plan to separate the restauran same-store-sales, and to holter the restaurant eanings as well as marketing and promotions Table 1 reports Olive Garden's quarterly same-sales pe concepts into the most logical grouping and re-design anden b intentional and domestic franchising program. Such combinatio would most likely unlock value by creating a stand-alone compan with significant economical foundation and stable growth With the fresh perspective of Starboard's new leadership, Darden has made by converting its real estate assets to real estate trust fundi (Ras a significant part of its cost-cutting and debt structuring program under Starboard's strategic turnaround and wucturing plans. The company announced in prog real estate conversion plan Prior to the sale of Four Comers Property Trust the company executed leasing agreements with the must for 64 of the properties, mainly Olive Garden stores. Then, an additional 424 properties were transfered to the publicly traded real estate trust funding 488 properties and restaurant stores (N2015 From the cash acquired in this conversion process, Darden paid down 31 bon indebthat led the company to have no idea ments un 2035. This conversion also helped Dardennapital expenditures in order to maintain ts sizable piryout to shareholders 82 Molume & Mu rants Sarbant Value Investor Presentation 2014 The wide of Darde corporate culture is that this board estructuring might restrict the flexibility of Dardenscument major shareholders in otical decision making processes, such as establishing some of the essential corporate governance provisions Abo, existing shareholders will now have les voting power in the board However, Starboard believes that replacing the majority of incumbent board members in necessary to bring fresh managerial and operational penpectives to the company from revamping the menu items and portions , vel added to the pastal to boostingaanging the corporational ture, converting Dardenproperto as Olive Garden and Red Lobster. In this operational reform package, Starboard proposes to improve IT margins by $215-1326 milion per year for the next five year period while improving the overhead costs, food cost and guest dining experience and customer traf fc Darden's existing shareholders are still spocal about immediate positive outcomes of these operational cost efficiency and main improvement. Their conclusion remarks that these reforms wit cause huge fluctuations in earnings and pres and the company will lose tseting customer base. Nevertheless, Starboard thanks fors will give roughly 20% boost to same sales especially for Olive Garden Net 2015). This plan is mostly implemented to turnaround Ove Gardens sluppeh same store sales, facking service standards and increasing food waste Starboard also adds that higher earings This multidimensional plan has also been inated to implement critical to the operations of underperforming brands such of ty&ou share, and recovering the brand image will positively affect their credit ratings, dividend policies and inter national franchising programs in the long run since Darden will higher levels of earnings Are Darden's Corporate Turnaround Strategies Effective? Additionally and new corporate them is free of corporate centric structure, which entities every decision to be and set heavy-structure which focuses on high levels of property acquisition and investment in this way, Starboard financial initiatives target les property buyouts and intments. Therefore, Darden can have reduced capital expenditures, decreased levels of external debes Belong term commercial loan and lower interest payments Also Darden can succeed lowering lease expenses by converting restaurant properties in and selling off underperformed brands such as Red Lobster and specialty restaurant grups Eddie VS Byin plementing these financial plans, Starboand suggests that anden will improve its cashews and stock returns so they can remontoit holders by paying out higher amounts of dividends It has been a bumpy road for Darden trying to bounce back from nancial distress since early 2012. The company has been under pres sure by its shareholders. The profe picture has been defined and the overhead costs se, food cost and fand payments, lease penses) have reached to undesirable levels. On top of that customer tufichas weakened due to conservative consumer spending on ou for menu items and there has been an ongoing financial decline in same-store-sales between the first quarter of 2012 and the last quarter of 2015 handforming Danden Restaurants, Starboard Valve L investor Presentation 2014 Pomped by Starboard take-over actions one of the first actions in Dardensturnaround plans was selling off Red Lob to unlock shareholder value. Although Danden still continues to face Lastly, Starboard points that coment advertising and marketing efforts an outdated and ineffective. Thus, Starboards comprehensive from its shareholders following the sale of Red Lobite the revival strategies to enhance Dardens undergive company initiated a share repurchase plan totaling $500 million Abo the management put $1 billion to refine its deberg 5208 Garden's competitive positioning in the restaurant industry and its ad vertising spending Startond thinks that customer traffic and retumbo in cash and $28.3 milion net of transaction related costs from a $2.1 en Red Letter sale lagher 2014 The of aduction effort was to strengthen Darden's creditworthiness by improving its net earings, eamings per share EPS EBITDA stock and therefore its shareholder's wealth Table 2 Layout Dard quarterly earningsture with the important earning measures will be positively affected with the reduced advertising and marketing spending for Olive Garden The plan specifically targets to stimulate Olive Garden'sective price point promotions and couponing not enough advertising messaging efforts, and lacking awareness and digital marketing. However, the existing board t questions the effectiveness of Olive Garden's repositioning attempts Antherical action taken by Starband was to drive sig since it might be difficult for customers to get accustomed to these can improvements in Dardens stock returns since its stock p drastic changes, restaurant logi menu tem, menu design Taken has underperformed the entire market (NASDAQ Composite in this all together Starboards comprehensive improvement plan and strate vein, Starboard's priority was to increase stock us by selling Red gies for Darden are to preserve and create substantial shareholder Lobster nominating twelve directors for board elections, and bring value by higher level of earnings, stock price appreciation, more maring rich strategies to capture more investors and stockh Table 2 Darden's Quarterly EBITDA, Net Earnings (Loss), and EPS Structure (2014-2015) Dollars in millions, except for per share data Quarter 01-14 02-1403-14 04-14 01-15 07-15 03:15 0415 5300 $1612 $1583 1085 52508 5246-4 52136 51647 EBITDA Net Earnings ( EPS $1007 1865 $5052 1532 51338 $105.3 564 1417 $0.84 5066 $181 150.20 $0.61 5068 50.34 meat is the CCOMPU Source Quarterly Notes EBITDA aming belore interest Tax Depreciation, and Amortstation Dad's EBDA con Opng Depron and Amortation Expensel Impaments and Dispo Number 1 (