Question: Sample Question 2) a) Explain what happens to the balance sheet of a central bank and to base money when it (i) lends $100mn to

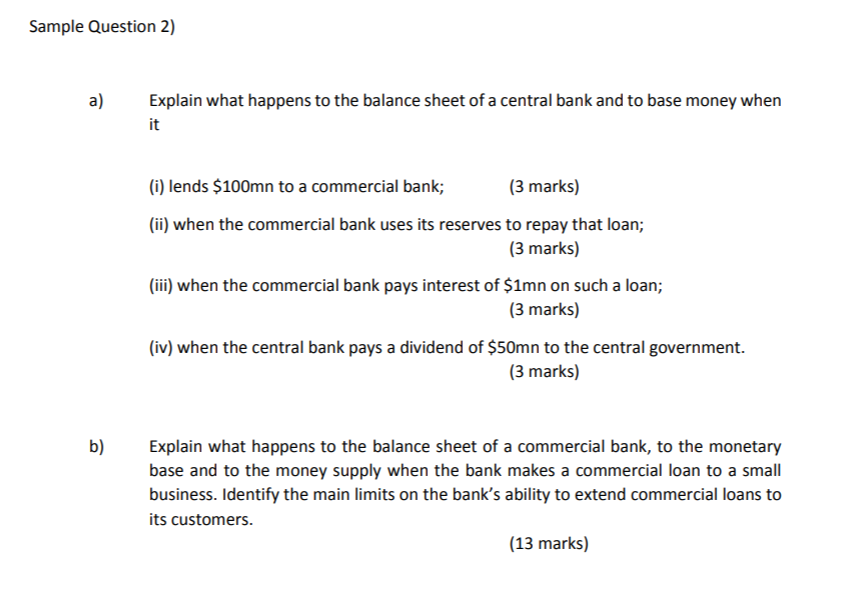

Sample Question 2) a) Explain what happens to the balance sheet of a central bank and to base money when it (i) lends $100mn to a commercial bank; (3 marks) (ii) when the commercial bank uses its reserves to repay that loan; (3 marks) (ii) when the commercial bank pays interest of $1mn on such a loan; (3 marks) (iv) when the central bank pays a dividend of $50mn to the central government. (3 marks) Explain what happens to the balance sheet of a commercial bank, to the monetary b) base and to the money supply when the bank makes a commercial loan to a small business. Identify the main limits on the bank's ability to extend commercial loans to its customers. (13 marks) Sample Question 2) a) Explain what happens to the balance sheet of a central bank and to base money when it (i) lends $100mn to a commercial bank; (3 marks) (ii) when the commercial bank uses its reserves to repay that loan; (3 marks) (ii) when the commercial bank pays interest of $1mn on such a loan; (3 marks) (iv) when the central bank pays a dividend of $50mn to the central government. (3 marks) Explain what happens to the balance sheet of a commercial bank, to the monetary b) base and to the money supply when the bank makes a commercial loan to a small business. Identify the main limits on the bank's ability to extend commercial loans to its customers. (13 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts