Question: Samsung bond has been just issued under th e conditions: 10 years to maturity, coupon rate 7 %, YTM 6%, semi-annual coupon payments. If

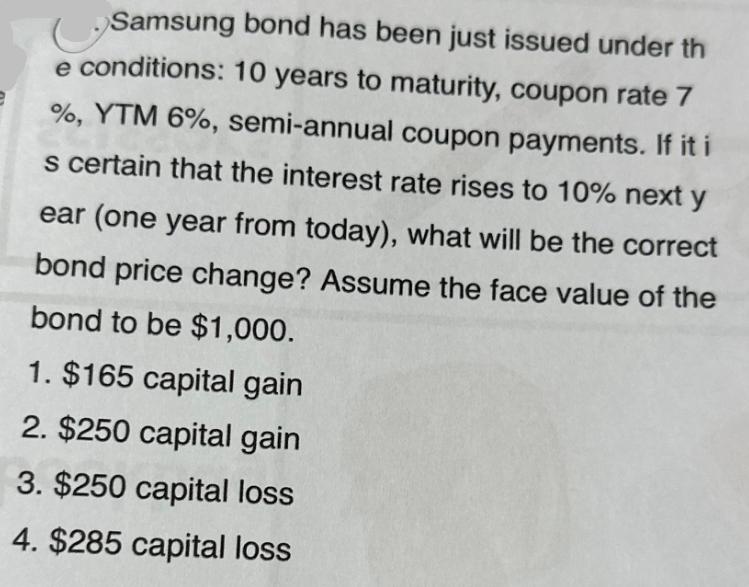

Samsung bond has been just issued under th e conditions: 10 years to maturity, coupon rate 7 %, YTM 6%, semi-annual coupon payments. If it i s certain that the interest rate rises to 10% next y ear (one year from today), what will be the correct bond price change? Assume the face value of the bond to be $1,000. 1. $165 capital gain 2. $250 capital gain 3. $250 capital loss 4. $285 capital loss

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Answer Apologies for the confusion in my previous response I made an error in the calculation Lets recalculate the bond price change correc... View full answer

Get step-by-step solutions from verified subject matter experts