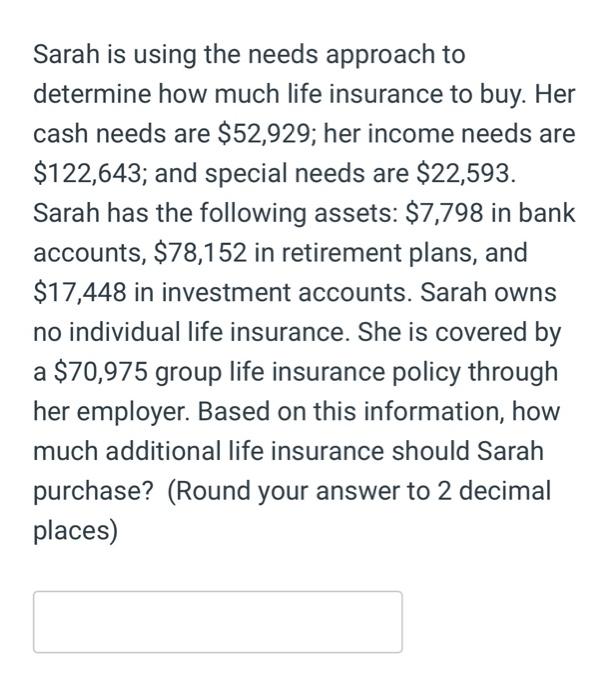

Question: Sarah is using the needs approach to determine how much life insurance to buy. Her cash needs are $52,929; her income needs are $122,643; and

Sarah is using the needs approach to determine how much life insurance to buy. Her cash needs are $52,929; her income needs are $122,643; and special need are $22,593. Sarah has the following assets: $7,798 in bank accounts, $78,152 in retirement plans, and $17,448 in investment accounts. Sarah owns no individual life insurance. She is covered by a $70,975 group life insurance policy through her employer. Based on this information, how much additional life insurance should Sarah purchase? (Round your answer to 2 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts