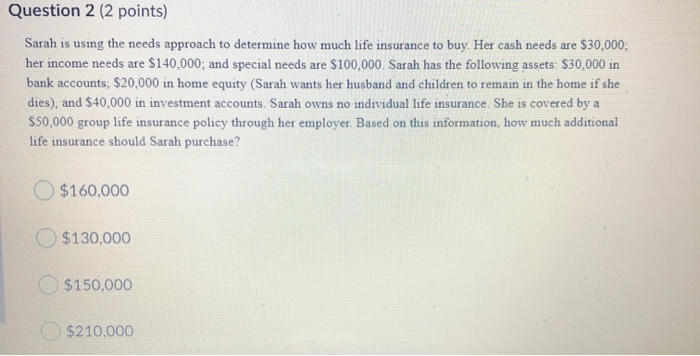

Question: Sarah is using the needs approach to determine how much life insurance to buy. Her cash needs are $30,000; her income needs are $140,000, and

Sarah is using the needs approach to determine how much life insurance to buy. Her cash needs are $30,000; her income needs are $140,000, and special needs are $100,000. Sarah has the following assets: $30,000 in bank accounts, $20,000 in home equity (Sarah wants her husband and children to remain in the home if she dies), and $40,000 in investment accounts. Sarah owns no individual life insurance. She is covered by a $50,000 group life insurance policy through her employer. Based on this information, how much additional life insurance should Sarah purchase? $160,000 $130,000 $150,000 $210,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts