Question: Sard Function abo etes the following degree, will mo 5) with lowes Suppose you hold a $1 million portfolio of stocks tracking the S&P 500

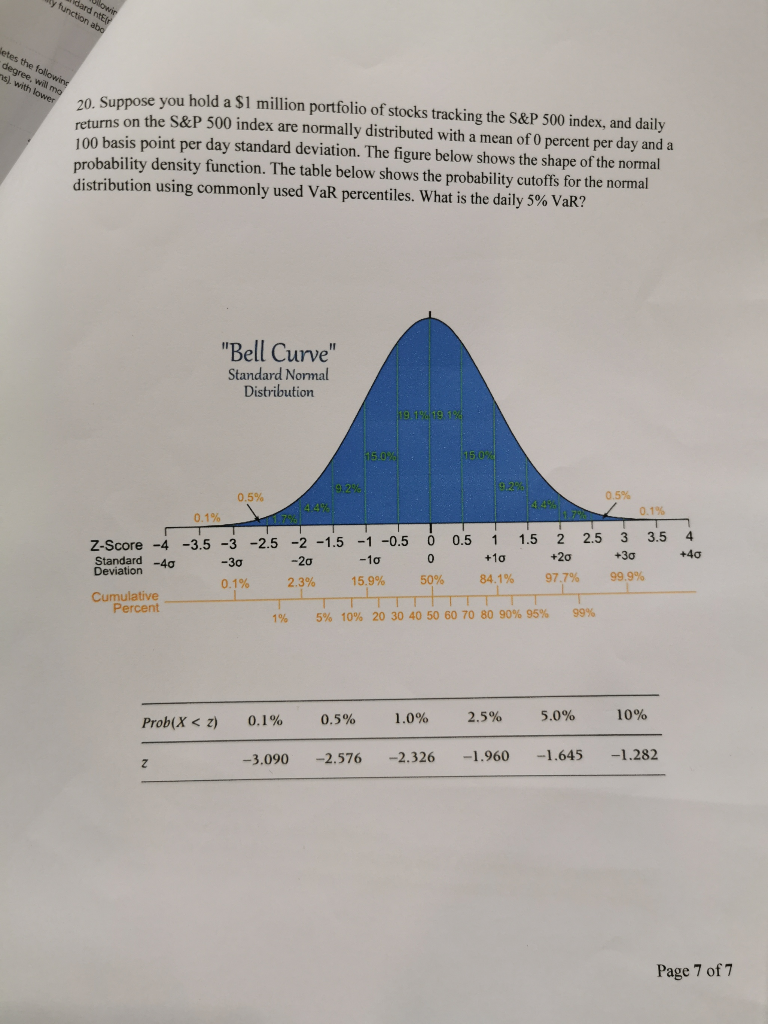

Sard Function abo etes the following degree, will mo 5) with lowes Suppose you hold a $1 million portfolio of stocks tracking the S&P 500 index, and daily returns on the S&P 500 index are normally distributed with a mean of O percent per day and a 100 basis point per day standard deviation. The figure below shows the shape of the normal probability density function. The table below shows the probability cutoffs for the normal distribution using commonly used VaR percentiles. What is the daily 5% VaR? "Bell Curve" Standard Normal Distribution 0.1% Z-Score -4 -3.5 -3 -2.5 -2 -1.5 -1 -0.5 0.5 1 1.5 2 2.5 3 3.5 4 Standard -40 -30 -20 -1 0 +10 +20 +30 +40 0.1% 2.3% 15.9% 50% 84.1% 97,7% 99.9% Cumulative 1% 5% 10% 20 30 40 50 60 70 80 90% 95% 99% Percent Prob(x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts