Answered step by step

Verified Expert Solution

Question

1 Approved Answer

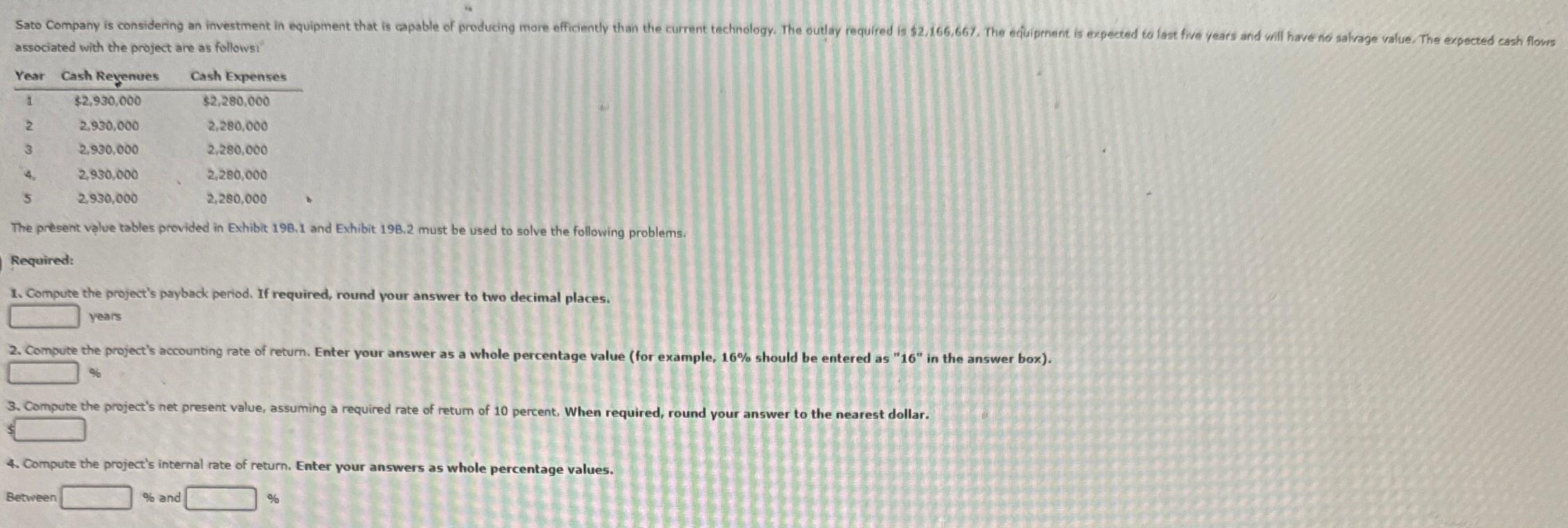

Sato Company is considering an investment in equipment that is capable of producing more efficiently than the current technology. The outlay required is $2,166.667.

Sato Company is considering an investment in equipment that is capable of producing more efficiently than the current technology. The outlay required is $2,166.667. The equipment is expected to fast five years and will have no salvage value. The expected cash flows associated with the project are as follows: Year Cash Revenues Cash Expenses $2,280,000 1 $2,930,000 2 2,930,000 2,280,000 3 2,930,000 2,280,000 4. 2,930,000 2,280,000 5 2,930,000 2,280,000 The present value tables provided in Exhibit 198.1 and Exhibit 198.2 must be used to solve the following problems. Required: 1. Compute the project's payback period. If required, round your answer to two decimal places. years 2. Compute the project's accounting rate of return. Enter your answer as a whole percentage value (for example, 16% should be entered as "16" in the answer box). % 3. Compute the project's net present value, assuming a required rate of return of 10 percent. When required, round your answer to the nearest dollar. 4. Compute the project's internal rate of return. Enter your answers as whole percentage values. Between % and %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Compute the projects payback period Cash Flows Year 1 2930000 2280000 650000 Year 2 2930000 228000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642d2e8810e4_973848.pdf

180 KBs PDF File

6642d2e8810e4_973848.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started