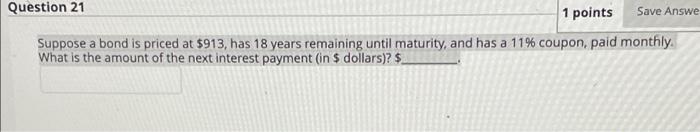

Question: Save Answe Question 21 1 points Suppose a bond is priced at $913, has 18 years remaining until maturity, and has a 11% coupon, paid

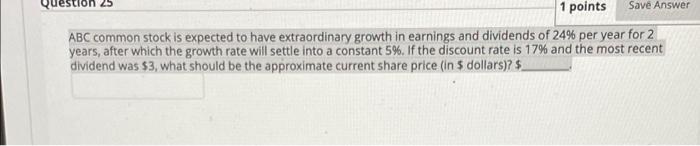

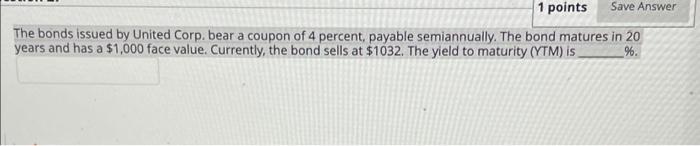

Save Answe Question 21 1 points Suppose a bond is priced at $913, has 18 years remaining until maturity, and has a 11% coupon, paid monthly What is the amount of the next interest payment in $ dollars)? $_ 1 points Save Answer ABC common stock is expected to have extraordinary growth in earnings and dividends of 24% per year for 2 years, after which the growth rate will settle into a constant 5%. If the discount rate is 17% and the most recent dividend was $3, what should be the approximate current share price (in $ dollars)? $_ 1 points Save Answer The bonds issued by United Corp, bear a coupon of 4 percent payable semiannually. The bond matures in 20 years and has a $1,000 face value. Currently, the bond sells at $1032. The yield to maturity (YTM) is %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts