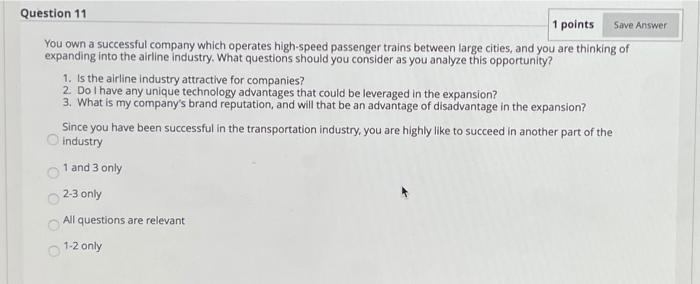

Question: Save Answer Question 11 1 points You own a successful company which operates high-speed passenger trains between large cities, and you are thinking of expanding

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock