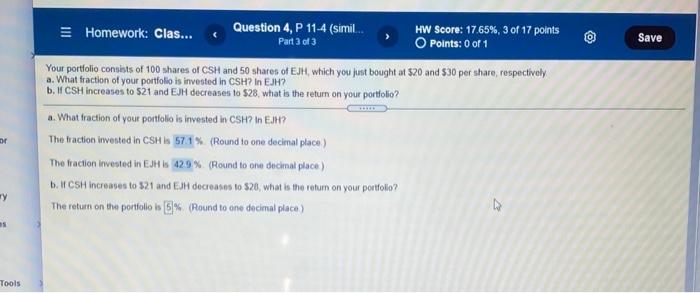

Question: Save E Homework: Clas... Question 4, P 11-4 (simil.. HW Score: 17.65%, 3 of 17 points Part 3 of 3 Points: 0 of 1 Your

Save E Homework: Clas... Question 4, P 11-4 (simil.. HW Score: 17.65%, 3 of 17 points Part 3 of 3 Points: 0 of 1 Your portfolio consists of 100 shares of CSH and 50 shares of EJH, which you just bought at $20 and $30 per share, respectively a. What fraction of your portfolio is invested in CSH? In EJH? b. If CSH increases to $21 and EJH decreases to $28, what is the return on your portfolio? a. What traction of your portfolio is invested in CSH? In EJH? The traction invested in CSHI 571% (Round to one decimal place) The fraction invested in EJH is 42.9% (Round to one decimal place) 6. CSH Increases to 521 and EH decreases to $26, what is the rotum on your portfolio? The return on the portfolio i 6% (Round to one decimal place) Dr Ty Tools

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts