Question: Save . En Sub eck my work mode: This shows what is correct or Incorrect for the work you have completed so far. It does

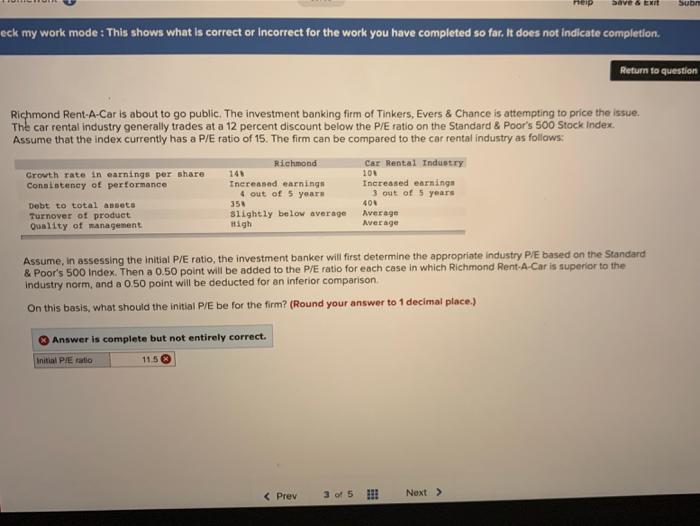

Save . En Sub eck my work mode: This shows what is correct or Incorrect for the work you have completed so far. It does not indicate completion. Return to question Richmond Rent-A-Car is about to go public. The investment banking firm of Tinkers, Evers & Chance is attempting to price the issue. The car rental industry generally trades at a 12 percent discount below the P/E ratio on the Standard & Poor's 500 Stock Index. Assume that the index currently has a P/E ratio of 15. The firm can be compared to the car rental industry as follows: Growth rate in earnings per share Consistency of performance Richmond 141 Increased earnings 4 out of 5 years 351 Slightly below average | High Car Rental Industry 100 Increased earnings 3 out of 5 years 400 Average Average Debt to total assets Turnover of product Quality of management Assume, in assessing the initial P/E ratio, the investment banker will first determine the appropriate industry Pre based on the Standard & Poor's 500 Index. Then a 0.50 point will be added to the P/E ratio for each case in which Richmond Rent-A-Car is superior to the Industry norm, and a 0.50 point will be deducted for an inferior comparison On this basis, what should the initial P/E be for the firm? (Round your answer to 1 decimal place.) Answer is complete but not entirely correct. Initial PE ratio 115

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts