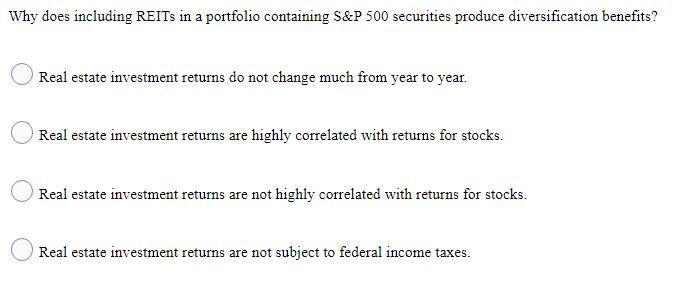

Question: Why does including REITs in a portfolio containing S&P 500 securities produce diversification benefits? Real estate investment returns do not change much from year to

Why does including REITs in a portfolio containing S&P 500 securities produce diversification benefits? Real estate investment returns do not change much from year to year. Real estate investment returns are highly correlated with returns for stocks. Real estate investment returns are not highly correlated with returns for stocks. Real estate investment returns are not subject to federal income taxes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock