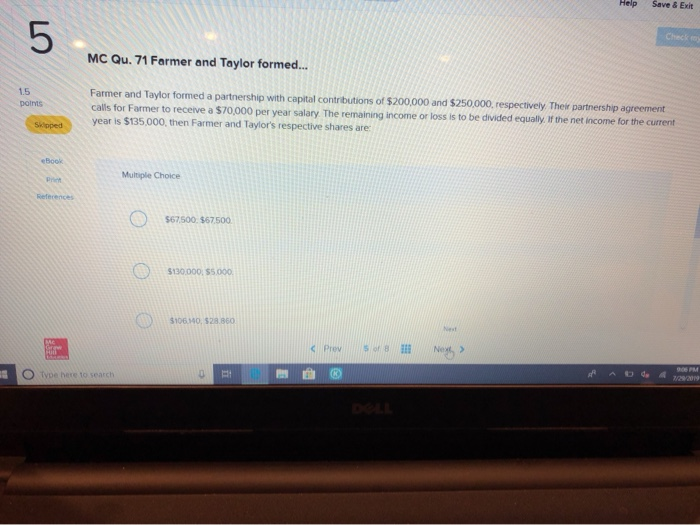

Question: Save & Exit Help 5 Check MC Qu. 71 Farmer and Taylor formed... Farmer and Taylor formed a partnership with capital contributions of $200,000 and

Save & Exit Help 5 Check MC Qu. 71 Farmer and Taylor formed... Farmer and Taylor formed a partnership with capital contributions of $200,000 and $250,000, respectively Their partnership agreement calls for Farmer to receive a $70,000 per year salary The remaining income or loss is to be divided equally. If the net income for the current year is $135,000, then Farmer and Taylor's respective shares are 1.5 points Sklpped eBook Multiple Choice Print References $67500. $67500 $130,000, $5.000 $106.40, $28.860 Next s of 8 Nexh Prev 908 PM 7/29/2019 Type here 10 search DOLL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts