Question: Save & Exit Submit 01. 13 You would like to compare two funds you have read about in the Wall Street Journal. You download the

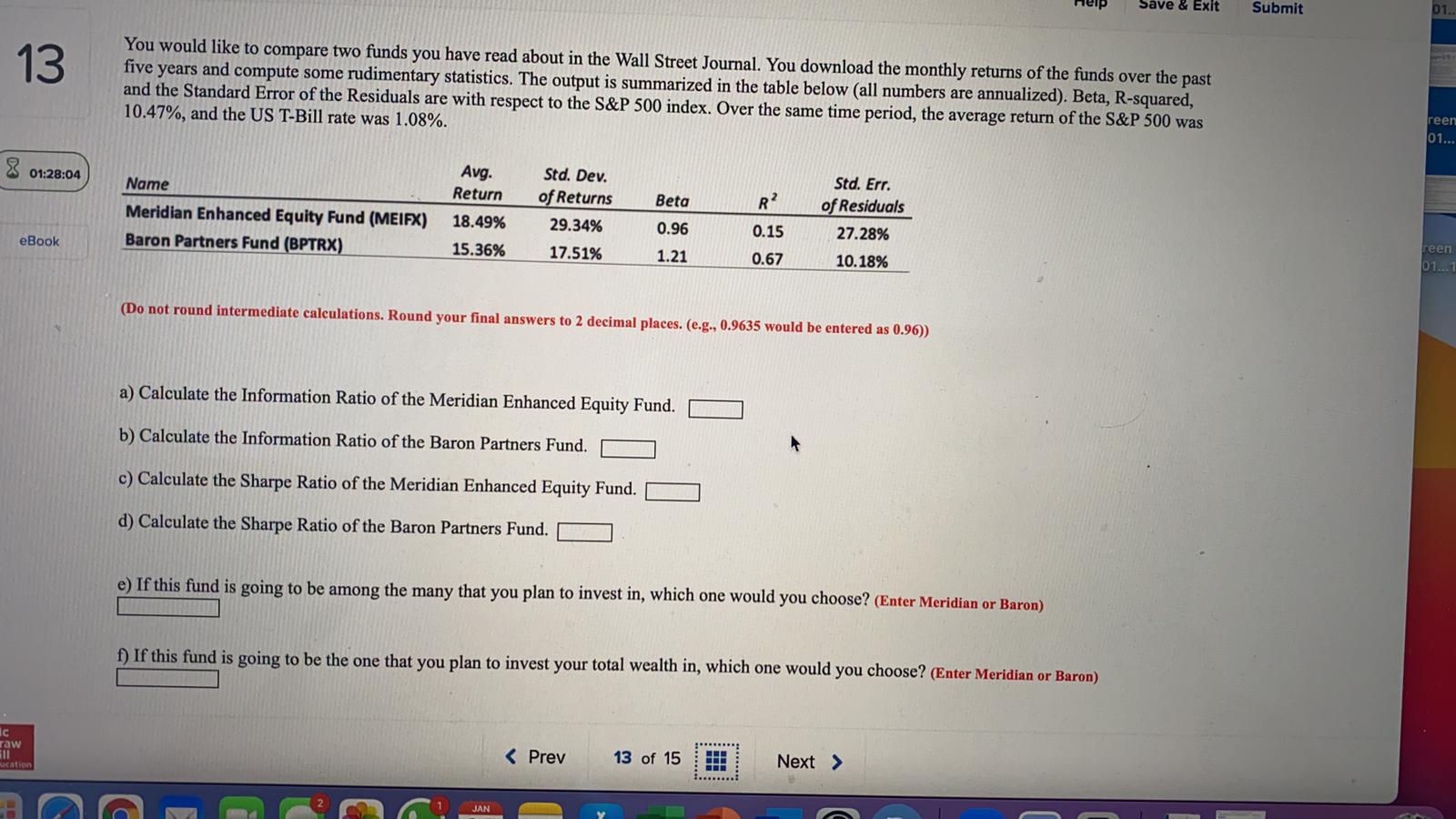

Save & Exit Submit 01. 13 You would like to compare two funds you have read about in the Wall Street Journal. You download the monthly returns of the funds over the past five years and compute some rudimentary statistics. The output is summarized in the table below (all numbers are annualized). Beta, R-squared, and the Standard Error of the Residuals are with respect to the S&P 500 index. Over the same time period, the average return of the S&P 500 was 10.47%, and the US T-Bill rate was 1.08%. reen 01... 01:28:04 Avg. Return Std. Dev. of Returns 29.34% Beta Name Meridian Enhanced Equity Fund (MEIFX) Baron Partners Fund (BPTRX) R? 18.49% 15.36% 0.96 Std. Err. of Residuals 27.28% 10.18% 0.15 eBook 17.51% 1.21 0.67 reen 01... 1 (Do not round intermediate calculations. Round your final answers to 2 decimal places. (e.g., 0.9635 would be entered as 0.96)) a) Calculate the Information Ratio of the Meridian Enhanced Equity Fund. b) Calculate the Information Ratio of the Baron Partners Fund. c) Calculate the Sharpe Ratio of the Meridian Enhanced Equity Fund. d) Calculate the Sharpe Ratio of the Baron Partners Fund. e) If this fund is going to be among the many that you plan to invest in, which one would you choose? (Enter Meridian or Baron) f) If this fund is going to be the one that you plan to invest your total wealth in, which one would you choose? (Enter Meridian or Baron) raw 311 ucation JAN Save & Exit Submit 01. 13 You would like to compare two funds you have read about in the Wall Street Journal. You download the monthly returns of the funds over the past five years and compute some rudimentary statistics. The output is summarized in the table below (all numbers are annualized). Beta, R-squared, and the Standard Error of the Residuals are with respect to the S&P 500 index. Over the same time period, the average return of the S&P 500 was 10.47%, and the US T-Bill rate was 1.08%. reen 01... 01:28:04 Avg. Return Std. Dev. of Returns 29.34% Beta Name Meridian Enhanced Equity Fund (MEIFX) Baron Partners Fund (BPTRX) R? 18.49% 15.36% 0.96 Std. Err. of Residuals 27.28% 10.18% 0.15 eBook 17.51% 1.21 0.67 reen 01... 1 (Do not round intermediate calculations. Round your final answers to 2 decimal places. (e.g., 0.9635 would be entered as 0.96)) a) Calculate the Information Ratio of the Meridian Enhanced Equity Fund. b) Calculate the Information Ratio of the Baron Partners Fund. c) Calculate the Sharpe Ratio of the Meridian Enhanced Equity Fund. d) Calculate the Sharpe Ratio of the Baron Partners Fund. e) If this fund is going to be among the many that you plan to invest in, which one would you choose? (Enter Meridian or Baron) f) If this fund is going to be the one that you plan to invest your total wealth in, which one would you choose? (Enter Meridian or Baron) raw 311 ucation JAN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts