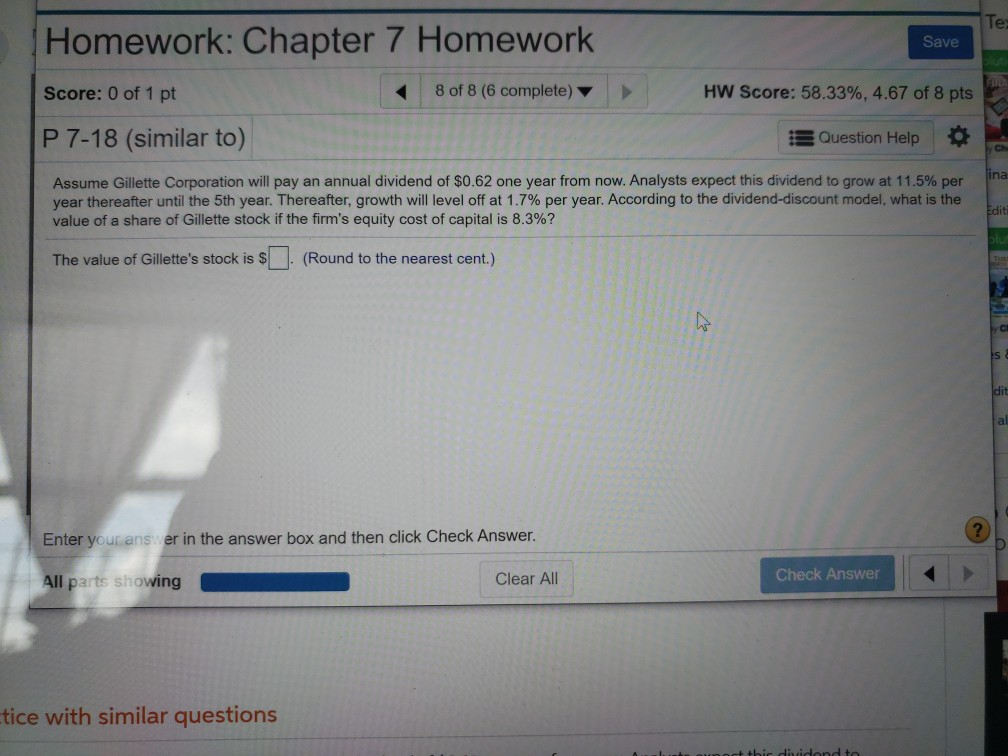

Question: Save Homework: Chapter 7 Homework Score: 0 of 1 pt 8 of 8 (6 complete) P 7-18 (similar to) HW Score: 58.33%, 4.67 of 8

Save Homework: Chapter 7 Homework Score: 0 of 1 pt 8 of 8 (6 complete) P 7-18 (similar to) HW Score: 58.33%, 4.67 of 8 pts 3 Question Help Assume Gillette Corporation will pay an annual dividend of $0.62 one year from now. Analysts expect this dividend to grow at 11.5% per year thereafter until the 5th year. Thereafter, growth will level off at 1.7% per year. According to the dividend-discount model, what is the value of a share of Gillette stock if the firm's equity cost of capital is 8.3%? Editi Blu The value of Gillette's stock is $ . (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. All parts showing Clear All Check Answer tice with similar questions bedded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts