Question: Saved 2 Problem 13-7 Leverage and Stock Value (L01) Honeycutt Corp. is comparing two different capital structures. Plan I would result in 33,000 shares of

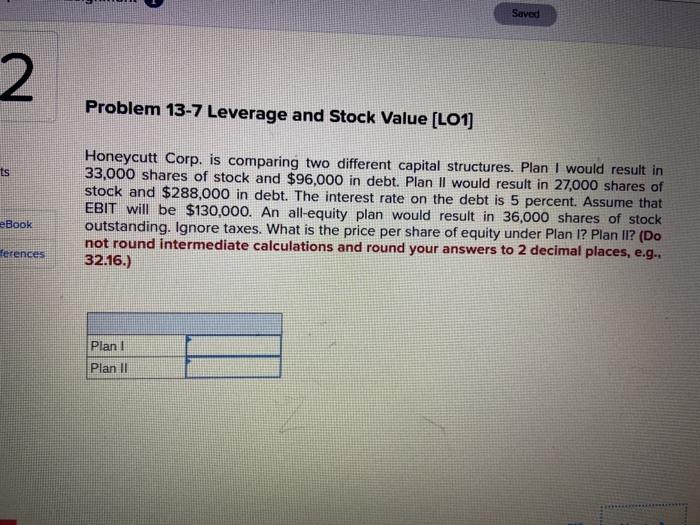

Saved 2 Problem 13-7 Leverage and Stock Value (L01) Honeycutt Corp. is comparing two different capital structures. Plan I would result in 33,000 shares of stock and $96,000 in debt. Plan II would result in 27,000 shares of stock and $288,000 in debt. The interest rate on the debt is 5 percent. Assume that EBIT will be $130,000. An all-equity plan would result in 36,000 shares of stock outstanding. Ignore taxes. What is the price per share of equity under Plan 1? Plan 11? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) eBook ferences Plan Plan Il

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts