Question: Saved Help How do IFRS and U.S. GAAP differ in their approach to allowing reversals of inventory write-downs? Multiple Choice IFRS requires the reversal of

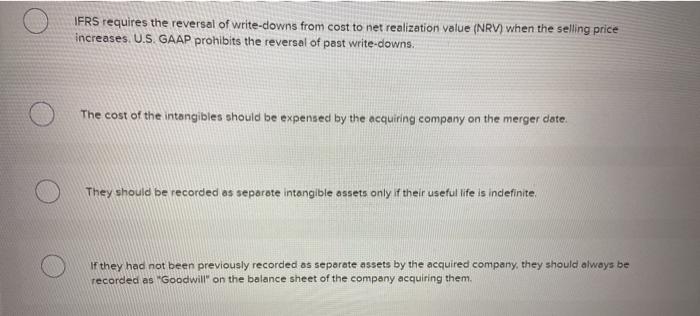

Saved Help How do IFRS and U.S. GAAP differ in their approach to allowing reversals of inventory write-downs? Multiple Choice IFRS requires the reversal of write-downs from cost to net realization value (NRV) when the selling price increases. U.S. GAAP prohibits the reversal of past write-downs. The cost of the intangibles should be expensed by the acquiring company on the merger date. They should be recorded os separate intangible assets only if their useful life is indefinite If they had not been previously recorded as separate assets by the acquired company, they should always be recorded as "Goodwill on the balance sheet of the company acquiring them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts