Question: Saved Help Save & Che In 2018, Jessica bought a new heavy truck for $44,000 to use 80% for her sole proprietorship. Total miles driven

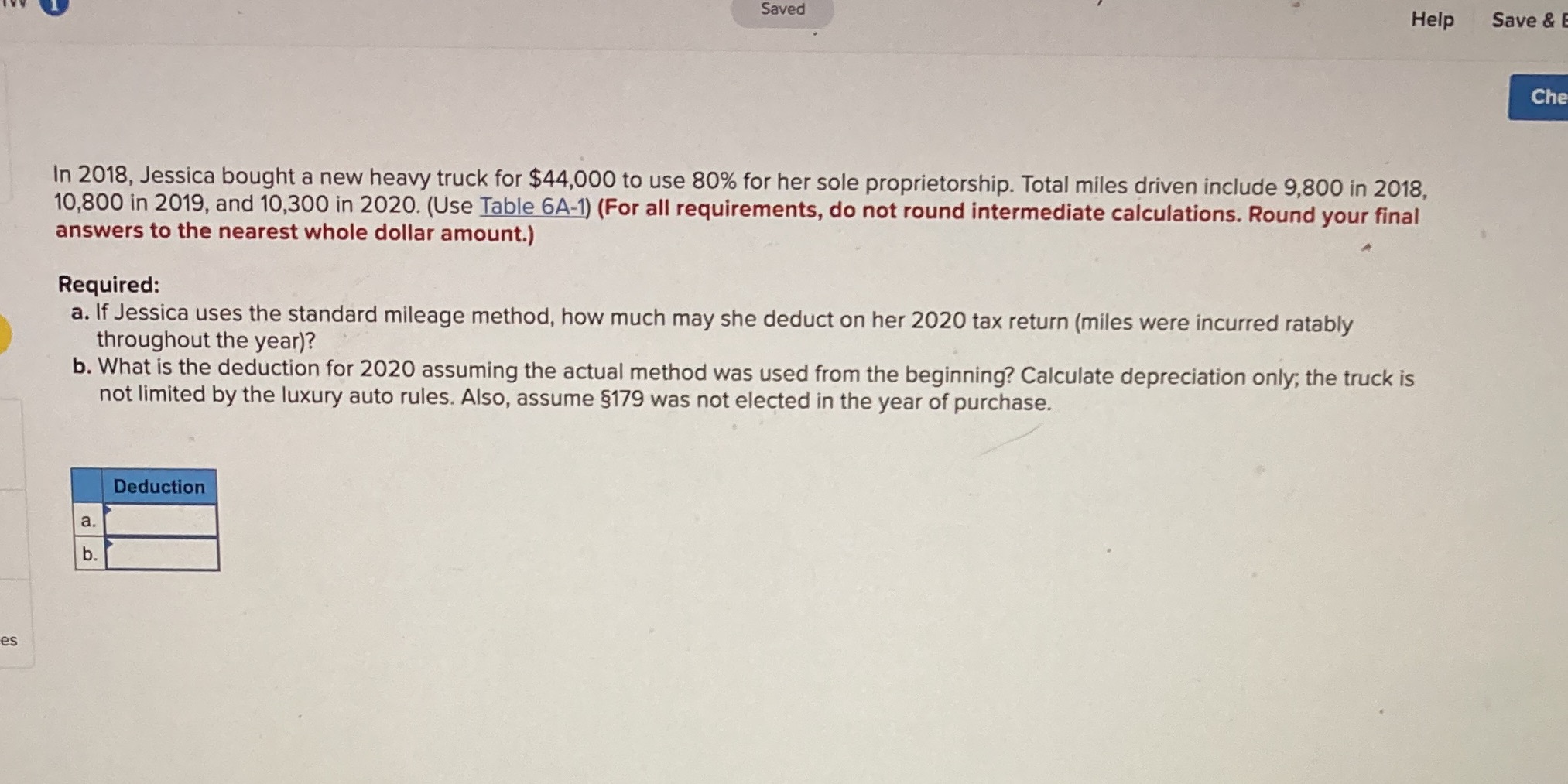

Saved Help Save & Che In 2018, Jessica bought a new heavy truck for $44,000 to use 80% for her sole proprietorship. Total miles driven include 9,800 in 2018, 10,800 in 2019, and 10,300 in 2020. (Use Table 6A-1) (For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Required: a. If Jessica uses the standard mileage method, how much may she deduct on her 2020 tax return (miles were incurred ratably throughout the year)? b. What is the deduction for 2020 assuming the actual method was used from the beginning? Calculate depreciation only; the truck is not limited by the luxury auto rules. Also, assume $179 was not elected in the year of purchase. Deduction a h es

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts