Question: Saved Help Save & E Required information [ The following information applies to the questions displayed below. ] Meir, Benson, and Lau are partners and

Saved

Help

Save & E

Required information

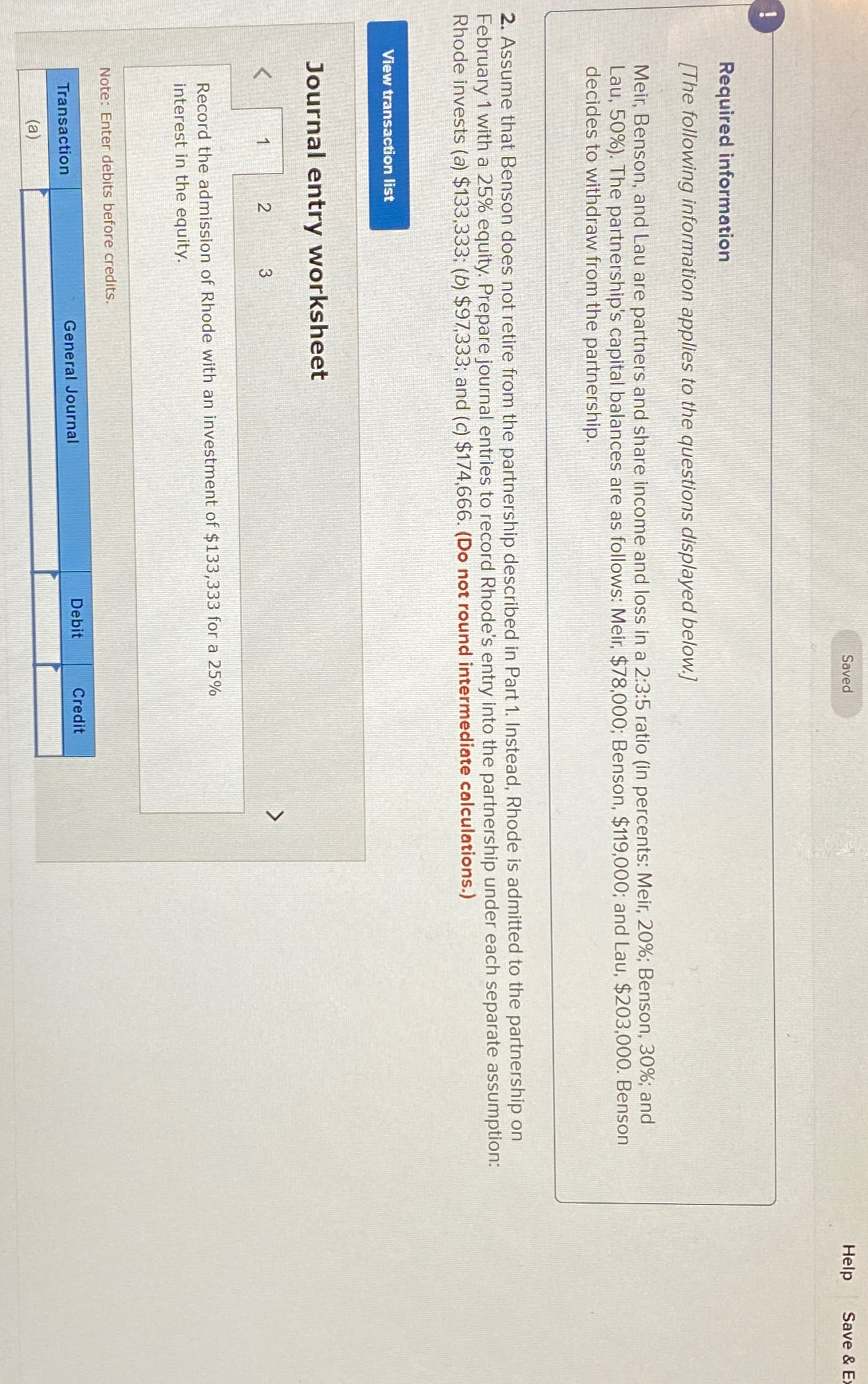

The following information applies to the questions displayed below.

Meir, Benson, and Lau are partners and share income and loss in a :: ratio in percents: Meir, ; Benson, ; and Lau, The partnership's capital balances are as follows: Meir, $; Benson, $; and Lau, $ Benson decides to withdraw from the partnership.

Assume that Benson does not retire from the partnership described in Part Instead, Rhode is admitted to the partnership on February with a equity. Prepare journal entries to record Rhode's entry into the partnership under each separate assumption: Rhode invests a $; b $; and c $Do not round intermediate calculations.

Journal entry worksheet

Record the admission of Rhode with an investment of $ for a interest in the equity.

Note: Enter debits before credits.

tableTransactionGeneral Journal,Debit,Credita

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock