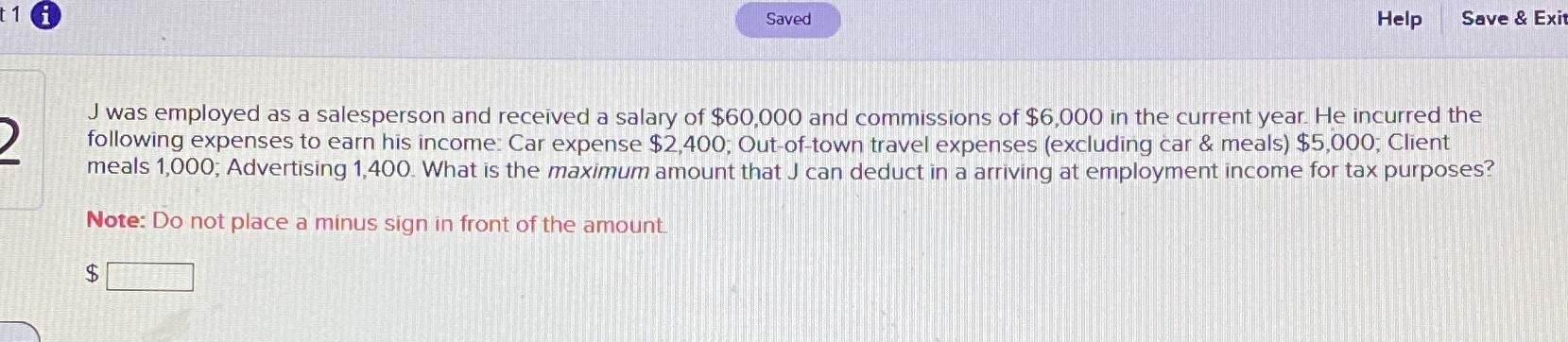

Question: Saved Help Save & Exit J was employed as a salesperson and received a salary of $60,000 and commissions of $6,000 in the current year.

Saved Help Save & Exit J was employed as a salesperson and received a salary of $60,000 and commissions of $6,000 in the current year. He incurred the following expenses to earn his income: Car expense $2,400, Out-of-town travel expenses (excluding car & meals) $5,000, Client meals 1,000; Advertising 1,400. What is the maximum amount that J can deduct in a arriving at employment income for tax purposes? Note: Do not place a minus sign in front of the amount $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts