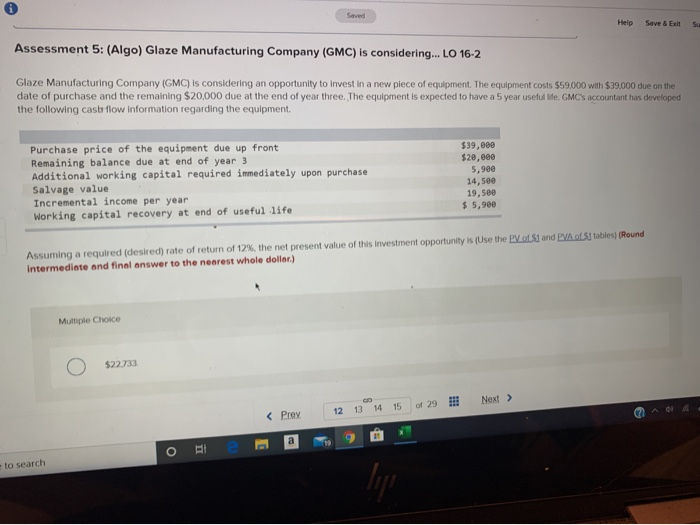

Question: Saved Help Save & Exit Su Assessment 5: (Algo) Glaze Manufacturing Company (GMC) is considering... LO 16-2 Glaze Manufacturing Company (GMC) is considering an opportunity

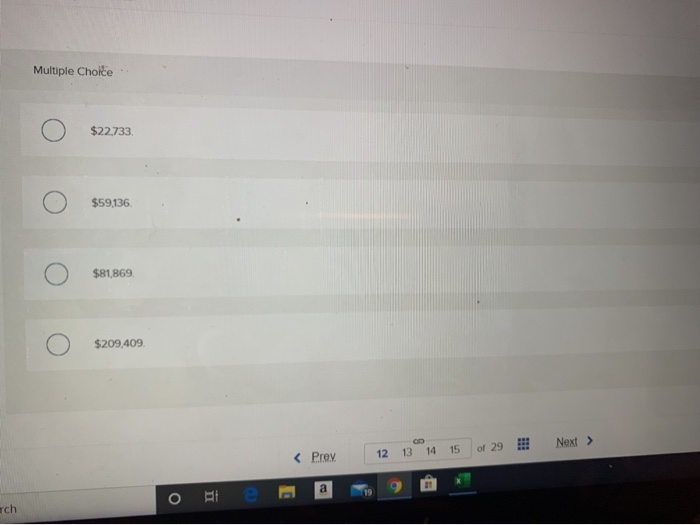

Saved Help Save & Exit Su Assessment 5: (Algo) Glaze Manufacturing Company (GMC) is considering... LO 16-2 Glaze Manufacturing Company (GMC) is considering an opportunity to invest in a new piece of equipment. The equipment costs $59.000 with $39,000 due on the date of purchase and the remaining $20,000 due at the end of year three. The equipment is expected to have a 5 year useful life. GMC's accountant has developed the following cash flow information regarding the equipment Purchase price of the equipment due up front Remaining balance due at end of year 3 Additional working capital required immediately upon purchase Salvage value Incremental income per year Working capital recovery at end of useful life $39,000 $20,000 5,900 14,500 19,500 $ 5,900 Assuming a required (desired) rate of return of 12%, the net present value of this investment opportunity is (Use the PLS1 and PVA S1 tables) (Round Intermediate and final answer to the nearest whole dollar) Multiple Choice $22.733 Next > 14 12 13 15 of 29 15 12 13 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts