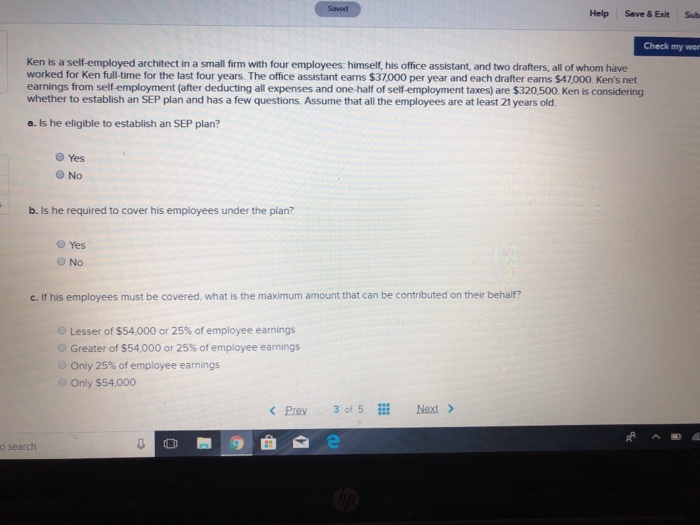

Question: Saved Help Save & Exit Sub Check my wor Ken is a self-employed architect in a small firm with four employees: himself, his office assistant,

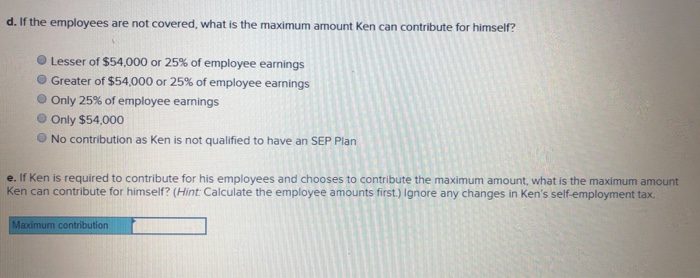

Saved Help Save & Exit Sub Check my wor Ken is a self-employed architect in a small firm with four employees: himself, his office assistant, and two drafters, all of whom have worked for Ken full-time for the last four years. The office assistant earns $37000 per year and each drafter earns $47000. Ken's net earnings from self-employment (after deducting all expenses and one-half of self-employment taxes) are $320,500. Ken is considering whether to establish an SEP plan and has a few questions. Assume that all the employees are at least 21 years old a. Is he eligible to establish an SEP plan? O Yes O No b. Is he required to cover his employees under the plan? Yes O No c. If his employees must be covered, what is the maximum amount that can be contributed on their behalf? Lesser of S54.000 or 25% of employee earnings @ Greater of S54.000 or 25% of employee earnings Only 25% of employee earnings Only $54,000 Prey 3f5 Next o search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts