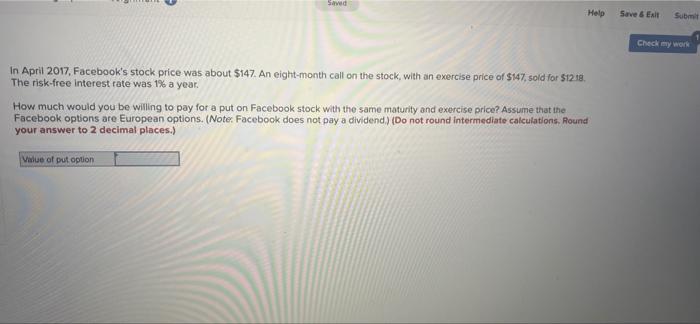

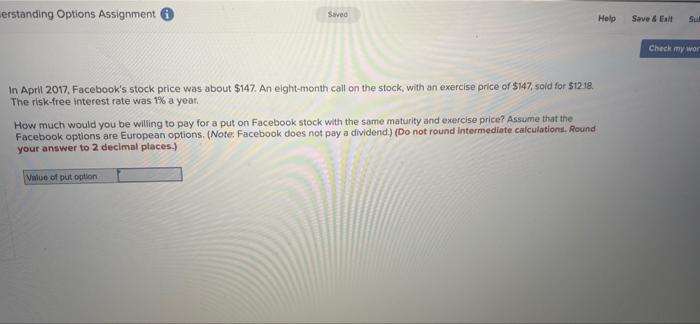

Question: Saved Help Save & Exit Subm Check my word In April 2017, Facebook's stock price was about $147. An eight-month call on the stock, with

Saved Help Save & Exit Subm Check my word In April 2017, Facebook's stock price was about $147. An eight-month call on the stock, with an exercise price of $147, sold for $12.18. The risk-free interest rate was 1% a year. How much would you be willing to pay for a put on Facebook stock with the same maturity and exercise price? Assume that the Facebook options are European options. (Note: Facebook does not pay a dividend) (Do not round intermediate calculations. Round your answer to 2 decimal places.) Value of put option erstanding Options Assignment 6 Saved Help Save & El Sul Check my wor In April 2017, Facebook's stock price was about $147. An eight-month call on the stock, with an exercise price of $147, sold for $12.18 The risk-free interest rate was 1% a year How much would you be willing to pay for a put on Facebook stock with the same maturity and exercise price? Assume that the Facebook options are European options. (Note: Facebook does not pay a dividend) (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Value of put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts