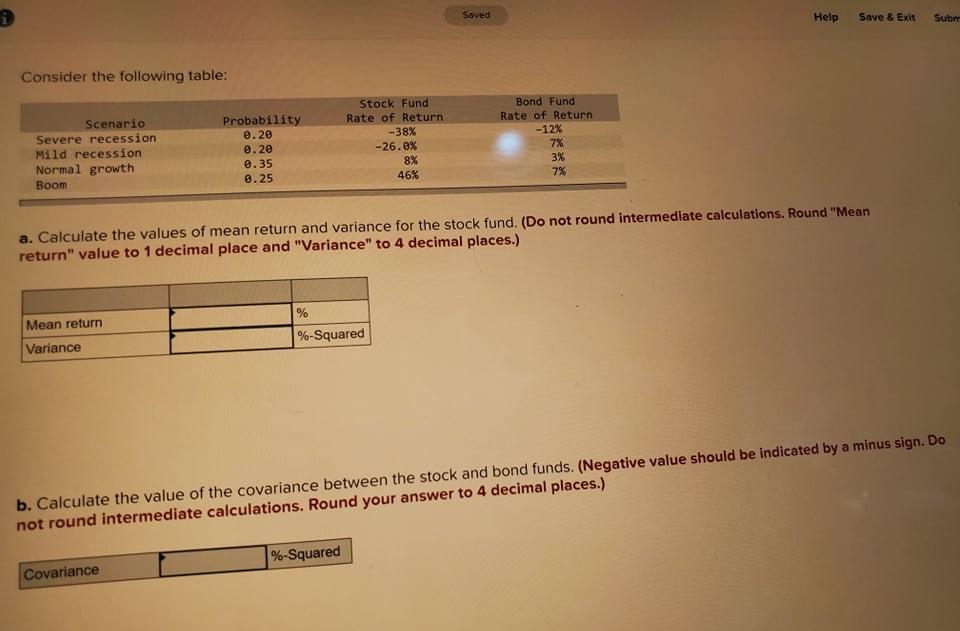

Question: Saved Help Save & Exit Subm Consider the following table: Scenario Severe recession Mild recession Normal growth Boom Probability 0.28 @.20 0.35 0.25 Stock Fund

Saved Help Save & Exit Subm Consider the following table: Scenario Severe recession Mild recession Normal growth Boom Probability 0.28 @.20 0.35 0.25 Stock Fund Rate of Return -38% -26.0% 8% 46% Bond Fund Rate of Return -12% 7% 3% 7% a. Calculate the values of mean return and variance for the stock fund. (Do not round intermediate calculations. Round "Mean return" value to 1 decimal place and "Variance" to 4 decimal places.) % Mean return %-Squared Variance b. Calculate the value of the covariance between the stock and bond funds. (Negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 4 decimal places.) %-Squared Covariance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts