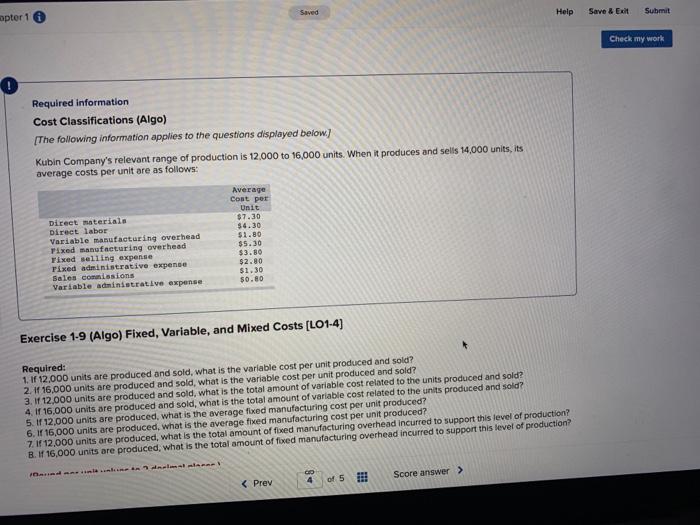

Question: Saved Help Save & Exit Submit apter 1 Check my work Required information Cost Classifications (Algo) [The following information applies to the questions displayed below.)

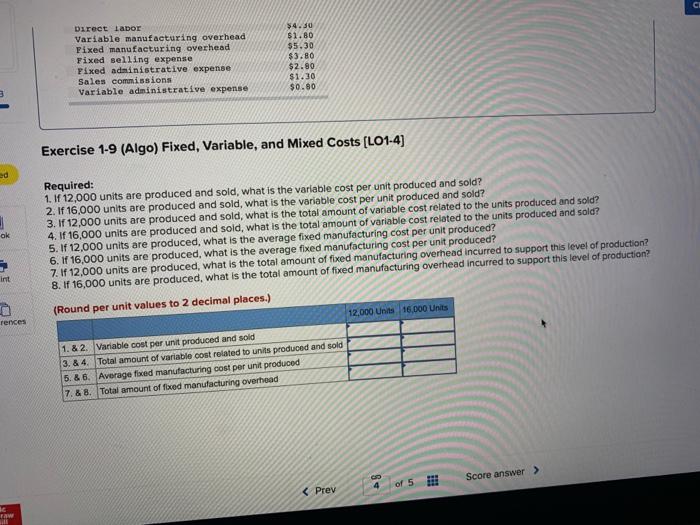

Saved Help Save & Exit Submit apter 1 Check my work Required information Cost Classifications (Algo) [The following information applies to the questions displayed below.) Kubin Company's relevant range of production is 12,000 to 16,000 units. When it produces and sells 14,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales comissions Variable administrative expense Average Cost per Unit $7.30 $4.30 $1.80 $5.30 $3.80 $2.80 $1.30 $0.80 Exercise 1-9 (Algo) Fixed, Variable, and Mixed Costs [LO1-4) Required: 1. If 12,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 16,000 units are produced and sold, what is the variable cost per unit produced and sold? 3.1 12,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4 1 16,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 12,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. 16,000 units are produced, what is the average fixed manufacturing cost per unit produced? 7. 112.000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? B.1 16,000 units are produced, what is the total amount of foxed manufacturing overhead incurred to support this level of production? C Direct Labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Pixed administrative expense Sales commissions Variable administrative expense $4.30 $1.80 $5.30 $3.80 $2.80 $1.30 $0.90 Exercise 1-9 (Algo) Fixed, Variable, and Mixed Costs (L01-4) ed ok Required: 1. If 12,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 16,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 12,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 16,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 12,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 16,000 units are produced, what is the average fixed manufacturing cost per unit produced? 7. If 12,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? 8. I 16,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? (Round per unit values to 2 decimal places.) 12.000 units 16.000 Units int rences 1. & 2. Variable cost per unit produced and sold 3.& 4 Total amount of variable cost related to units produced and sold 5.& 6. Average fred manufacturing cost per unit produced 7. & 8. Total amount of faced manufacturing overhead CD 4 Score answer > of 5 Prey Sill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts