Question: Saved Help Save & Exit Submit Check my work Allen Company acquired 100 percent of Bradford Company's voting stock on January 1, 2014, by issuing

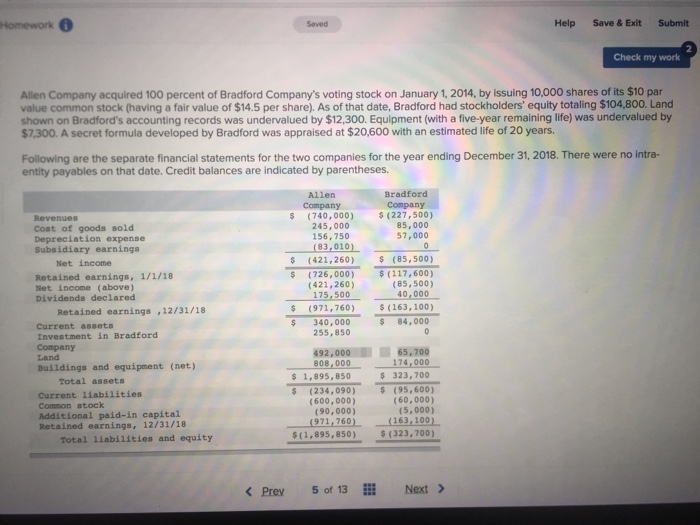

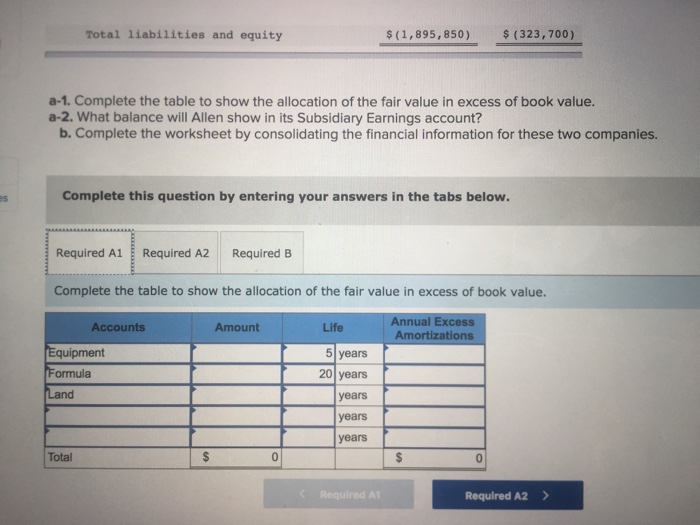

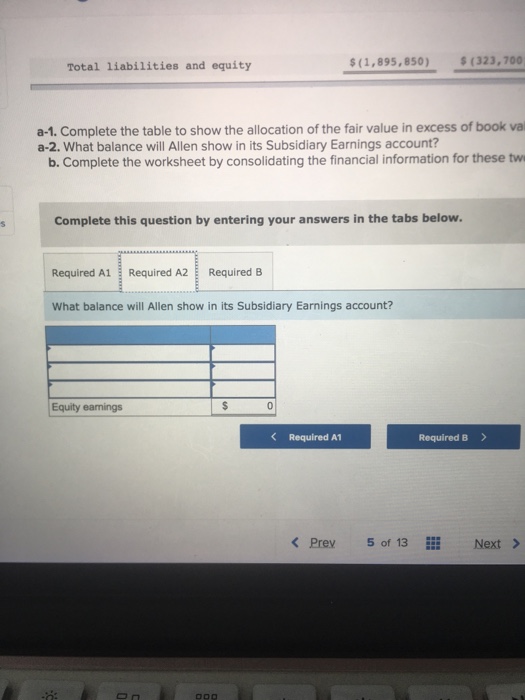

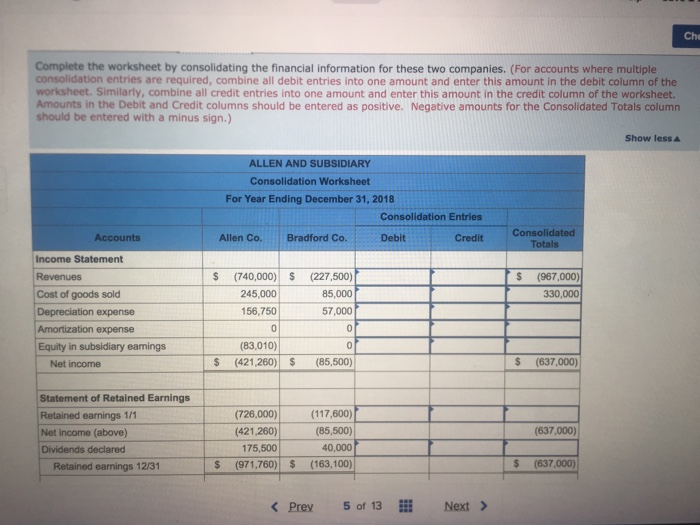

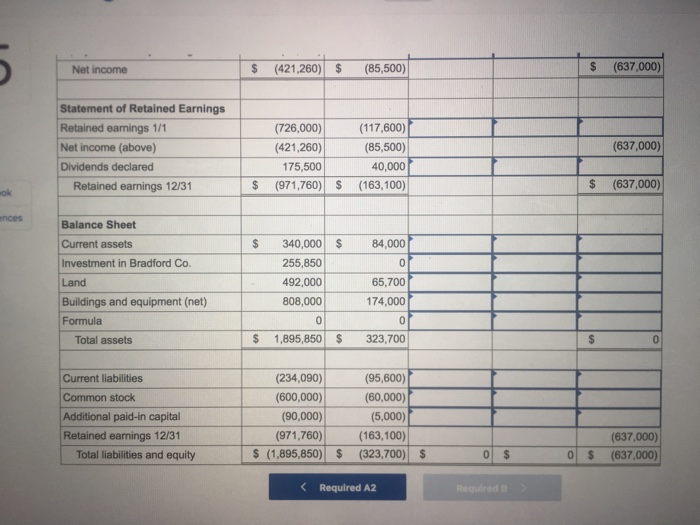

Saved Help Save & Exit Submit Check my work Allen Company acquired 100 percent of Bradford Company's voting stock on January 1, 2014, by issuing 10,000 shares of its $10 par value common stock (having a fair value of $14.5 per share). As of that date, Bradford had stockholders' equity totaling $104,800. Land shown on Bradford's accounting records was undervalued by $12,300. Equipment (with a five-year remaining life) was undervalued by $7,300. A secret formula developed by Bradford was appraised at $20,600 with an estimated life of 20 years. Following are the separate financial statements for the two companies for the year ending December 31, 2018. There were no intra- entity payables on that date. Credit balances are indicated by parentheses Bradford Company Allen Compan)y $ (740,000) Revenues Cost of goods sold Depreciation expense Subsidiary earnings 245,000 156,750 (83-010) (227,500) 85,000 57,000 (421,260) (85,500) $(117,600) (85, 500) 40,000 $ (971,760) (163,100) Net income $ (726,000) Retained earnings, 1/1/18 Net income (above) Dividends declared (421,260) 175,500 Retained earnings12/31/18 $340,000 $ 84,000 Current assetS Investment in Bradford Company Land Buildings and equipment (net) 255, 850 03.00,00 808,000 s 1,895,850 $ 323,700 Total assets Current liabilities Common stock Additional paid-in capital Retained earnings, 12/31/18 s (234,090) (95,600) (60,000) (5,000) 1971,760)--(163,100) (323,700) (600,000) (90,000) $ (1,895,850) Total liabilities and equity Prey 5 of 13Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts