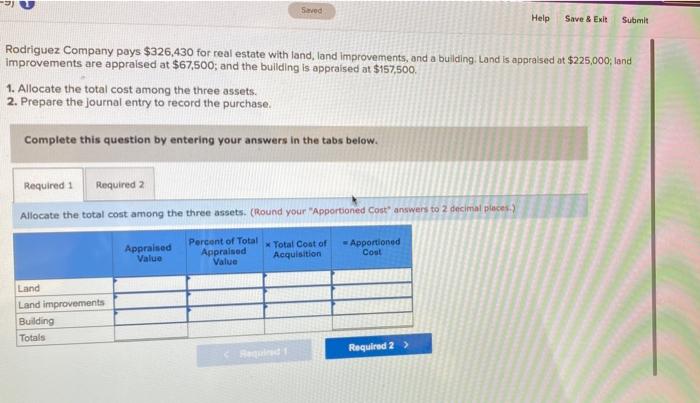

Question: Saved Help Save & Exit Submit Rodriguez Company pays $326,430 for real estate with land, land improvements, and a building. Land is appraised at $225,000;

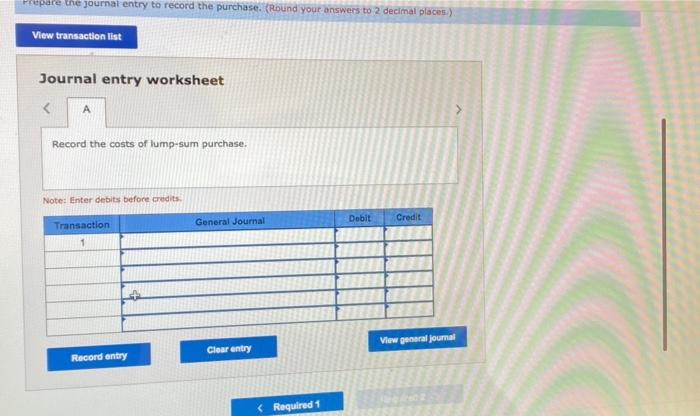

Saved Help Save & Exit Submit Rodriguez Company pays $326,430 for real estate with land, land improvements, and a building. Land is appraised at $225,000; land Improvements are appraised at $67,500; and the building is appraised at $157,500 1. Allocate the total cost among the three assets. 2. Prepare the journal entry to record the purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Allocate the total cost among the three assets. (Round your "Apportioned Cost answers to 2 decimal places) Appraised Value Percent of Total Appraised Value * Total Cost of Acquisition -Apportioned Cost Land Land improvements Building Totals Required 2 > Prepare the journal entry to record the purchase. (Round your answers to 2 decimal places) View transaction list Journal entry worksheet A Record the costs of lump-sum purchase. Note: Enter debits before credits General Journal Dobit Credit Transaction 1 View general journal Clear entry Record entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts