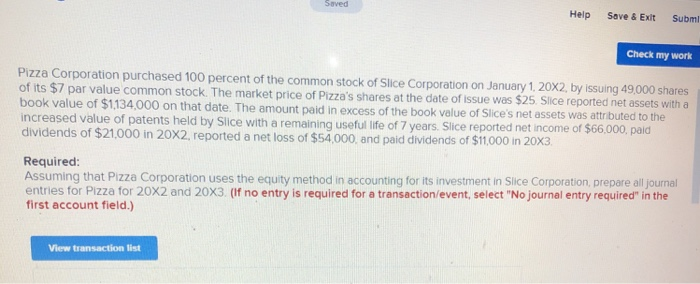

Question: Saved Help Save & Exit Subml Check my work Pizza Corporation purchased 100 percent of the common stock of Slice Corporation on January 1, 20X2,

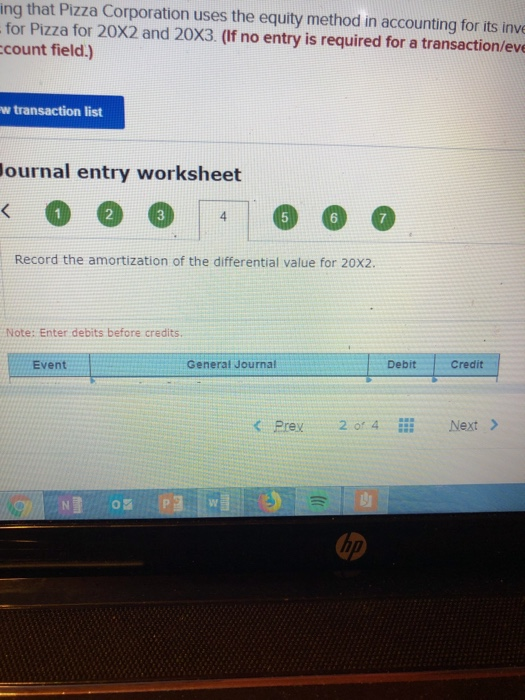

Saved Help Save & Exit Subml Check my work Pizza Corporation purchased 100 percent of the common stock of Slice Corporation on January 1, 20X2, by issuing 49,000 shares of its $7 par value common stock. The market price of Pizza's shares at the date of issue was $25. Slice reported net assets with a book value of $1134,000 on that date. The amount paid in excess of the book value of Slice's net assets was attributed to the increased value of dividends of $21,000 in 20X2, reported a net loss of $54,000, and paid dividends of $11,000 in 20X3 patents held by Slice with a remaining use ful life of 7 years. Sice reported net income of $66.000, paid Required Assuming that Pizza Corporation uses the equity method in accounting for its investment in Slice Corporation, prepare all journal entries for Pizza for 20x2 and 20X3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list ng that Pizza Corporation uses the equity method in accounting for its inve for Pizza for 20X2 and 20X3. (If no entry is required for a transaction/eve count field.) w transaction list lournal entry worksheet 2 3 5 6 Record the amortization of the differential value for 20X2. Note: Enter debits before credits. Event General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts