Question: Saved les Markets * Help Save & Exit Checkr You are bullish on Telecom stock. The current market price is $60 per share, and you

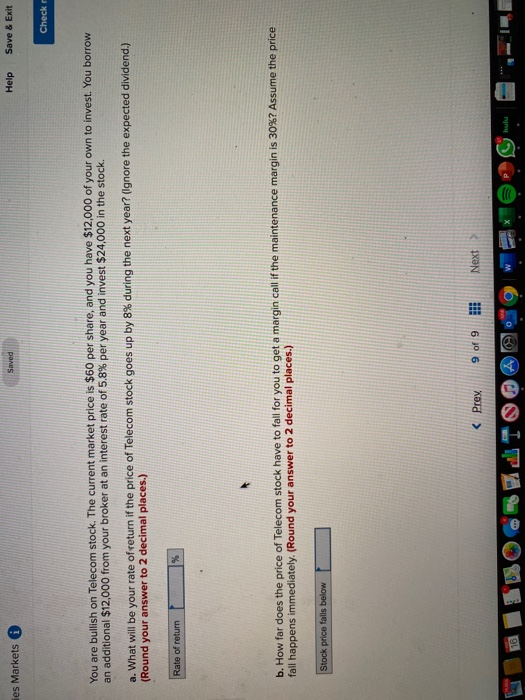

Saved les Markets * Help Save & Exit Checkr You are bullish on Telecom stock. The current market price is $60 per share, and you have $12,000 of your own to invest. You borrow an additional $12,000 from your broker at an interest rate of 5.8% per year and invest $24,000 in the stock. a. What will be your rate of return if the price of Telecom stock goes up by 8% during the next year? (Ignore the expected dividend.) (Round your answer to 2 decimal places.) Rate of return % b. How far does the price of Telecom stock have to fall for you to get a margin call if the maintenance margin is 30%? Assume the price fall happens immediately. (Round your answer to 2 decimal places.) Stock price falls below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts