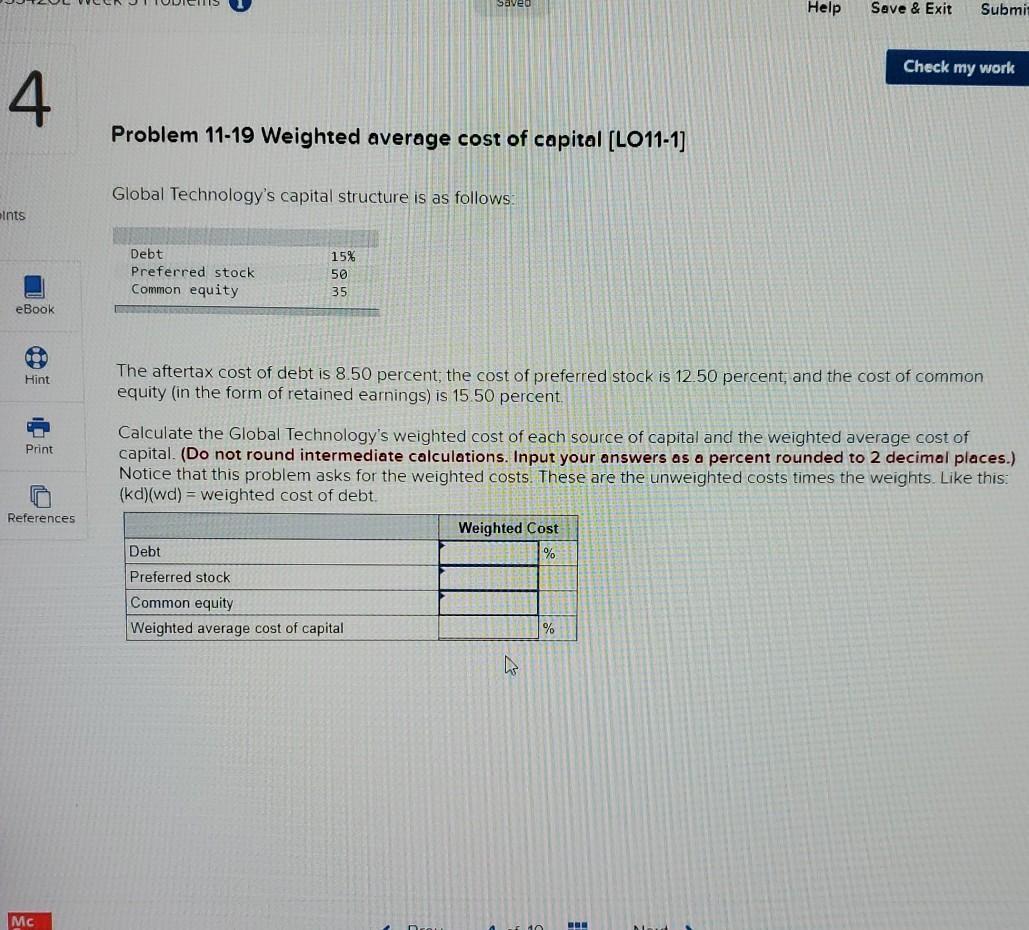

Question: Saveo Help Save & Exit Submit Check my work 4 Problem 11-19 Weighted average cost of capital (LO11-1] Global Technology's capital structure is as follows:

Saveo Help Save & Exit Submit Check my work 4 Problem 11-19 Weighted average cost of capital (LO11-1] Global Technology's capital structure is as follows: ints Debt Preferred stock Common equity 15% 50 35 eBook Hint The aftertax cost of debt is 8.50 percent; the cost of preferred stock is 12.50 percent, and the cost of common equity (in the form of retained earnings) is 15.50 percent. Print References Calculate the Global Technology's weighted cost of each source of capital and the weighted average cost of capital. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Notice that this problem asks for the weighted costs. These are the unweighted costs times the weights. Like this: (kd)(wd) = weighted cost of debt. Weighted Cost Debt % Preferred stock Common equity Weighted average cost of capital % | 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts