Question: savings goals cash flow bank service build your own financial plan Goals 1. Estimate how much you will need to save in order to achieve

savings

goals

cash flow

bank service

build your own financial plan

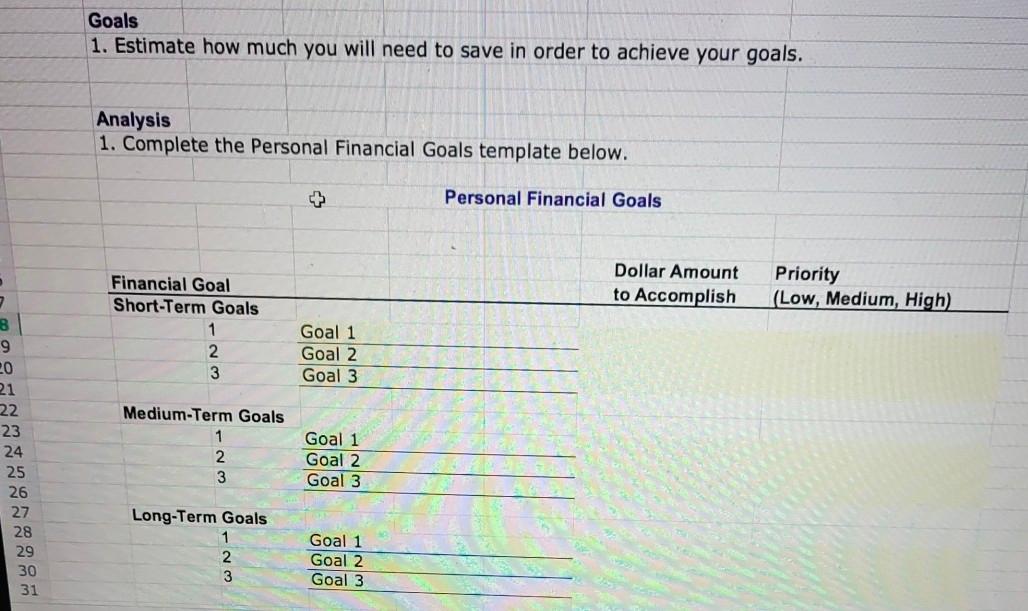

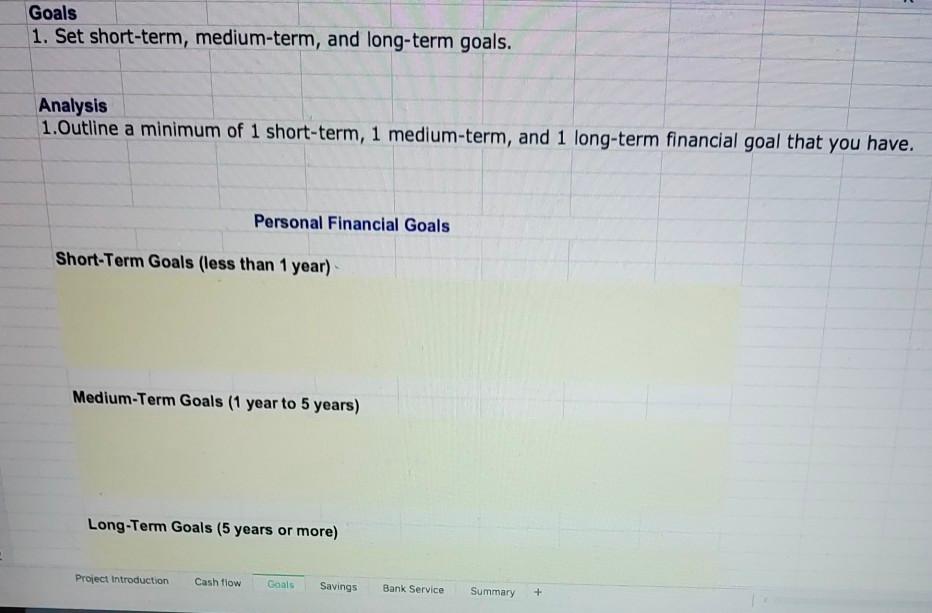

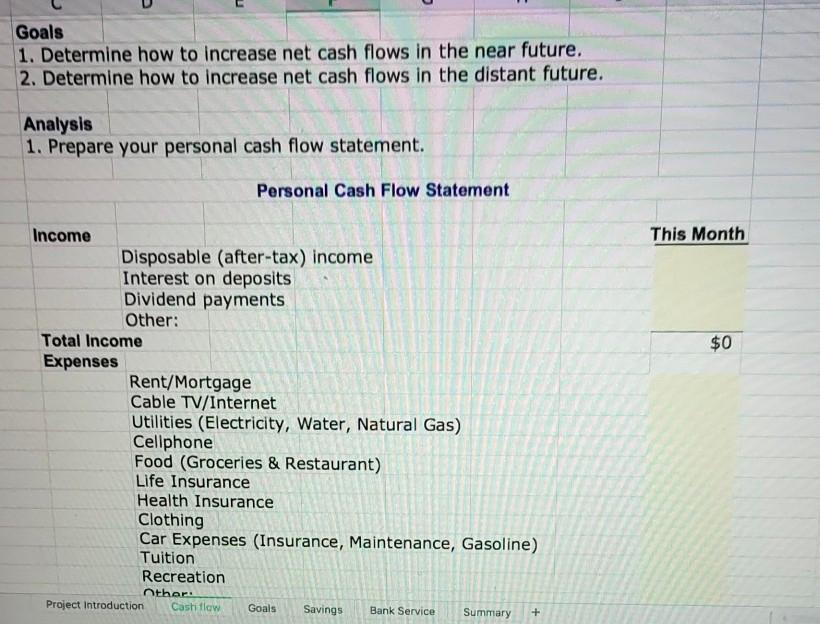

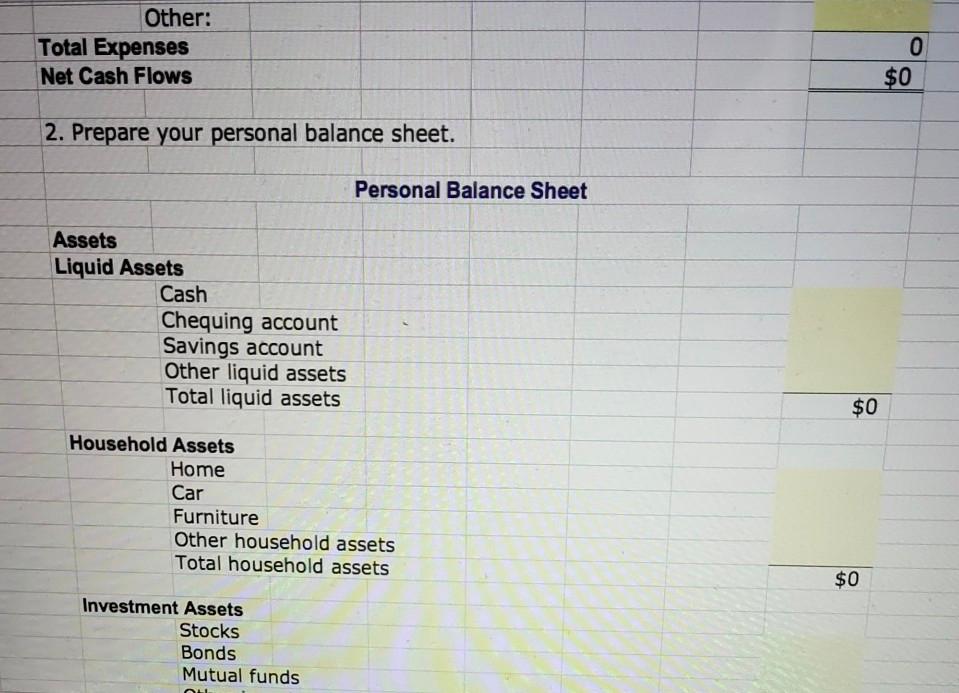

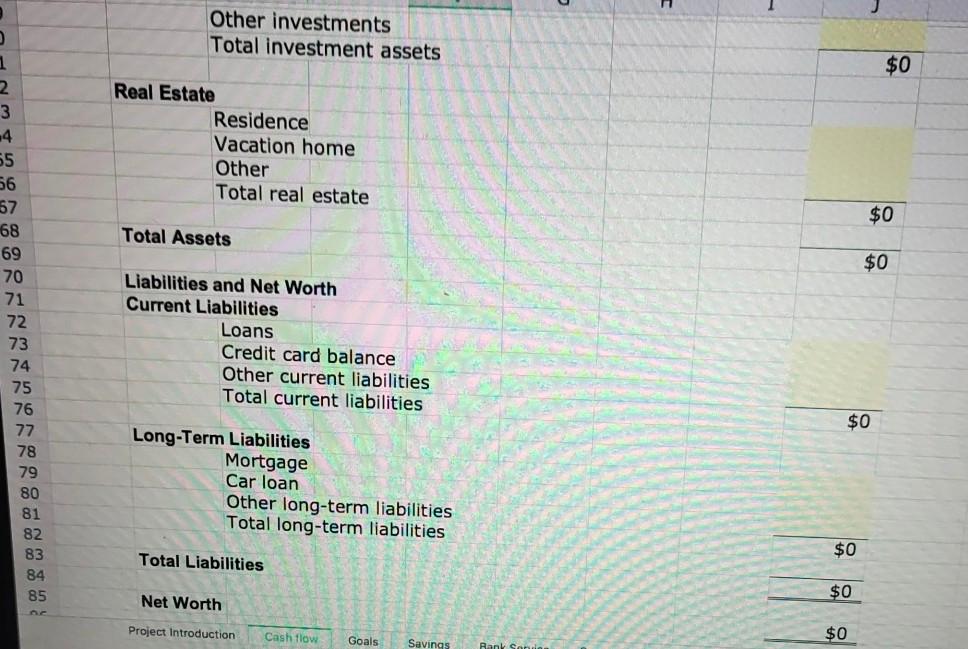

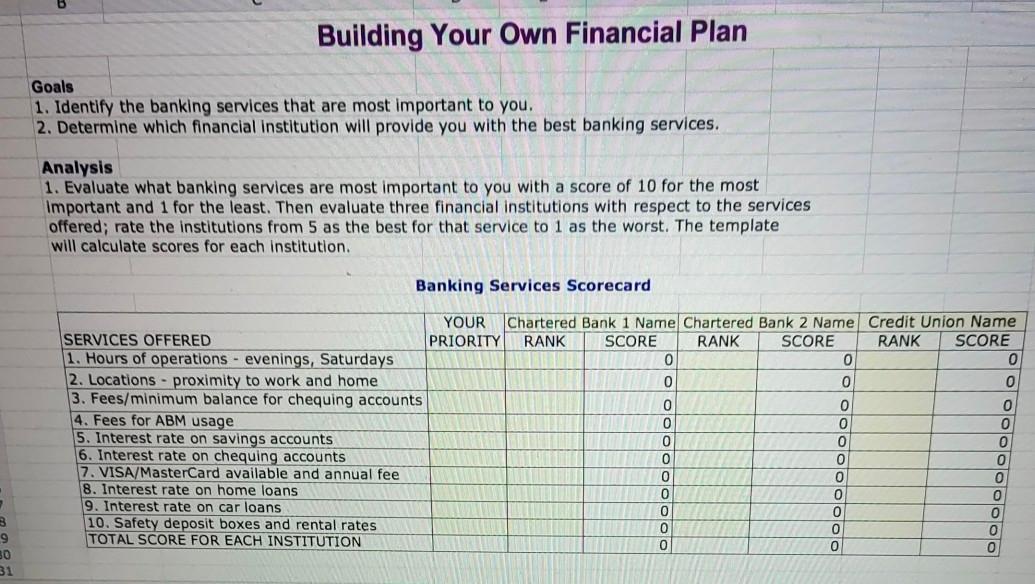

Goals 1. Estimate how much you will need to save in order to achieve your goals. Analysis 1. Complete the Personal Financial Goals template below. + Personal Financial Goals Dollar Amount to Accomplish Priority (Low, Medium, High) Financial Goal Short-Term Goals 1 2 3 Goal 1 Goal 2 Goal 3 7 8 9 20 21 22 23 24 25 26 27 28 29 30 31 Medium-Term Goals 1 2 3 Goal 1 Goal 2 Goal 3 Long-Term Goals WN Goal 1 Goal 2 Goal 3 Goals 1. Set short-term, medium-term, and long-term goals. Analysis 1.Outline a minimum of 1 short-term, 1 medium-term, and 1 long-term financial goal that you have. Personal Financial Goals Short-Term Goals (less than 1 year) Medium-Term Goals (1 year to 5 years) Long-Term Goals (5 years or more) Project Introduction Cash flow Goals Savings Bank Service Summary + Goals 1. Determine how to increase net cash flows in the near future. 2. Determine how to increase net cash flows in the distant future. Analysis 1. Prepare your personal cash flow statement. Personal Cash Flow Statement This Month $0 Income Disposable (after-tax) income Interest on deposits Dividend payments Other: Total Income Expenses Rent/Mortgage Cable TV/Internet Utilities (Electricity, Water, Natural Gas) Cellphone Food (Groceries & Restaurant) Life Insurance Health Insurance Clothing Car Expenses (Insurance, Maintenance, Gasoline) Tuition Recreation thor: Project Introduction Cash flow Goals Savings Bank Service Summary + Other: Total Expenses Net Cash Flows 0 $0 2. Prepare your personal balance sheet. Personal Balance Sheet Assets Liquid Assets Cash Chequing account Savings account Other liquid assets Total liquid assets $0 Household Assets Home Car Furniture Other household assets Total household assets $0 Investment Assets Stocks Bonds Mutual funds OLI Other investments Total investment assets $0 Real Estate Residence Vacation home Other Total real estate $0 Total Assets $0 1 2 3 -4 55 56 57 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 Liabilities and Net Worth Current Liabilities Loans Credit card balance Other current liabilities Total current liabilities $0 wawwwg Long-Term Liabilities Mortgage Car loan Other long-term liabilities Total long-term liabilities $0 Total Liabilities 84 85 Net Worth $0 Project Introduction Cash flow $0 Goals Savings Rank Son Building Your Own Financial Plan Goals 1. Identify the banking services that are most important to you. 2. Determine which financial institution will provide you with the best banking services. Analysis 1. Evaluate what banking services are most important to you with a score of 10 for the most Important and 1 for the least. Then evaluate three financial institutions with respect to the services offered; rate the institutions from 5 as the best for that service to 1 as the worst. The template will calculate scores for each institution. Banking Services Scorecard YOUR Chartered Bank 1 Name Chartered Bank 2 Name Credit Union Name SERVICES OFFERED PRIORITY RANK SCORE RANK SCORE RANK SCORE 0 0 1. Hours of operations - evenings, Saturdays 0 2. Locations - proximity to work and home 0 0 3. Fees/minimum balance for chequing accounts 0 0 4. Fees for ABM usage 0 0 5. Interest rate on savings accounts 0 0 6. Interest rate on chequing accounts 0 0 7. VISA/MasterCard available and annual fee 0 0 8. Interest rate on home loans 0 9. Interest rate on car loans 0 0 10. Safety deposit boxes and rental rates 0 TOTAL SCORE FOR EACH INSTITUTION 0 3 9 30 31 Goals 1. Estimate how much you will need to save in order to achieve your goals. Analysis 1. Complete the Personal Financial Goals template below. + Personal Financial Goals Dollar Amount to Accomplish Priority (Low, Medium, High) Financial Goal Short-Term Goals 1 2 3 Goal 1 Goal 2 Goal 3 7 8 9 20 21 22 23 24 25 26 27 28 29 30 31 Medium-Term Goals 1 2 3 Goal 1 Goal 2 Goal 3 Long-Term Goals WN Goal 1 Goal 2 Goal 3 Goals 1. Set short-term, medium-term, and long-term goals. Analysis 1.Outline a minimum of 1 short-term, 1 medium-term, and 1 long-term financial goal that you have. Personal Financial Goals Short-Term Goals (less than 1 year) Medium-Term Goals (1 year to 5 years) Long-Term Goals (5 years or more) Project Introduction Cash flow Goals Savings Bank Service Summary + Goals 1. Determine how to increase net cash flows in the near future. 2. Determine how to increase net cash flows in the distant future. Analysis 1. Prepare your personal cash flow statement. Personal Cash Flow Statement This Month $0 Income Disposable (after-tax) income Interest on deposits Dividend payments Other: Total Income Expenses Rent/Mortgage Cable TV/Internet Utilities (Electricity, Water, Natural Gas) Cellphone Food (Groceries & Restaurant) Life Insurance Health Insurance Clothing Car Expenses (Insurance, Maintenance, Gasoline) Tuition Recreation thor: Project Introduction Cash flow Goals Savings Bank Service Summary + Other: Total Expenses Net Cash Flows 0 $0 2. Prepare your personal balance sheet. Personal Balance Sheet Assets Liquid Assets Cash Chequing account Savings account Other liquid assets Total liquid assets $0 Household Assets Home Car Furniture Other household assets Total household assets $0 Investment Assets Stocks Bonds Mutual funds OLI Other investments Total investment assets $0 Real Estate Residence Vacation home Other Total real estate $0 Total Assets $0 1 2 3 -4 55 56 57 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 Liabilities and Net Worth Current Liabilities Loans Credit card balance Other current liabilities Total current liabilities $0 wawwwg Long-Term Liabilities Mortgage Car loan Other long-term liabilities Total long-term liabilities $0 Total Liabilities 84 85 Net Worth $0 Project Introduction Cash flow $0 Goals Savings Rank Son Building Your Own Financial Plan Goals 1. Identify the banking services that are most important to you. 2. Determine which financial institution will provide you with the best banking services. Analysis 1. Evaluate what banking services are most important to you with a score of 10 for the most Important and 1 for the least. Then evaluate three financial institutions with respect to the services offered; rate the institutions from 5 as the best for that service to 1 as the worst. The template will calculate scores for each institution. Banking Services Scorecard YOUR Chartered Bank 1 Name Chartered Bank 2 Name Credit Union Name SERVICES OFFERED PRIORITY RANK SCORE RANK SCORE RANK SCORE 0 0 1. Hours of operations - evenings, Saturdays 0 2. Locations - proximity to work and home 0 0 3. Fees/minimum balance for chequing accounts 0 0 4. Fees for ABM usage 0 0 5. Interest rate on savings accounts 0 0 6. Interest rate on chequing accounts 0 0 7. VISA/MasterCard available and annual fee 0 0 8. Interest rate on home loans 0 9. Interest rate on car loans 0 0 10. Safety deposit boxes and rental rates 0 TOTAL SCORE FOR EACH INSTITUTION 0 3 9 30 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts