Question: personal finance plan Applying Time Value Concepts Personal Financial Plan Goals 1. Determine how much savings you plan to accumulate by various future points in

personal finance plan

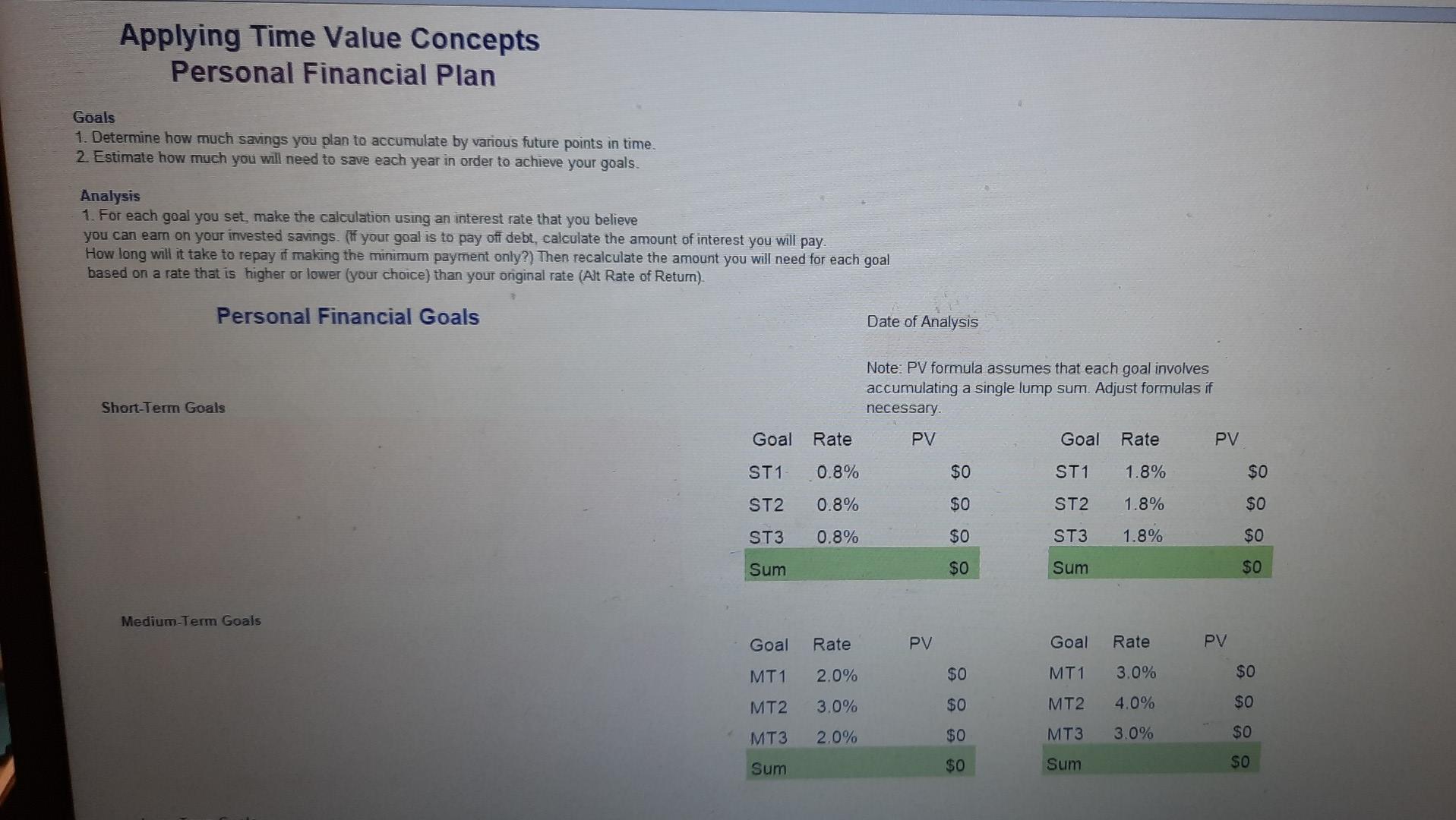

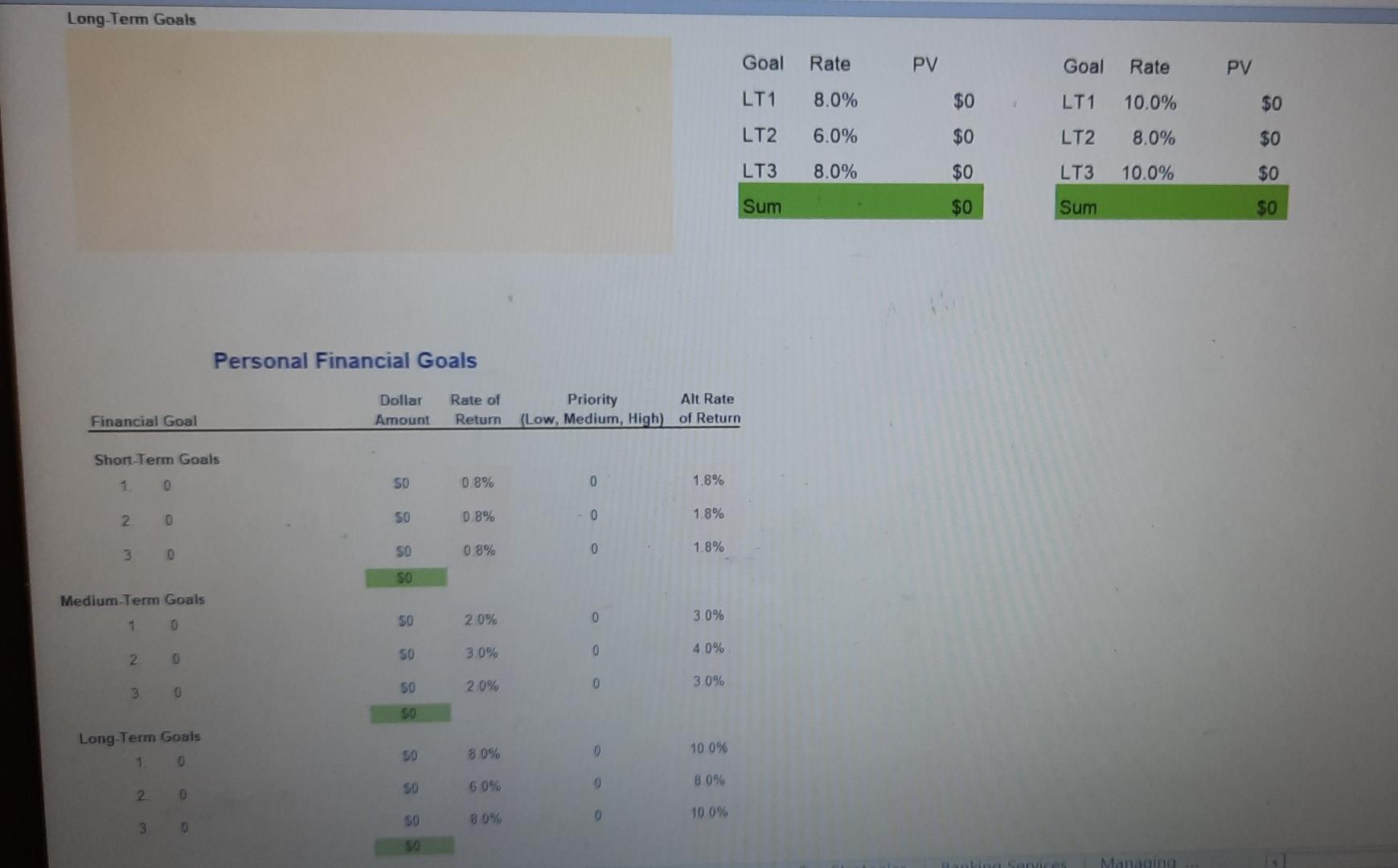

Applying Time Value Concepts Personal Financial Plan Goals 1. Determine how much savings you plan to accumulate by various future points in time. 2. Estimate how much you will need to save each year in order to achieve your goals. Analysis 1. For each goal you set, make the calculation using an interest rate that you believe you can earn on your invested savings. your goal is to pay off debt, calculate the amount of interest you will pay. How long will it take to repay if making the minimum payment only?) Then recalculate the amount you will need for each goal based on a rate that is higher or lower (your choice) than your original rate (Alt Rate of Return). Personal Financial Goals Short-Term Goals Goal Rate ST1 0.8% ST2 0.8% ST3 0.8% Sum Goal Rate MT1 2.0% MT2 3.0% MT3 2.0% Sum Medium-Term Goals Date of Analysis Note: PV formula assumes that each goal involves accumulating a single lump sum. Adjust formulas if necessary. PV Goal Rate PV $0 ST1 1.8% $0 ST2 1.8% $0 ST3 1.8% $0 Sum Goal Rate MT1 3.0% MT2 4.0% MT3 3.0% Sum PV $0 $0 $0 $0 PV $0 $0 $0 $0 $0 $0 $0 SO Long-Term Goals Financial Goal Short-Term Goals 1 0 2 0 3 10 Medium-Term Goals 1 0 2 0 3 0 Long-Term Goals 1 0 2 3 Personal Financial Goals Dollar Rate of Amount Return SO 0.8% SO 0.8% SO 0.8% SO 50 2.0% 50 3.0% 2.0% 80% 6.0% 8.0% 0 50 SO 50 50 $0 Priority Alt Rate (Low, Medium, High) of Return 0 1.8% 0 1.8% 0 1.8% 3.0% 4.0% 3.0% 10.0% 8.0% 10.0% 0 0 0 0 0 0 Goal Rate LT1 8.0% LT2 6.0% LT3 8.0% Sum PV $0 $0 $0 $0 Goal Rate LT1 10.0% LT2 8.0% LT3 10.0% Sum Zanking Services Managing PV $0 $0 $0 $0 Applying Time Value Concepts Personal Financial Plan Goals 1. Determine how much savings you plan to accumulate by various future points in time. 2. Estimate how much you will need to save each year in order to achieve your goals. Analysis 1. For each goal you set, make the calculation using an interest rate that you believe you can earn on your invested savings. your goal is to pay off debt, calculate the amount of interest you will pay. How long will it take to repay if making the minimum payment only?) Then recalculate the amount you will need for each goal based on a rate that is higher or lower (your choice) than your original rate (Alt Rate of Return). Personal Financial Goals Short-Term Goals Goal Rate ST1 0.8% ST2 0.8% ST3 0.8% Sum Goal Rate MT1 2.0% MT2 3.0% MT3 2.0% Sum Medium-Term Goals Date of Analysis Note: PV formula assumes that each goal involves accumulating a single lump sum. Adjust formulas if necessary. PV Goal Rate PV $0 ST1 1.8% $0 ST2 1.8% $0 ST3 1.8% $0 Sum Goal Rate MT1 3.0% MT2 4.0% MT3 3.0% Sum PV $0 $0 $0 $0 PV $0 $0 $0 $0 $0 $0 $0 SO Long-Term Goals Financial Goal Short-Term Goals 1 0 2 0 3 10 Medium-Term Goals 1 0 2 0 3 0 Long-Term Goals 1 0 2 3 Personal Financial Goals Dollar Rate of Amount Return SO 0.8% SO 0.8% SO 0.8% SO 50 2.0% 50 3.0% 2.0% 80% 6.0% 8.0% 0 50 SO 50 50 $0 Priority Alt Rate (Low, Medium, High) of Return 0 1.8% 0 1.8% 0 1.8% 3.0% 4.0% 3.0% 10.0% 8.0% 10.0% 0 0 0 0 0 0 Goal Rate LT1 8.0% LT2 6.0% LT3 8.0% Sum PV $0 $0 $0 $0 Goal Rate LT1 10.0% LT2 8.0% LT3 10.0% Sum Zanking Services Managing PV $0 $0 $0 $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts