Question: Savory Seafood Inc.s managers select projects based only on the MIRR criterion. Should Savory Seafood Inc.s managers accept this independent project? Yes or no? 8.

Savory Seafood Inc.s managers select projects based only on the MIRR criterion. Should Savory Seafood Inc.s managers accept this independent project?

Yes or no?

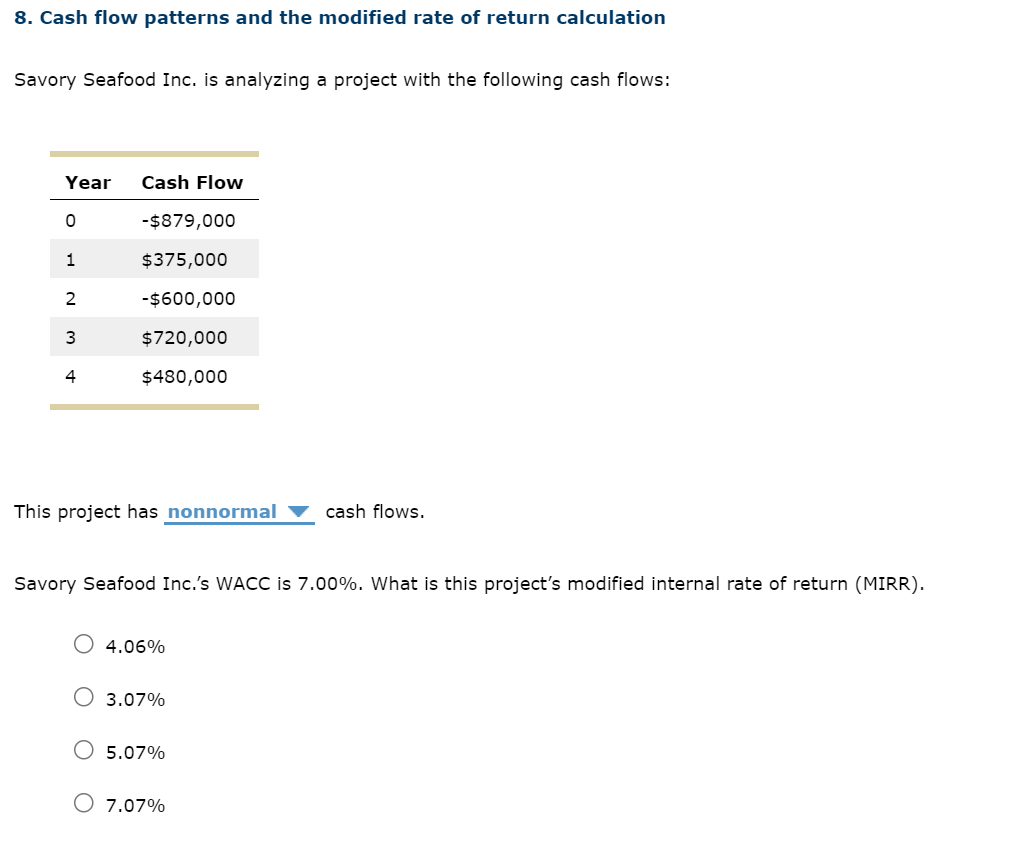

8. Cash flow patterns and the modified rate of return calculation Savory Seafood Inc. is analyzing a project with the following cash flows: This project has cash flows. Savory Seafood Inc.'s WACC is 7.00%. What is this project's modified internal rate of return (MIRR). 4.06%3.07%5.07%7.07%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts