Question: Saying answer is not complete, I don't know what I'm missing.... The equity sections for Atticus Group at the beginning of the year (January 1)

Saying answer is not complete, I don't know what I'm missing....

The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow.

| Stockholders Equity (January 1) | |

|---|---|

| Common stock$4 par value, 100,000 shares authorized, 40,000 shares issued and outstanding | $ 160,000 |

| Paid-in capital in excess of par value, common stock | 120,000 |

| Retained earnings | 320,000 |

| Total stockholders equity | $ 600,000 |

| Stockholders Equity (December 31) | |

|---|---|

| Common stock$4 par value, 100,000 shares authorized, 47,400 shares issued, 3,000 shares in treasury | $ 189,600 |

| Paid-in capital in excess of par value, common stock | 179,200 |

| Retained earnings ($30,000 restricted by treasury stock) | 400,000 |

| 768,800 | |

| Less cost of treasury stock | (30,000) |

| Total stockholders equity | $ 738,800 |

The following transactions and events affected its equity during the year.

| January 5 | Declared a $0.50 per share cash dividend, payable on January 10. |

|---|---|

| March 20 | Purchased treasury stock for cash. |

| April 5 | Declared a $0.50 per share cash dividend, payable on April 10. |

| July 5 | Declared a $0.50 per share cash dividend, payable on July 10. |

| July 31 | Declared a 20% stock dividend when the stocks market value was $12 per share. |

| August 14 | Issued the stock dividend that was declared on July 31. |

| October 5 | Declared a $0.50 per share cash dividend, date of record October 10 |

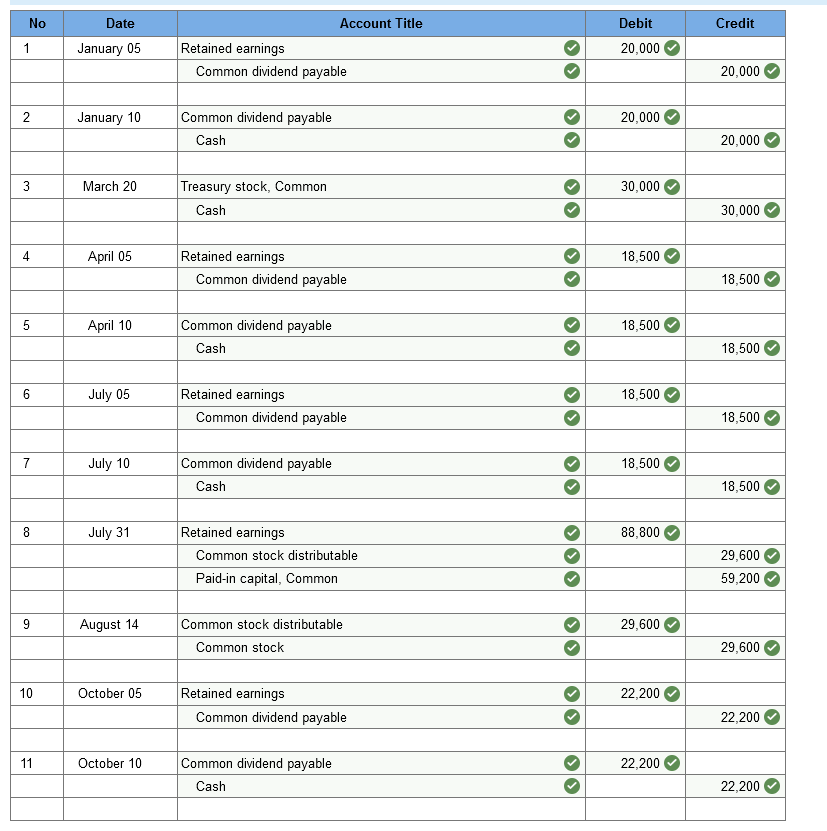

No Date Debit Credit 1 January 05 Account Title Retained earnings Common dividend payable 20,000 20,000 January 10 20,000 N Common dividend payable Cash 20,000 3 March 20 30,000 Treasury stock, Common Cash 30,000 4 April 05 18,500 Retained earnings Common dividend payable 18,500 5 April 10 18,500 Common dividend payable Cash 18,500 6 July 05 18,500 Retained earnings Common dividend payable 18,500 7 July 10 18,500 Common dividend payable Cash 18,500 8 July 31 88,800 Retained earnings Common stock distributable Paid-in capital, Common 29,600 59,200 O 9 August 14 29,600 Common stock distributable Common stock >> 29,600 10 October 05 22,200 Retained earnings Common dividend payable 22,200 11 October 10 22,200 Common dividend payable Cash 22,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts