Question: SBB CFF SA is considering a project to start Cargo trains in Swiss Romande. It has a D/E ratio of 2, a marginal tax

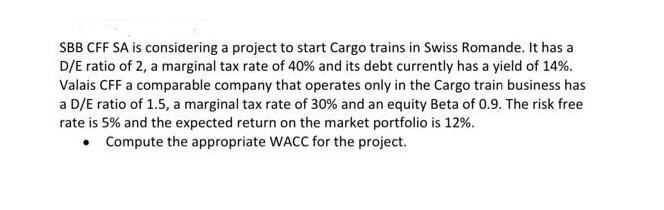

SBB CFF SA is considering a project to start Cargo trains in Swiss Romande. It has a D/E ratio of 2, a marginal tax rate of 40% and its debt currently has a yield of 14%. Valais CFF a comparable company that operates only in the Cargo train business has a D/E ratio of 1.5, a marginal tax rate of 30% and an equity Beta of 0.9. The risk free rate is 5% and the expected return on the market portfolio is 12%. Compute the appropriate WACC for the project.

Step by Step Solution

3.33 Rating (168 Votes )

There are 3 Steps involved in it

1 SBB CFF SAs cost of debt SBB CFF SAs cost of debt Yield on debt 1 Marginal tax rate SBB CFF SAs co... View full answer

Get step-by-step solutions from verified subject matter experts