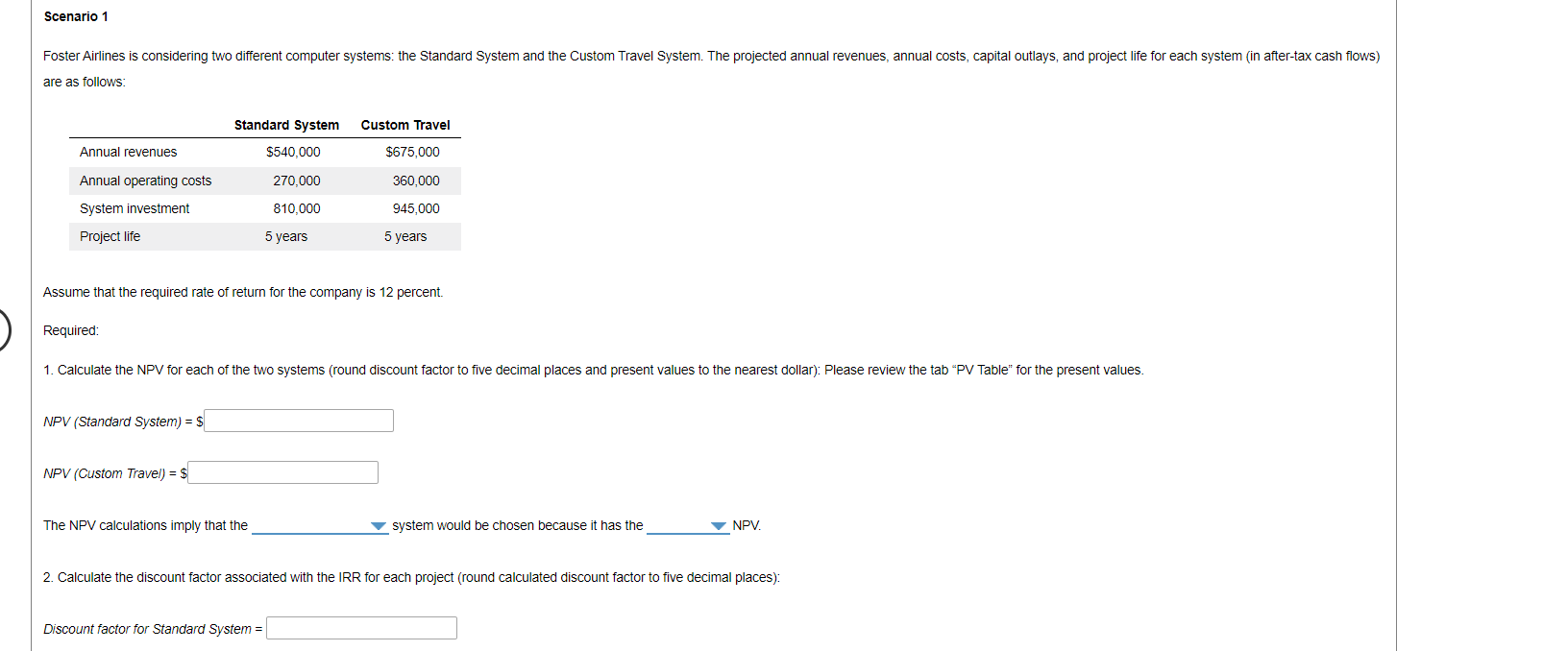

Question: Scenario 1 Foster Airlines is considering two different computer systems: the Standard System and the Custom Travel System. The projected annual revenues, annual costs, capital

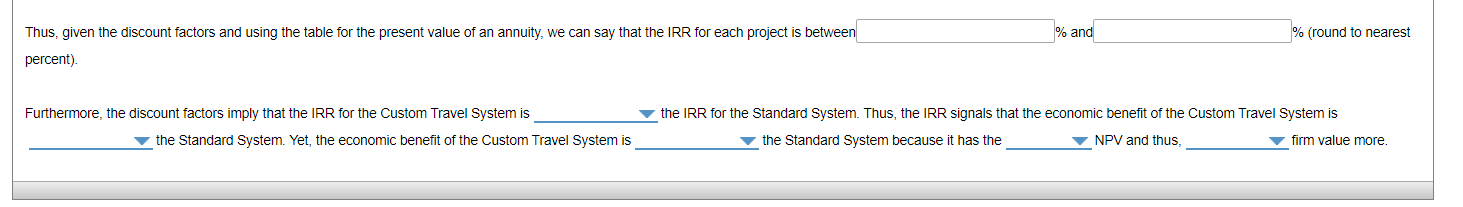

Scenario 1 Foster Airlines is considering two different computer systems: the Standard System and the Custom Travel System. The projected annual revenues, annual costs, capital outlays, and project life for each system (in after-tax cash flows) are as follows: Standard System Custom Travel Annual revenues $540,000 $675,000 Annual operating costs 270,000 360.000 System investment 810,000 945,000 Project life 5 years 5 years Assume that the required rate of return for the company is 12 percent. Required: 1. Calculate the NPV for each of the two systems (round discount factor to five decimal places and present values to the nearest dollar): Please review the tab "PV Table" for the present values. NPV (Standard System) = $ NPV (Custom Travel) = $ The NPV calculations imply that the system would be chosen because it has the NPV. 2. Calculate the discount factor associated with the IRR for each project (round calculated discount factor to five decimal places): Discount factor for Standard System = % and % (round to nearest Thus, given the discount factors and using the table for the present value of an annuity, we can say that the IRR for each project is between percent) Furthermore, the discount factors imply that the IRR for the Custom Travel System is the Standard System. Yet, the economic benefit of the Custom Travel System is the IRR for the Standard System. Thus, the IRR signals that the economic benefit of the Custom Travel System is the Standard System because it has the NPV and thus, firm value more

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts