Question: Scenario 3: Maximize the expected return R(x1, x2, x3, x4, x5) of a portfolio consisting of international stocks (x1%), domestic stocks (x2%), stocks from emerging

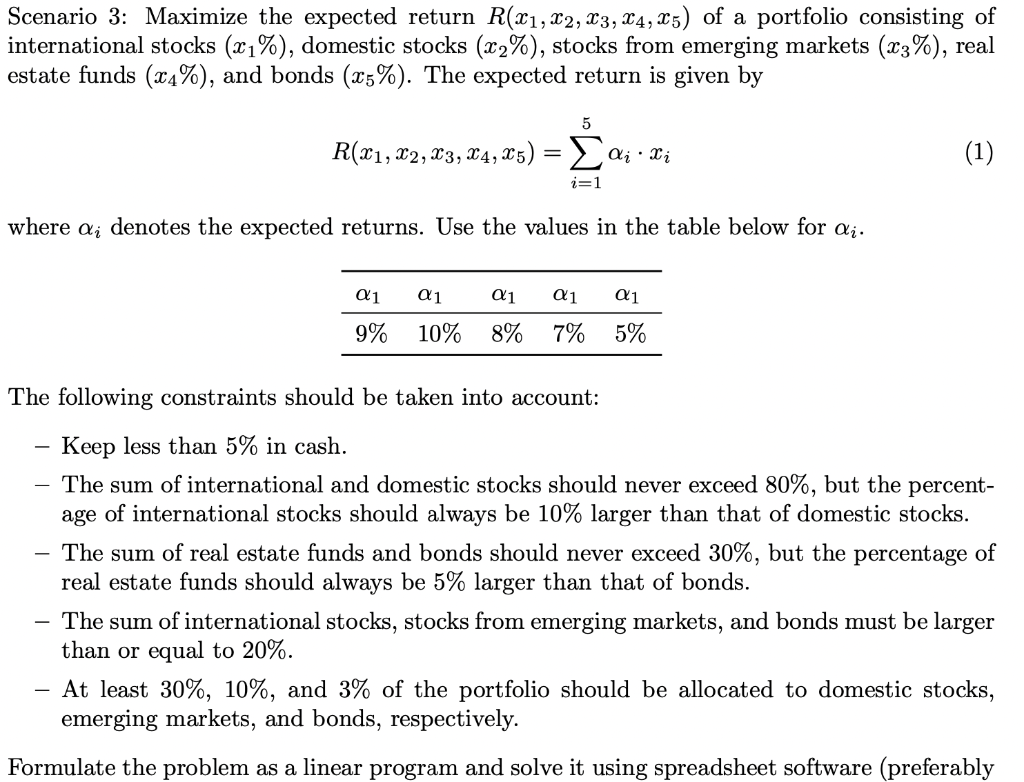

Scenario 3: Maximize the expected return R(x1, x2, x3, x4, x5) of a portfolio consisting of international stocks (x1%), domestic stocks (x2%), stocks from emerging markets (x3%), real estate funds (x4%), and bonds (x5%).

The following constraints should be taken into account:

The following constraints should be taken into account:

-

Keep less than 5% in cash.

-

The sum of international and domestic stocks should never exceed 80%, but the percent- age of international stocks should always be 10% larger than that of domestic stocks.

-

The sum of real estate funds and bonds should never exceed 30%, but the percentage of real estate funds should always be 5% larger than that of bonds.

-

The sum of international stocks, stocks from emerging markets, and bonds must be larger than or equal to 20%.

-

At least 30%, 10%, and 3% of the portfolio should be allocated to domestic stocks, emerging markets, and bonds, respectively.

Formulate the problem as a linear program and solve it using spreadsheet software (preferably Excel). (Tip: Watch lecture 3.) Does the solution make sense?

Scenario 3: Maximize the expected return R(x1, 22, 23, 24, 25) of a portfolio consisting of international stocks (21%), domestic stocks (x2%), stocks from emerging markets (33%), real estate funds (x4%), and bonds (25%). The expected return is given by 5 R(21, 22, 23, 24, x5) = ai Xi (1) i=1 where di denotes the expected returns. Use the values in the table below for d. a1 a1 ai ai 9% 10% 8% 7% 5% The following constraints should be taken into account: Keep less than 5% in cash. The sum of international and domestic stocks should never exceed 80%, but the percent- age of international stocks should always be 10% larger than that of domestic stocks. The sum of real estate funds and bonds should never exceed 30%, but the percentage of real estate funds should always be 5% larger than that of bonds. The sum of international stocks, stocks from emerging markets, and bonds must be larger than or equal to 20%. At least 30%, 10%, and 3% of the portfolio should be allocated to domestic stocks, emerging markets, and bonds, respectively. Formulate the problem as a linear program and solve it using spreadsheet software (preferably Scenario 3: Maximize the expected return R(x1, 22, 23, 24, 25) of a portfolio consisting of international stocks (21%), domestic stocks (x2%), stocks from emerging markets (33%), real estate funds (x4%), and bonds (25%). The expected return is given by 5 R(21, 22, 23, 24, x5) = ai Xi (1) i=1 where di denotes the expected returns. Use the values in the table below for d. a1 a1 ai ai 9% 10% 8% 7% 5% The following constraints should be taken into account: Keep less than 5% in cash. The sum of international and domestic stocks should never exceed 80%, but the percent- age of international stocks should always be 10% larger than that of domestic stocks. The sum of real estate funds and bonds should never exceed 30%, but the percentage of real estate funds should always be 5% larger than that of bonds. The sum of international stocks, stocks from emerging markets, and bonds must be larger than or equal to 20%. At least 30%, 10%, and 3% of the portfolio should be allocated to domestic stocks, emerging markets, and bonds, respectively. Formulate the problem as a linear program and solve it using spreadsheet software (preferably

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts