Question: Scenario: On December 3 1 , 2 0 2 2 , you decide to open a lemonade stand. You incorporate the business and make yourself

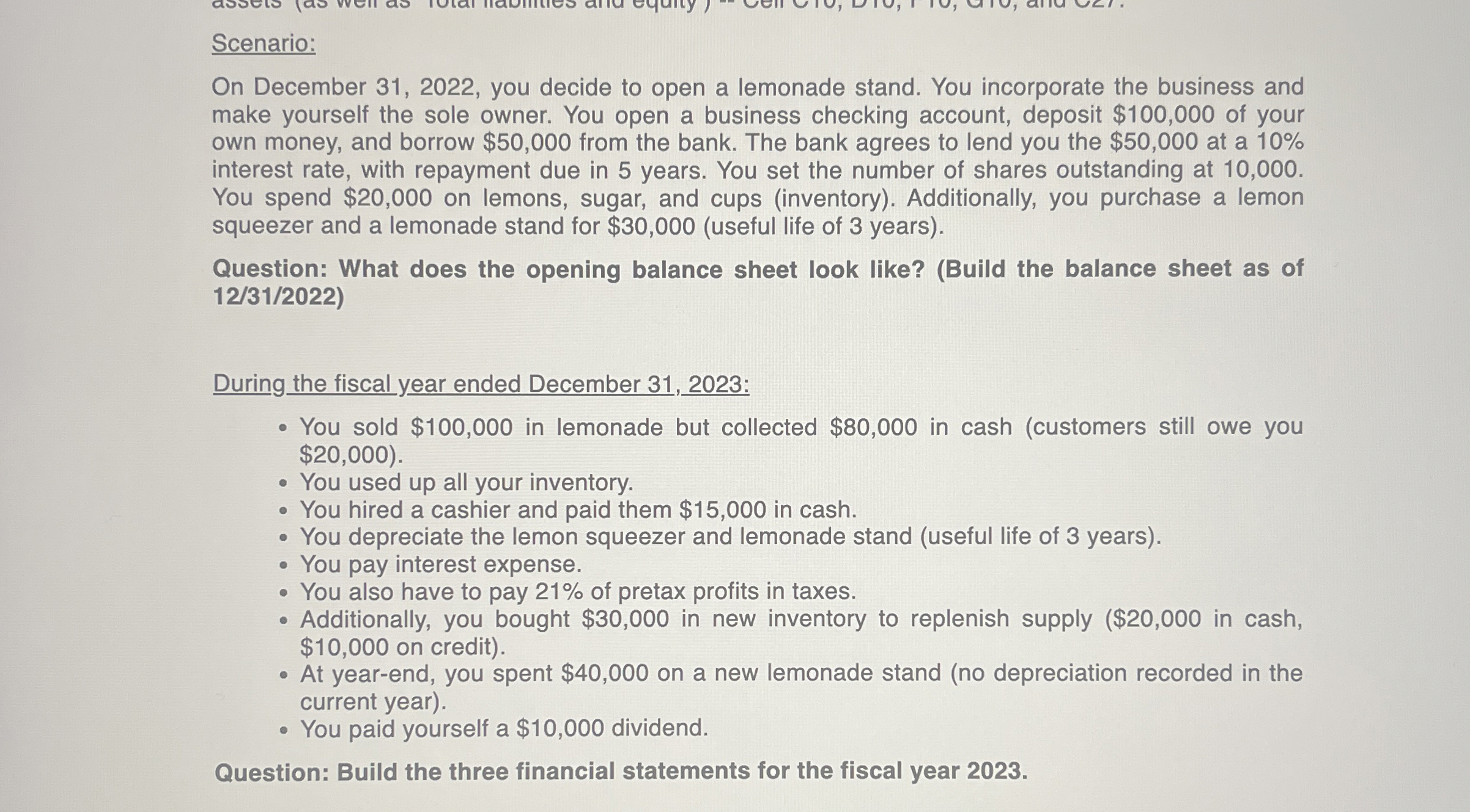

Scenario:

On December you decide to open a lemonade stand. You incorporate the business and

make yourself the sole owner. You open a business checking account, deposit $ of your

own money, and borrow $ from the bank. The bank agrees to lend you the $ at a

interest rate, with repayment due in years. You set the number of shares outstanding at

You spend $ on lemons, sugar, and cups inventory Additionally, you purchase a lemon

squeezer and a lemonade stand for $useful life of years

Question: What does the opening balance sheet look like? Build the balance sheet as of

During the fiscal year ended December :

You sold $ in lemonade but collected $ in cash customers still owe you

$

You used up all your inventory.

You hired a cashier and paid them $ in cash.

You depreciate the lemon squeezer and lemonade stand useful life of years

You pay interest expense.

You also have to pay of pretax profits in taxes.

Additionally, you bought $ in new inventory to replenish supply $ in cash,

$ on credit

At yearend, you spent $ on a new lemonade stand no depreciation recorded in the

current year

You paid yourself a $ dividend.

Question: Build the three financial statements for the fiscal year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock