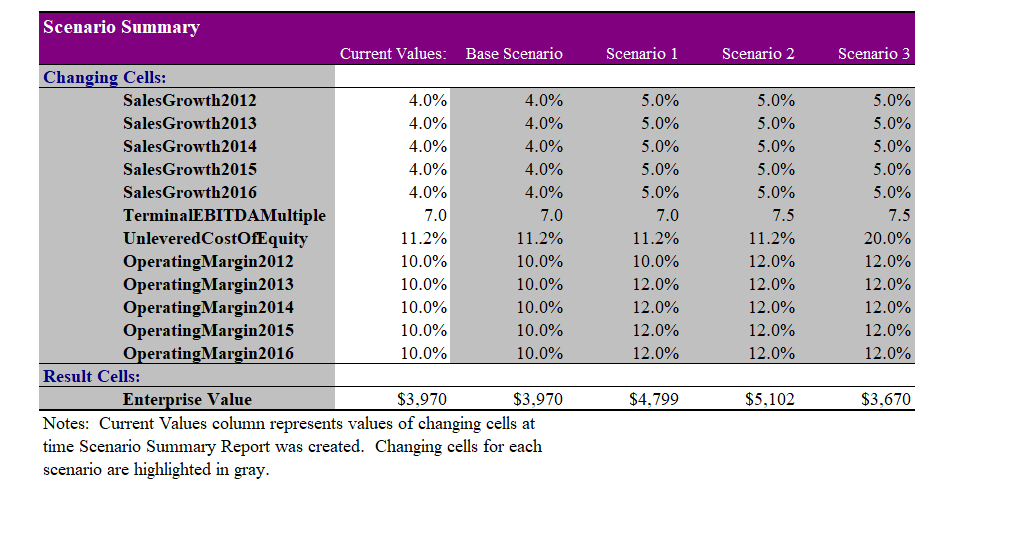

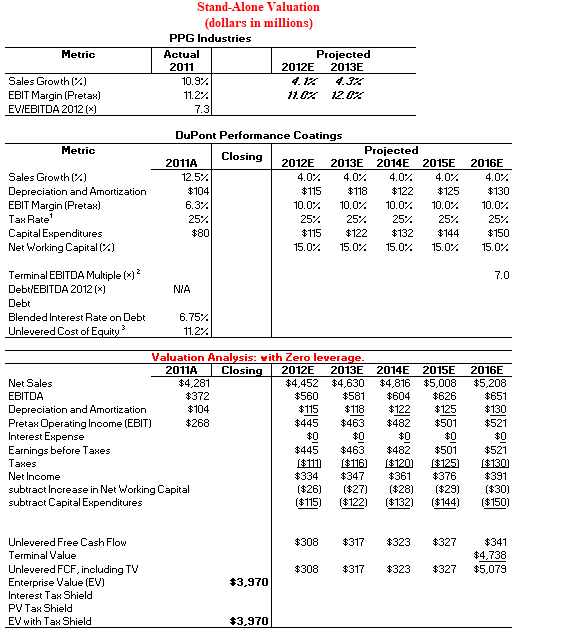

Question: Scenario Summary Current Values: Base Scenario Scenario 1 Scenario 2 Scenario 3 Changing Cells: SalesGrowth2012 4.0% 4.0% 5.0% 5.0% 5.0% SalesGrowth2013 4.0% 4.0% 5.0% 5.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts